7 Strong Strengths and Important Risks of ThinkMarkets Every Trader Should Weigh

7 Strong Strengths and Important Risks of ThinkMarkets Every Trader Should Weigh

ThinkMarkets is a well-known forex / CFD broker that offers multiple platforms, regulation in several top jurisdictions, and a variety of account types. On the positive side, it scores well among regulators and users for many core features. On the negative side, there are trade-offs and concerns that traders should understand clearly before committing significant funds. Below are seven strong strengths and important risks of trading with ThinkMarkets.

1) Regulation is solid, multiple high-standard authorities oversee it

One of ThinkMarkets’ biggest positives is its regulation by top-tier authorities. It is regulated by the Australian Securities and Investments Commission (ASIC) and by the UK Financial Conduct Authority (FCA). It also has oversight in South Africa (FSCA), Cyprus (CySEC), and other jurisdictions, depending on the entity used. Review sites like BrokerChooser emphasize that regulation under ASIC and FCA gives strong legal protection. Traders in these jurisdictions benefit from obligations like client funds segregation, risk disclosure, auditing, and more rigorous oversight. (Sources: BrokerChooser, TradersUnion, Good Money Guide)

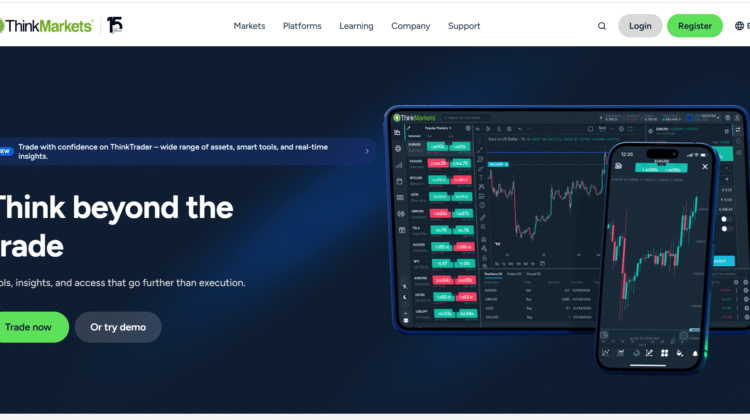

2) Variety of platforms and instruments gives flexibility

ThinkMarkets offers multiple platform choices: MetaTrader 4, MetaTrader 5, and its proprietary ThinkTrader platform. This allows traders to pick interfaces, features, tools, and charting styles they like. The instrument selection is wide: forex pairs, commodities, indices, CFDs on stocks and ETFs, futures, cryptocurrencies, etc. Users on Forums and TradingView praise the clean interface, good execution speed, and variety of markets.

3) Competitive pricing in many cases, but not uniformly low

ThinkMarkets has different account types, including a “Standard” account (commission-free but with wider spreads) and a “ThinkZero” account (tighter spreads + commission). Reviewers note that spreads on major forex pairs are competitive for many traders, especially under the ThinkZero account. However, non-trading fees, inactivity fees, or costs during volatility can reduce the cost benefit. Some user feedback notes that during busy market periods spread widening or slippage occur.

4) Good reputation from many users, with reported fast execution and reliable service

On user review sites including Trustpilot and TradingView, many clients report positive experiences with ThinkMarkets. They often praise account setup speed, execution, reliability of deposits and withdrawals, and responsive customer service. Many say they prefer the ThinkTrader platform for its usability. These kinds of reports build confidence for prospective traders.

5) Risk protection features exist, though with constraints

ThinkMarkets provides negative balance protection (so you cannot lose more than your deposit under certain accounts/jurisdictions). It also requires verification (KYC) for accounts, segregates client funds, and adheres to regulatory requirements in strong jurisdictions. These features reduce certain types of risk. Still, protections depend on which regulatory entity you are under, your location, and your account type. For example, leverage is restricted in UK/EU under FCA rules, which limits risk but also limits profit potential for aggressive traders.

