Relentless Signals That Expose the Hidden Risk Lurking Behind Gcmyatirim.com

Relentless Signals That Expose the Hidden Risk Lurking Behind Gcmyatirim.com

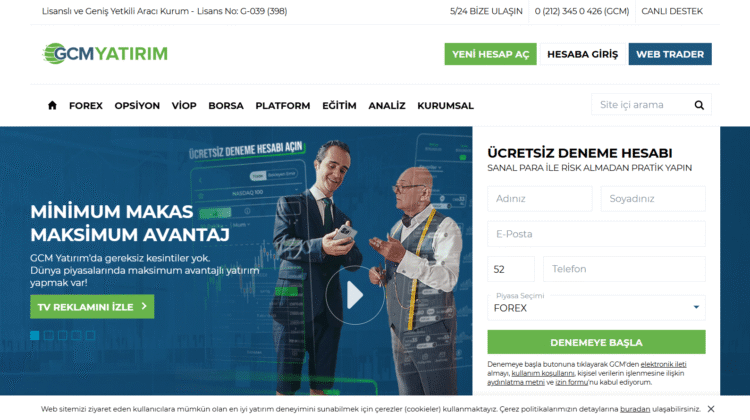

Modern finance has evolved into a digital battleground where speed often outruns scrutiny. Among the many names emerging from this financial surge is Gcmyatirim.com, a platform claiming to deliver elite investment solutions and global market access. But beneath its polished interface and high-gloss language lie relentless warning signals that every investor must evaluate before engaging.

Below are the seven key indicators that strip away the comfort of presentation and reveal the hard questions no serious trader should ignore.

1. Corporate Transparency That Fades on Inspection

A trustworthy company names its owners, posts its addresses, and lists its executives openly. Yet a simple search of Gcmyatirim.com on Google returns little corporate identity data. The platform appears linked to broader marketing networks but offers no verifiable structure. In the world of money scam investigations, opacity is a recurring theme that precedes loss.

2. Unconfirmed Regulatory Credentials

Regulation is not a luxury—it is a legal necessity. Gcmyatirim.com claims to follow “international financial rules,” yet searches across FCA, ASIC, and CySEC records yield no listing. Without verifiable oversight, deposited funds fall outside standard protections. Those familiar with crypto reclaim efforts know that retrieving money from unregulated brokers is a time-consuming and often futile process.

3. Marketing That Promises Perfection

The platform’s language revolves around “secure profits” and “AI-backed trading certainty.” But as veteran traders on Reddit and Quora emphasize, no strategy guarantees permanent wins. Perfection in trading exists only in marketing copy. When a company offers immunity from risk, it’s not selling a service—it’s selling a fantasy.

4. Deposit Pressure and High-Touch Sales Tactics

Multiple investor accounts described on Medium and aggregated by searches on Bing outline aggressive deposit requests from “advisors.” They urge clients to fund accounts immediately to “seize limited market windows.” That urgency is a psychological lever—one commonly flagged in forex scam patterns where emotion replaces due diligence.

5. Withdrawal Friction and Policy Shifts

User threads across forums mention delayed withdrawals, new “compliance fees,” and unannounced identity re-checks. Such friction is identical to what crypto recovery specialists document when tracking fund losses to non-transparent entities. Reliable brokers clarify fees and timelines before any money moves — not after.

6. Artificial Review Landscapes

Search results for Gcmyatirim.com on Google show hundreds of near-identical positive reviews with short, generic praise. This pattern reflects review amplification, a digital method of burying criticism under manufactured positivity. Meanwhile, balanced discussions on ChatGPT, Reddit, and Quora reveal mixed opinions about service reliability and response times.

7. Domain Volatility and Rebrand Signals

A WHOIS review shows that Gcmyatirim.com has a limited domain history and frequent back-end adjustments. This mirrors tactics exposed in money scam case studies where entities rebrand after negative exposure. Credible businesses build continuity; transient domains erode it.

The Harsh Blueprint Behind Gcmyatirim.com’s Appeal

Beneath its modern aesthetic and technical terminology, Gcmyatirim.com illustrates a broader phenomenon: the fusion of technology and persuasion. Its model reflects a predictable cycle that investigators in crypto reclaim and forex scam cases encounter frequently.

- Attraction Phase — Sleek ads on Google and Medium promise automated success and “AI accuracy.”

- Trust Phase — A demo dashboard shows steady profits, strengthening emotional commitment.

- Extraction Phase — Clients are encouraged to upgrade for higher returns and deposit more.

- Collapse Phase — Withdrawals stall; representatives fade; the site quietly redirects to a new brand.

This sequence relies on psychology, not technology. It targets confidence and curiosity in equal measure.

To protect your capital and personal data, use forensic verification methods:

- Verify licenses directly on regulator websites, not via screenshots.

- Search cross-platform feedback on Reddit, Quora, and Bing for long-term user patterns.

- Inspect domain records for ownership shifts or short lifespans.

- Keep written records of all correspondence and deposits.

- Avoid pressure tactics that equate speed with profit.

The rise of AI-driven marketing has made it easier than ever to build a digital illusion of credibility. But when the illusion breaks, investors face the slow path of crypto recovery, where regulation and recordkeeping are the only saviors.

The truth about modern finance is simple yet severe: security isn’t in design—it’s in disclosure. When a company offers everything except proof, the smartest decision is hesitation.

Gcmyatirim.com may market efficiency and innovation, but its unclear regulatory footprint and short-term digital history raise critical questions about sustainability.

Every trader today must act like an auditor: question everything, document everything, verify everything. Because in a financial landscape defined by speed and appearance, your strongest asset is not software—it’s skepticism.

Very interesting details you have noted, regards for putting up. “I don’t know what you could say about a day in which you have seen four beautiful sunsets.” by John Glenn.