7 Major Warning Signs That ClaytonMarkets.com Is Highly Risky

7 Major Warning Signs That ClaytonMarkets.com Is Highly Risky

ClaytonMarkets.com, operating under Clayton Markets Ltd., heavily markets itself as a modern multi-asset trading platform. But beneath the surface, multiple sources point to serious red flags.

1. Poor Trust Score on Trustpilot

Trustpilot rates ClaytonMarkets.com at 2.3 out of 5, with 100% of the reviews at 1 star. Reviewers overwhelmingly claim withdrawal issues, fund freezes, and rely on recovery agents instead of the platform.

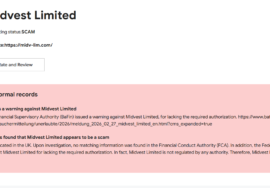

2. No Licensing—St. Lucia IBC Registration Only

Although registered in Saint Lucia as Clayton Markets Ltd, BrokersView confirms this only reflects a basic company registration—not financial regulation. This means the site functions as an unauthorized trading platform without investor protections.

3. No Web Traffic or Community Engagement

FXVerify reports negligible web traffic and no user reviews. A legit broker with MT5 and diverse instruments typically garners far more engagement.

4. Newly Registered Domain & Hidden Ownership

Whois data shows ClaytonMarkets.com was registered in early 2025 via Hostinger with ownership disguised using privacy protection. This facilitates anonymity and accountability evasion—common in fraud schemes.

5. Video Warnings Afloat

YouTube reviewers explicitly warn viewers that Clayton Markets appears to be a highly deceptive scam. These alerts often come from user experiences and community investigations.

6. Questionable Product Offerings

Though the broker offers a range of instruments—forex, crypto, metals, indices—it promotes exceptionally high leverage (e.g., 1:500) combined with bonuses and tiered account types. Such packages, lacking regulation, carry excessive risk and are often marketing hooks for scam operations.

7. No Evidence of Customer Support or Accountability

There’s scant public info on client support or legal recourse frameworks. Without transparent contact channels, communication, or response options, users are effectively locked out when problems arise.

Protection Checklist Against Platforms Like ClaytonMarkets.com

- Confirm Regulation: Always verify licensing through official bodies (e.g., FCA, ASIC, CySEC).

- Beware of Echo Chamber Reviews: Consistent 1-star reviews often denote coordinated warning signs.

- Avoid Hidden Ownership: Transparent, named operations allow accountability.

- Demand Trading Transparency: Legit brokers show verifiable performance and strong client relationships.

- Avoid Recovery Fee Scams: Seek only legitimate recovery through licensed channels if victimized.

Conclusion : ClaytonMarkets.com — A Platform to Steer Clear Of

ClaytonMarkets.com might fashion itself as a legitimate broker with broad market offerings, but evidence reveals a dangerous lack of integrity and oversight.

The FCA-level oversight absence is glaring. Clayton Markets’ mere IBC registration in Saint Lucia doesn’t shield clients from fraud—rather, it’s often used by unregulated entities to appear legitimate without accountability. Without regulatory compliance, there’s no recourse if you lose funds or face mismanagement.

Community feedback underscores this danger. Trustpilot’s 2.3/5 rating, with all reviewers awarding one star, paints a stark picture: users reporting funds being frozen and needing outside assistance for crypto asset recovery. This suggests the platform lacks even the minimal operational ethics or support needed to address client concerns.

Further compounding the risk is the site’s recent launch and cloaked ownership. Registered in January 2025 and masked by privacy services, Clayton Markets is structured to obscure accountability. Legit brokers usually offer named leadership, verifiable credentials, and clear jurisdictional ties not shadowy anonymity.

Moreover, the site’s marketing lacks substance. FXVerify notes zero independent user feedback, signaling the firm has little to no organic traction. When combined with YouTube warnings about deceptive behavior, it’s evident ClaytonMarkets.com is gaining attention for the wrong reasons withdrawal issues and suspicious practices.

Warnings about product structuring are also serious. High leverage options and crypto instruments lure traders with the promise of big swings but without regulated safeguards or risk controls, those swings often result in significant investor losses. The absence of clearly documented margin protocols and the lack of structured digital funds tracing safeguards only deepen the distrust.

In the realm of investment scam prevention, ClaytonMarkets.com fails at each hurdle: transparency, regulation, user protection, and ethical commitment. The operating model suggests a short-lived venture designed to extract funds and vanish—classic scam behavior.

For potential victims, the path to recapture losses is long and tenuous—often needing litigation or cyber recovery experts. That’s why prevention is your strongest weapon. Evaluate brokers through regulators, verified reviews, and emphasis on transparency before committing funds.

To summarize: ClaytonMarkets.com should not be considered for investment under any condition. It is a cautionary example of how polished interfaces can mask urgent risks. In crypto and forex, diligence matters more than dazzling UI. Protect your capital by choosing licensed, transparent brokers with a proven track record not ones built to deceive.