6) Mixed feedback and some complaints about costs, support or trade execution

While many users report positive experiences, there are also reports of dissatisfaction. Some complaints relate to occasional delays in withdrawals, slippage under volatile conditions, spread widening, or support that is slow or less helpful for complex issues. A thread on ForexPeaceArmy recounts a user complaining about delayed execution of orders and poor responsiveness. These are not unique to ThinkMarkets, but they are notable because they appear repeatedly in user-feedback.

7) Transparency and history are better than many competitors, but “ideal conditions” expectations must be managed

ThinkMarkets has been operating since about 2010. It has a history, multiple regulatory registrations, published rules and claims (account types, spreads, platforms). Many review sites and comparative broker-rating tools compare it favorably to brokers like OANDA or FOREX.com on spreads, regulation, or platform tools. However, some features or claims work best under “ideal conditions” — low volatility, high liquidity periods, smaller trade sizes. During major news events or less liquid markets, live spreads, slippage, or execution delays may occur. Traders should not assume that the lowest spreads advertised will apply all the time.

Conclusion: Final Verdict on TinkMarkets

ThinkMarkets is a broker that demonstrates significant credibility in the trading space. Among its strongest assets are its regulation under multiple strong authorities (ASIC in Australia, FCA in the UK, FSCA in South Africa, CySEC etc.), which provide meaningful legal protection, oversight obligations, and financial safety features. For many traders, especially in regulated jurisdictions, this is a major advantage over brokers that operate under weak or offshore regulation only. The provision of negative balance protection, verified client fund segregation, compliance with KYC regulations, and transparency of terms under regulated entities further contribute to safety and trust.

The platform offerings are also a plus. Having access to established platforms like MT4 and MT5, plus proprietary options like ThinkTrader, gives users flexibility. The range of instruments is sufficient for most retail and advanced traders: forex, metals, indices, stocks/CFDs, crypto. Many users report good experience with trade execution, platform stability under normal conditions, and efficient customer service. In reviews, ThinkMarkets often gets high marks for its user interface, deposit/withdrawal reliability, and clarity. For traders who appreciate stable foundations and reasonable pricing, ThinkMarkets is often among the safer choices.

Yet, ThinkMarkets is not perfect. There are trade-offs. Pricing is competitive, but not always the lowest, especially when all costs are included (commission, spread widening, slippage, non-trading fees, inactivity charges). Traders who trade during news events or with large sized orders might see less favorable conditions than those advertised. Complaints about support delays or execution under volatile or low liquidity conditions are real, though not overwhelming; but they indicate risk for traders who cannot afford surprises.

Another important factor is that protections and best terms depend heavily on your location, your account type, which regulatory entity your account is under, and whether you qualify for higher-tier (“zero”/“ECN-style”) accounts. For example, leverage is often restricted under FCA or EU rules, so what you see in marketing may not apply to you. Also, some users report differences between promotional or comparison-site claims and their live account experience, especially once profits or withdrawal amounts get significant.

If I were advising someone considering ThinkMarkets, here’s how I’d proceed:

- Begin with a small deposit, place some trades, and make a small profit, then attempt a withdrawal. This helps test the practical behavior of spreads, execution, and withdrawals.

- Use conservative leverage, especially if you are new or trading large positions.

- Read the terms & conditions carefully, especially sections on commissions, spreads, trade execution policy, “slippage,” account inactivity/non-trading fees, and withdrawal procedures.

- Consider using the regulated branch in your jurisdiction (if available) to gain the strongest protection.

- Keep records (screenshots, trade logs, email replies) in case of dispute.

In sum, ThinkMarkets stands out as one of the stronger brokers in the CFD/forex space for traders who value regulation, reliability, platform variety, and relatively fair cost under normal conditions. It is not flawless, but its weaknesses are known and quantifiable. For most traders who care about safety and service, the risk/profit balance leans in its favor. For those chasing maximum leverage, minimum conditions, or perfection in execution under all market conditions, there may be better options—but such options often come with greater risk. ThinkMarkets is a reasonable “middle to upper” option: not the cheapest, but more dependable than many lower-standard brokers.