9 Powerful Warnings Exposing the Risky Reality of CryptoKlutzApp.net

9 Powerful Warnings Exposing the Risky Reality of CryptoKlutzApp.net

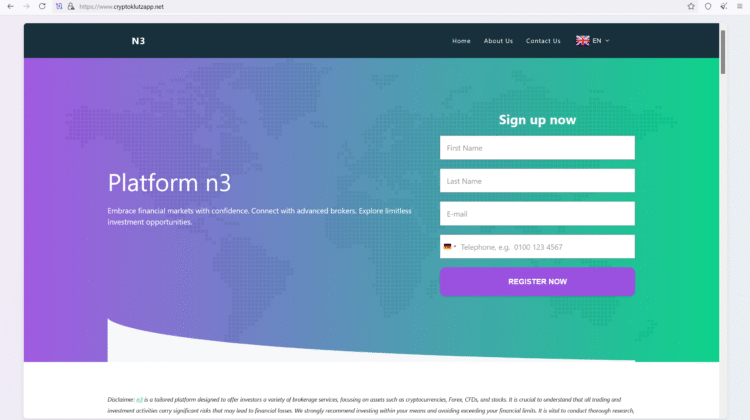

Names can be deceiving in the online-investment world. A brand like CryptoKlutzApp.net might sound playful and approachable—almost disarming—yet the tactics commonly linked to such fly-by-night “apps” are anything but harmless. On the surface, a slick landing page and bold promises can make any platform feel like the next breakout success. Underneath, however, many of these outfits rely on opaque ownership, vague legal terms, unrealistic returns, and withdrawal games that trap deposits rather than steward them.

This in-depth analysis follows your Element 1 framework—clear, numbered red flags with a strong, practical conclusion—so you can educate audiences, protect potential victims, and position your brand as a voice of reason. Because public data on CryptoKlutzApp.net is limited, the focus here is on the verifiable risk patterns and behavioral markers that similar operations repeatedly exhibit. Treat this as a high-alert checklist: if multiple items below match what you see on the site or in your conversations with their “account managers,” the only prudent response is to step away.

1) Explosive Claims of Fast, Guaranteed Returns

If any platform promises guaranteed profits, low risk with high yield, or daily/weekly return targets that beat market norms, that is your first red flag. In legitimate markets, even world-class funds can’t promise certainty. Volatility, liquidity, and macro shocks make “guaranteed” performance an impossibility. When you see mathematical fantasies presented as inevitabilities, you are not looking at innovation—you’re looking at inducement.

What to do: Ask for an independently audited, multi-year track record and compare it to broad benchmarks. If you get slides, slogans, or screenshots instead of audited documents, that speaks volumes.

2) Vague or Contradictory “About Us” Details

Scam-prone apps often avoid naming real executives, governing jurisdiction, registered entity numbers, or physical addresses. Sometimes they bury identity scraps across pages that contradict each other, or they recycle generic “leadership” headshots easily found in stock photo libraries. A credible firm wants to be known; an evasive one wants to be unfindable.

What to do: Look for a legally precise company name, registration number, and a verifiable office address. Cross-check those details against public registries. If your search returns dead ends, proceed as if your money will, too.

3) One-Way Friction: Easy Deposits, Blocked Withdrawals

Fraud-pattern platforms make depositing seamless—and withdrawing tortuous. Common tactics include: surprise “liquidity” fees, sudden “tax clearance” demands, new “compliance” deposits, or long “cool-down” windows that never seem to end. As balances rise, the tone often shifts from salesy warmth to stony silence, closed tickets, or suspended accounts.

What to do: Before any serious funding, test a tiny deposit and immediate withdrawal. If the process is anything but clean, you have your answer.

4) Legal Language That Strips Your Rights

Terms that look official can conceal claws. Watch for clauses that:

- Force disputes into internal mediation only (run by them),

- Grant the platform authority to freeze accounts at its sole discretion,

- Impose punitive “release fees,”

- Declare performance figures are “illustrative only,”

- Or claim that site errors void obligations.

These provisions don’t shield you; they shield them. A solid firm will offer fair, balanced terms, recognisable governing law, and accessible dispute resolution.

What to do: Read every line. If you see sweeping unilateral powers or withdrawal penalties that don’t exist at reputable brokers, walk away.

5) Pressure Funnels and Psychological Engineering

Deceptive operators are less about finance than behavior design. They script the journey:

-

- Authority bias: badges, charts, and pseudo-certificates to appear official.

- Foot-in-the-door: tiny wins or “matching bonuses” to build trust.

REPORT NOW

- FOMO/urgency: time-limited tiers, “last seats,” or “bonus windows.”

- Escalation: push to “upgrade” so you won’t “cap your profits.”

- Control: once your balance grows, withdrawals meet delay loops.

If communications sound like a sales boiler room—rushed calls, relentless texts, and manipulative copy—you’re not investing; you’re being processed.

What to do: Slow everything down. Real opportunities survive scrutiny and time.

