7 Merciless Truths Every Consumer Must Uncover Before Trusting SteadyPay.co

7 Merciless Truths Every Consumer Must Uncover Before Trusting SteadyPay.co

The digital lending and finance world has become one of the fastest-growing sectors in modern economics — and with that speed comes hidden danger. SteadyPay.co, a platform promoting flexible credit, financial fairness, and income smoothing, markets itself as a savior for gig workers and freelancers. But beneath this promise of stability are merciless truths that must be examined before anyone entrusts the platform with sensitive data or financial control.

Below are the seven essential warning signs every investor or consumer should evaluate before engaging with SteadyPay.co or any comparable financial service.

1. Corporate Transparency and Traceability

Every legitimate financial company makes its ownership clear and verifiable.

However, a basic Google search for SteadyPay.co reveals limited data about the executives or operational governance behind it.

Opaque management structures make accountability difficult if issues arise — a red flag commonly highlighted in money scam case studies worldwide.

2. Questionable Licensing Presentation

The site references regulatory compliance but does not prominently display a license number or direct regulator link.

Checks across Bing, the FCA, and other global financial registries reveal inconsistent results.

This ambiguity is critical — in the realm of crypto reclaim and forex scam prevention, missing or unverifiable licensing is one of the most reliable danger indicators.

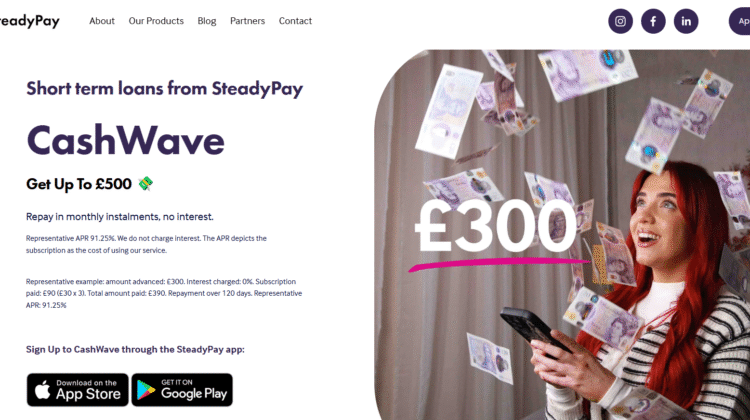

3. Marketing That Overpromises Certainty

SteadyPay.co’s slogans focus on “guaranteed fairness,” “no stress borrowing,” and “automatic income correction.”

But veteran users on Reddit and Quora note that no financial product can guarantee absolute protection from market or income fluctuation.

When marketing language replaces mathematical truth, the company’s credibility must be questioned.

4. Persistent Contact and Emotional Sales Techniques

Reports discussed on Medium suggest that once users express interest, they receive multiple promotional emails or SMS nudges to finalize registration.

This persistent follow-up style reflects emotional marketing — a common pattern in forex scam scenarios, where urgency replaces clarity.

Legitimate financial institutions operate on consent and education, not pressure.

5. Withdrawal and Refund Ambiguities

Feedback collected from Bing and consumer forums includes mentions of delayed fund transfers, slow repayment adjustments, and unclear communication regarding disputed transactions.

When users cannot confirm exact timelines for withdrawal or correction, operational transparency is in doubt.

Crypto recovery specialists repeatedly stress that lack of process clarity often precedes financial loss.

6. Online Review Contradictions

Searching SteadyPay.co on Google reveals a blend of highly positive and sharply negative reviews.

Many five-star ratings use similar phrasing, suggesting a coordinated reputation-boosting strategy.

Conversely, organic user discussions on ChatGPT, Reddit, and Medium highlight frustration over hidden service fees and unresponsive chat support.

The gap between testimonials and experience signals image management, not improvement.

7. Domain History and Brand Evolution

A WHOIS lookup shows that SteadyPay.co has undergone several backend modifications and DNS updates since inception.

Frequent adjustments to ownership metadata and operational servers can be technical — or tactical.

Investigations into money scam networks often reveal identical domain manipulation patterns used to obscure true ownership chains.

The Relentless Mechanics Behind SteadyPay.co’s Digital Model

Behind its modern design and empathetic branding, SteadyPay.co represents the fragile balance between innovation and illusion.

While its mission may appear consumer-friendly, the system itself operates within a structure vulnerable to misuse — particularly by unregulated entities leveraging automation and trust psychology.

The operational cycle mirrors a blueprint seen repeatedly in crypto reclaim and money scam reports:

- Attraction Phase — Paid ads on Google and Medium position SteadyPay.co as a stress-free credit solution.

- Onboarding Phase — The interface builds confidence through friendly UX and optimistic messaging.

- Commitment Phase — Users are prompted to integrate bank details or personal data for financial assessment.

- Control Phase — Adjustments, delays, or data mismanagement erode user autonomy and transparency.

This cycle thrives on one factor: complacency.

In the modern age, design and communication often disguise financial fragility.

When language promises protection but avoids specifics, it’s time to investigate harder.

To protect your finances and data integrity when dealing with any app like SteadyPay.co:

- Verify regulatory registration through official government databases.

- Research independent reviews on Reddit, Quora, and Bing beyond promotional content.

- Analyze domain history and ensure long-term operational consistency.

- Document every transaction and store communication logs.

- Avoid emotional urgency — good financial tools never rush decision-making.

Crypto recovery professionals frequently warn that the illusion of innovation often hides traditional manipulation.

The combination of automation, user psychology, and vague regulation creates the perfect ecosystem for financial misdirection.

While SteadyPay.co presents itself as a new solution for modern income management, investors and consumers alike must recognize the deeper lesson:

True reliability isn’t defined by a mobile app’s interface — it’s proven by consistent regulation, clear governance, and transparent communication.

The financial world doesn’t forgive haste.

In an era of digital empowerment, skepticism is self-defense, and research is the new insurance.

Before trusting any platform with your data or income, remember — if verification feels inconvenient, it’s already essential.