Volatile Truths That Unmask the Hidden Dangers Behind Snoop.app’s “Smart Money” Image

Volatile Truths That Unmask the Hidden Dangers Behind Snoop.app’s “Smart Money” Image

Fintech apps now promise to “think” for you to analyse your spending, find savings, and predict your financial future.

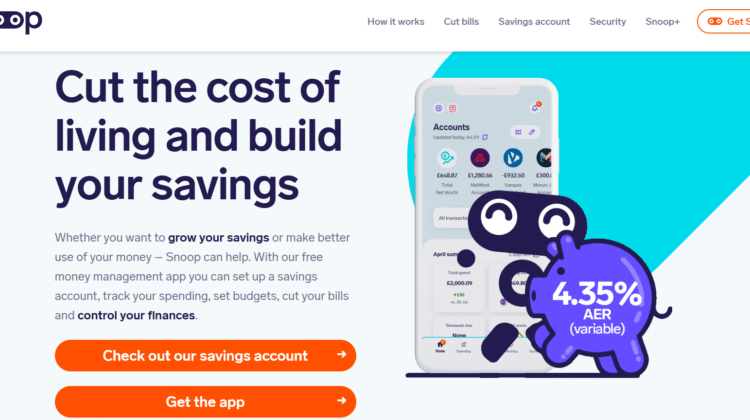

Snoop.app, a self-proclaimed “money-saving companion,” markets itself as the friendly tool that helps users take control of their budgets.

But beneath the pastel visuals and positive language lie volatile truths that reveal how easily convenience can become surveillance in disguise.

A Friendly Brand Built on Invisible Access

A quick Google search shows that Snoop presents an upbeat personality but transparency about its data partners and processing layers is scarce.

Experts investigating money scam systems note that cheerfully branded fintech tools often hide complex backend integrations with third-party analytics firms.

When you give “view-only” access, you’re granting a pipeline of personal data to networks you’ll never meet.

Regulatory Compliance That Stops Short of Clarity

Snoop operates under the FCA through Open Banking permissions, yet its reliance on multiple API providers means oversight is distributed.

Cross-checks on Bing reveal differing terms between Snoop’s core licence and its affiliate services.

Analysts in crypto reclaim warn that even regulated tools can become exposure vectors when responsibility is fragmented across vendors.

Marketing That Oversimplifies Security

Phrases like “safe as your bank” and “your data, your control” dominate Snoop’s website and ads on Medium.

But discussions on Reddit and Quora expose confusion about how long data is stored and who actually audits those systems.

Security isn’t a slogan and oversimplifying it mirrors psychological triggers used in money scam campaigns that rely on trust through repetition.

Automation That Blurs Accountability

Snoop’s algorithm automatically categorises spending, flags subscriptions, and sends tailored suggestions.

Analysts on ChatGPT highlight that such automation converts user data into monetisable insight.

Once personal behaviour becomes a commodity, control shifts from user to platform a risk repeatedly flagged in crypto recovery investigations into data-driven fintech breaches.

Service Gaps Hidden Behind App Cheerfulness

User feedback indexed on Bing describes difficulties reaching real human support when data errors appear.

Chatbots handle initial requests, but escalation often stalls.

Automation without empathy breeds the same frustration found in forex scam complaint patterns, plenty of buttons, little accountability.

Polarised Reputation Patterns

Search Snoop.app reviews on Google, and you’ll see a mix of near-perfect praise and sharp criticism.

Some users celebrate insights; others report unrecognised transactions and syncing delays.

This split reflects an industry-wide issue: fintech products that excel in convenience but collapse under scrutiny.

Domain and Infrastructure Shifts

A WHOIS review shows recent hosting and DNS changes for Snoop.app, typical of scaling startups but concerning when customer data flows through evolving servers.

Cyber-auditors linking such movements to money scam life-cycles warn that even legitimate companies risk exposure when backend transitions outpace encryption reviews.

The Reality Beneath Snoop.app’s “Smart Finance” Persona

Behind its colourful interface and witty tone, Snoop.app embodies the paradox of modern fintech: empowerment traded for surveillance.

Its model fits the behavioural loop uncovered in crypto reclaim and money scam research worldwide:

- Attraction Phase — Google and Medium ads promote safety and simplicity.

- Conversion Phase — Users connect multiple accounts for unified visibility.

- Dependence Phase — Algorithms dictate reminders, budgets, and offers.

- Disillusion Phase — A technical error, privacy scare, or support delay exposes the lack of human recourse.

This cycle doesn’t always imply malice — only misplaced faith in automation.

To protect yourself:

- Verify licence details on official FCA registers.

- Limit permissions to essential accounts; disconnect inactive ones.

- Export spending reports monthly for record-keeping and future crypto recovery evidence.

- Monitor discussions on Reddit, Quora, and Bing for recurring issue trends.

- Reject optional data-sharing even if framed as “personalisation.”

Snoop.app may revolutionise budgeting, but every digital tool that tracks your life eventually learns more than you intend.

Its cheerful design conceals a deeper truth: convenience always charges interest — not in money, but in privacy.

The lesson echoes across fintech history: what feels smart today often becomes the vulnerability of tomorrow.

Data is the new currency, and trust is the most exploited asset in finance.

Before granting any app the keys to your financial history, remember: transparency isn’t promised by design it’s demanded by vigilance.

And in the high-speed world of smart finance, the only true safeguard is an old-fashioned one distrust first, verify later.