6) Anonymised Domain and Disposable Branding

High-risk operators frequently hide behind privacy-masked domains, short registration terms, and interchangeable branding that can be re-skinned overnight. The goal is simple: if complaints snowball, they rebrand and respawn. Their continuity plan is a new logo; your continuity plan should be non-engagement.

What to do: Check domain age and ownership patterns. A throwaway domain with no institutional footprint is not where you park life savings.

7) No Independent Audits, Custody Clarity, or Regulator Footprint

A real investment outfit can show:

- Regulatory authorization in a named jurisdiction,

- Third-party audits of performance and controls,

- Clear custody arrangements (where, how, and under whose supervision client assets are held),

- Named banking relationships with mainstream institutions.

When a platform lives only on its own website, when its “proof” is circular, or when it brand-drops well-known exchanges without naming specific institutional accounts or agreements, the omissions are not accidental—they are structural.

What to do: Demand the regulator, the license number, the auditor, the custodian. Then verify independently.

8) Community “Noise” Without Traceable Substance

Beware of choreographed “communities”—chat rooms with suspiciously enthusiastic posts, recycled profit screenshots, and “members” who appear at the exact moment you hesitate. Manufactured social proof is a low-cost, high-impact persuasion tool. Real communities contain complaints, nuance, and debate. Fake ones are flawless—and useless.

What to do: Privately message several participants for details. If they dodge specifics, repeat scripts, or push you back to a handler, you’re watching a show.

9) Recovery-Scam Shadow That Follows the Primary Scam

Where there is a primary platform siphoning deposits, a secondary ring often appears—“recovery experts” promising instant refunds if you pay another upfront fee. This is the second bite of the same apple. Desperation is fertile ground for con artists; protect it fiercely.

What to do: If losses occur, work with professionals who are transparent about processes, costs, and legal pathways—and who do not guarantee outcomes. Document everything and report promptly to relevant authorities.

Practical Playbook: Due Diligence You Can Use Today

- Identify the Entity: Full legal name, company number, registered address, and governing law.

- Verify Regulation: Find the firm directly in the regulator’s public register. Don’t accept screenshots.

- Confirm Custody: Where are assets held? Under which custodian? In segregated accounts?

- Audit & Track Record: Obtain independent audit letters and multi-year, benchmarked performance.

- Test Withdrawals: Start tiny; confirm exit friction is low and transparent.

- Scrutinise Terms: Look for unilateral freeze rights, punitive “release fees,” or sham dispute procedures.

- Check Domain & Signals: New, masked, or recycled domains warrant maximum caution.

- Assess Communication Tone: Education over pressure; facts over fear.

- Plan the “No”: If even two or three red flags stack up, your decision is made.

Conclusion

The most dangerous thing about an operation like CryptoKlutzApp.net isn’t just the prospect of financial loss—it’s how easy it is to feel safe while walking toward it. That’s the cornerstone of modern financial deception: design, language, and scripted interactions arranged to feel respectable, urgent, and inevitable. But investments worthy of your capital don’t demand faith; they stand on proof—proof of regulation, proof of audited performance, proof of transparent custody, and proof that you can exit with your money on your timeline.

When you peel back the layers on platforms that mirror CryptoKlutzApp.net’s patterns, you see the same architecture repeating: bold claims that dodge accountability, anonymous or contradictory corporate details, legal terms that tilt all power to the platform, and a funnel engineered to convert hesitation into deposits while turning withdrawals into a labyrinth. The sophistication here is not financial innovation—it’s behavioral engineering. It works by borrowing the aesthetics of legitimate finance while rejecting every obligation that makes finance legitimate.

However, vigilance is powerful. A methodical review can puncture the illusion quickly. Ask for regulator names and license numbers; confirm them in official registers. Request independent audits and multi-year track records; check the auditor’s real existence. Map the custody path for assets; verify segregated accounts and named relationships. Then, simulate reality: try a small withdrawal and measure how the platform behaves when funds flow out, not in. Truth reveals itself most clearly at the exit gate.

If you or your clients have already engaged, act—don’t ruminate. Freeze further deposits, gather every document, export chats and emails, and compile transaction IDs. Report promptly to the authorities in your jurisdiction and consult qualified investigators who are frank about constraints and who never guarantee miracles. If someone promises an instant, fee-for-refund solution, recognise that as the second scam orbiting the first.

The broader lesson is lasting: appearance isn’t assurance. A trustworthy operation invites verification because it survives verification. An untrustworthy one invites speed because time and scrutiny are its enemies. Put simply, money likes sunlight. If a platform dims the lights when you ask ordinary questions, you’ve learned everything you need to know.

So treat the red flags outlined above as your compass. If multiple warnings flare at once—grandiose guarantees, evasive ownership, withdrawal friction, legal traps—honor your caution and keep your capital out of reach. In a market crowded with noise, skepticism guided by evidence isn’t cynicism; it’s discipline. And discipline is how you protect not just your portfolio, but your peace of mind.