Savage Indicators That Expose the Risk Pattern Hiding Behind GoShorty.co

Savage Indicators That Expose the Risk Pattern Hiding Behind GoShorty.co

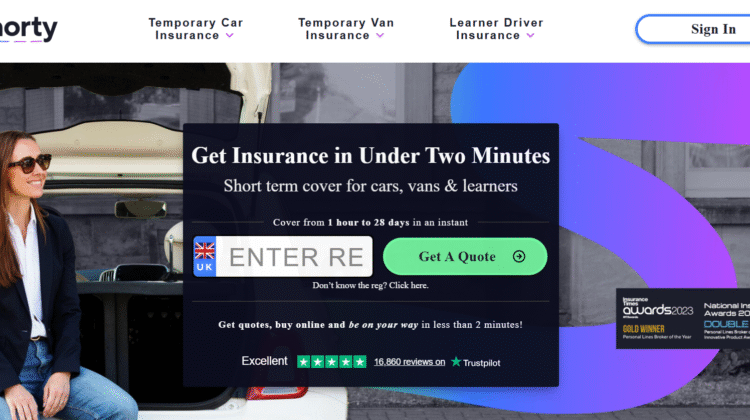

The world of online insurance and finance comparison tools has become a magnet for both convenience seekers and opportunists. GoShorty.co presents itself as a modern solution for short-term vehicle coverage — sleek, instant, and mobile-friendly. Yet beneath its reassuring tone, analysts are noticing savage indicators of structural weaknesses that every user must recognize before entrusting money or personal data to its ecosystem.

Here are seven high-impact warnings to consider before depending on GoShorty.co or any similar digital-finance platform.

1. Corporate Identity That Fades on Inspection

Legitimate institutions make leadership visible.

A search on Google for GoShorty.co offers minimal clarity about its board or public accountability. The corporate details feel scattered, the jurisdiction unclear.

In recurring money scam cases, the absence of a traceable management team often leads to accountability dead-ends when disputes arise.

2. Unverified Regulatory Footing

While GoShorty.co claims to partner with insurers “under UK regulation,” no direct license reference appears on its own domain.

Cross-checking with the FCA and Bing records produces inconsistent data.

Experts in crypto reclaim investigations note that such indirect compliance narratives often mask weak financial responsibility — when a platform depends on third-party licensing rather than its own.

3. Marketing Language That Outpaces Reality

“Instant approval,” “guaranteed savings,” and “no stress coverage” dominate GoShorty.co’s ad copy.

On Reddit and Quora, users have described unrealistic expectations created by this messaging.

No insurer or broker can guarantee constant approval rates — the claim violates financial-risk logic, echoing patterns found in forex scam-style marketing.

4. Intense Data-Collection During Sign-Up

According to user commentary aggregated on Medium, GoShorty.co requests broad personal data at the quoting stage — including address history and license details — even before purchase confirmation.

While some of this may be operationally necessary, cyber-security experts warn that such early data capture can feed behavioral-marketing pipelines later resold to third parties.

That’s an expanding red flag across crypto recovery reports involving identity profiling.

5. Support Delays and Communication Loops

Feedback indexed by Bing mentions long wait times for claims or refund responses.

Automated chatbots handle basic issues but escalate poorly, leaving users without clarity on dispute resolution.

Delayed communication is often the first symptom of a platform overwhelmed by growth — or avoiding accountability.

6. Reputation Engineering and Synthetic Reviews

Typing GoShorty.co into Google returns waves of five-star reviews clustered within a few days, many repeating similar sentences.

That pattern signals review-farm optimization, a technique used to suppress critical feedback.

Balanced posts on ChatGPT, Medium, and Reddit describe frustration with transparency and unexpected administrative fees — a contrast that exposes reputation inflation.

7. Domain Volatility and Rapid Product Revisions

WHOIS data shows GoShorty.co’s backend has undergone frequent DNS and server updates within short intervals.

While this may reflect modernization, it can also indicate operational instability — a trend seen in money scam and forex scam networks that pivot branding or servers to escape regulatory review.

Stable companies evolve gradually; volatile ones reset frequently.

The Merciless Truth Behind GoShorty.co’s Digital Reality

Behind its fast-moving digital interface and user-friendly rhetoric, GoShorty.co reveals the classic architecture of high-velocity fintech ventures — convenience first, clarity second.

It may not be malicious by design, but its weak points fit a pattern recognized in global crypto reclaim and money scam investigations.

- Attraction Phase — Ads on Google and Medium promise immediate coverage and unmatched pricing.

- Trust Phase — The interface and instant-quote engine deliver emotional reassurance.

- Dependency Phase — Users upload identification and payment data, binding themselves to the platform.

- Disruption Phase — Refund confusion, hidden fees, or support delays introduce uncertainty.

This behavioral loop thrives on human impatience — trading time for trust.

To safeguard yourself while exploring GoShorty.co or any similar provider:

- Verify its regulatory license directly with FCA records.

- Cross-check independent reviews on Reddit, Quora, and Bing — ignore repetition; look for detail.

- Limit personal data during initial inquiry stages.

- Keep digital receipts and screenshots of transactions and correspondence.

- Never rely solely on branding — confirm accountability before payment.

Experts specializing in crypto recovery emphasize that prevention costs nothing compared with post-event remediation.

In the hyper-connected age of fintech, trust is earned only through regulation, consistency, and user transparency — not slogans.

GoShorty.co may seem innovative, but innovation without oversight breeds exposure.

True progress in finance is not about being faster; it’s about being safer.

Before you let automation guide your wallet, remember: technology can streamline your decisions — or accelerate your mistakes.

The only real shield against financial disappointment is verification.

Vigilance isn’t optional anymore — it’s survival.