9 Frightening Reasons EvaTrades Is a Ruthless Scam Disguised as a Trading Platform

9 Frightening Reasons EvaTrades Is a Ruthless Scam Disguised as a Trading Platform

Introduction: The Sweet Voice of Financial Deception

EvaTrades advertises itself as a world-class online broker offering “secure trading,” “AI-assisted analytics,” and “guaranteed market precision.” Its branding is sleek, its language soothing, and its pitch convincing — designed to make you believe you’re joining a modern investment powerhouse.

But beneath the carefully crafted illusion lies a ruthless operation built to steal, deceive, and destroy. EvaTrades is not a financial platform; it’s a digital trap. Every polished promise, every “advisor,” and every chart on its dashboard exists to create an illusion of trust while draining its victims’ funds.

Here are nine frightening reasons why EvaTrades is one of the most dangerous scams circulating today.

1. Fake Regulation and Phantom Licensing

EvaTrades boldly claims to be “fully licensed and internationally regulated.” Yet, a thorough inspection of global financial databases — including the FCA (UK), ASIC (Australia), CySEC (Cyprus), and FSCA (South Africa) — exposes a painful truth: no such license exists.

This is a deliberate deception. The company fabricates license numbers and even displays counterfeit certificates on its website. Victims often assume these credentials guarantee safety, unaware that they’re dealing with a shadow company completely beyond legal jurisdiction.

2. Hidden Ownership and Offshore Operation

Transparency is the foundation of any legitimate broker. EvaTrades offers none. There is no verifiable physical address, no identifiable leadership, and no real company registration.

Domain research reveals that EvaTrades is hosted through anonymous offshore servers, often linked to known scam clusters. These jurisdictions shield fraudsters from prosecution and make it impossible for victims to trace their stolen money.

3. A Manipulated Trading Platform Built for Deception

EvaTrades boasts of “cutting-edge trading technology,” but in reality, its interface is a cleverly designed simulation. Every chart, statistic, and trade confirmation is generated by software, not real market activity.

Victims report seeing constant “profits” on their dashboards to encourage further deposits. However, when they attempt to withdraw, the excuses begin: “pending verification,” “system upgrade,” “compliance delay.” Eventually, all access is blocked.

The so-called profits are digital mirages — false numbers built to enslave your confidence.

4. Aggressive Sales Tactics by Trained Manipulators

Once you register, you’ll be contacted by persuasive “financial advisors” who sound professional and empathetic. They use a combination of flattery, urgency, and false authority to push you into investing more.

Lines like “You’re just one step away from major profits” or “Our algorithm just detected a huge opportunity” are part of their script. Once your deposits increase, their tone changes. They become impatient, dismissive, and eventually unreachable. These people aren’t advisors — they’re predators in suits.

5. False Testimonials and Paid Publicity

The internet is littered with fake five-star reviews praising EvaTrades for “life-changing returns.” These reviews are not genuine. Analysis reveals identical phrases, stock images, and cloned profiles across multiple websites.

Meanwhile, real victims tell a grim story: locked accounts, withheld withdrawals, and complete loss of funds. The fake positivity campaign is nothing more than a smokescreen, designed to bury legitimate complaints under layers of lies.

6. Cryptocurrency-Only Deposits — A Classic Scam Technique

EvaTrades insists on payments via cryptocurrency, claiming it’s “faster” and “more secure.” What they don’t tell you is that crypto payments are irreversible and untraceable.

This setup allows them to vanish with your funds instantly, leaving no paper trail and no refund path. Legitimate brokers always offer regulated payment options — including bank transfers or credit cards. Crypto-only deposits are a massive red flag that screams fraud.

7. Fabricated Compliance Checks and Withdrawal Traps

When victims try to withdraw funds, EvaTrades suddenly invokes “compliance reviews” or “tax clearance processes.” They ask for extra payments, claiming it’s needed to unlock profits. These payments go straight to the scammers’ pockets.

Even after paying, victims never see a cent. The account either gets permanently frozen or mysteriously “under investigation.” It’s a well-rehearsed trick designed to squeeze every last dollar before disappearing completely.

8. Theft of Personal Data and Identity Exploitation

EvaTrades demands identification documents under the guise of “Know Your Customer” protocols. Victims submit passports, IDs, and utility bills, believing it’s part of a legitimate process. In reality, these documents are harvested and reused in other fraudulent schemes.

Many former investors have reported identity theft, unauthorized credit accounts, and digital impersonation months after dealing with EvaTrades. This isn’t just financial crime — it’s personal violation.

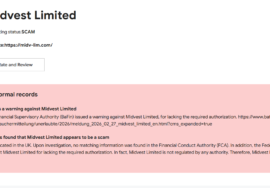

9. Warnings from Victims and Scam Watchdogs

Dozens of victims have come forward, and international scam-reporting platforms have already listed EvaTrades as a suspected fraud. Each story follows the same terrifying pattern: initial charm, fake profits, withdrawal delays, total loss.

This repetition proves one thing — EvaTrades is not an isolated case but part of a global fraud network operating under recycled names and domains. When one brand is exposed, they rebrand and start again.

Exclusive Conclusion: EvaTrades — The Harbor of False Hope

EvaTrades is the perfect example of how modern financial scams have evolved. Gone are the clumsy email cons and cheap websites — in their place stands a sleek, believable empire of deception. The company uses design, psychology, and technology to build the illusion of credibility while orchestrating theft behind the scenes.

The name “EvaTrades” itself is symbolic: “Eva,” derived from the Latin for “life,” and “Trades,” suggesting prosperity. But behind that warm name lies cold calculation. This operation doesn’t give life — it takes it. It drains not only bank accounts but also the dignity and peace of those it deceives.

Victims often describe the same emotional journey: confidence, trust, hope, then panic, disbelief, and despair. The pain of losing savings to EvaTrades isn’t just financial — it’s psychological. It leaves scars of shame, silence, and self-blame. But victims are not foolish — they are targeted by professionals who exploit human optimism and digital naivety.

If you’ve interacted with EvaTrades, act immediately:

- Stop communication with their “support” or “advisors.”

- Do not send additional money for verification, fees, or taxes.

- Report the scam to your national financial regulator, cybercrime authority, and local police.

- Preserve all evidence: emails, chat transcripts, and wallet addresses. These can assist investigators and help expose the people behind the scheme.

The only weapon against EvaTrades and similar operations is awareness. Share your experience. Warn others. Scams like these thrive in silence and crumble in exposure.

Legitimate brokers are transparent, registered, and easily verifiable. They don’t pressure you, promise guaranteed profits, or demand cryptocurrency deposits.

EvaTrades is not a trading platform — it’s a predator camouflaged in professionalism. Protect your money, your data, and your peace of mind. Remember: any company that has to convince you it’s “trusted” is probably the one you should never trust.