COINMARKETCAP.COM THE 10 FISHY CRYPTO BASE YOU MUST APPROACH WITH EXTREME CAUTION

COINMARKETCAP.COM THE 10 FISHY CRYPTO BASE YOU MUST APPROACH WITH EXTREME CAUTION

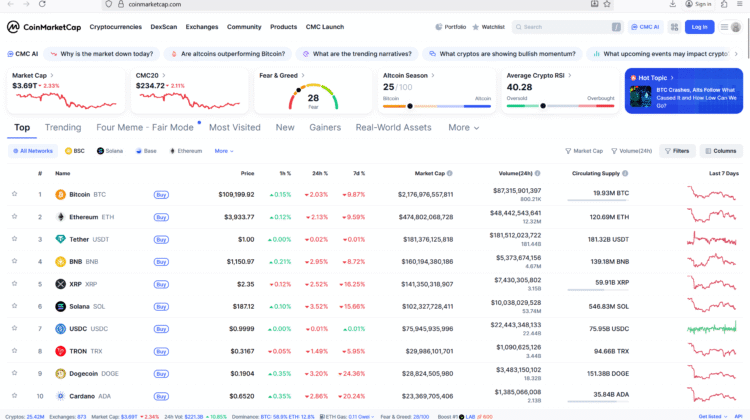

In the ruthless world of cryptocurrency, CoinMarketCap.com has positioned itself as a dominant force — a massive data giant showcasing prices, rankings, and volumes of thousands of digital coins. It’s flashy, it’s influential, and it’s everywhere. Yet beneath its polished interface and its air of authority lies a series of alarming red flags that every trader, investor, and crypto enthusiast must pay attention to. CoinMarketCap.com may look like a trustworthy data beacon, but many seasoned users are beginning to see it as something else — a fishy crypto base, manipulating perceptions and potentially leading investors into dangerous waters.

1. The Illusion of Transparency

CoinMarketCap.com promotes itself as the ultimate source for “accurate” and “transparent” crypto data. However, a closer look reveals that transparency is only skin deep. Many coins listed on the site show trading volumes and rankings that simply don’t align with real market conditions. Some exchanges with questionable reputations mysteriously hold top spots on the site, while reliable ones appear lower — sparking intense suspicion among analysts. This deliberate fogging of data isn’t just an inconvenience; it’s a weaponized manipulation tool that can shift the market’s pulse with a few subtle algorithmic adjustments.

2. The Binance Connection — A Conflict of Interest

One of the biggest warning signs surrounding CoinMarketCap.com is its ownership. The platform was acquired by Binance, the world’s largest cryptocurrency exchange, in 2020. What does that mean for users? It means that the so-called “independent” data provider is now under the direct control of a massive market player — one with enormous financial interests in shaping market narratives. This merger turned CoinMarketCap.com from a neutral data provider into a biased mouthpiece, selectively spotlighting Binance-linked projects and subtly overshadowing competitors. When the referee and the player belong to the same team, fair play no longer exists.

3. Inflated Metrics and Market Manipulation

CoinMarketCap.com is notorious for showcasing exaggerated metrics — inflated trading volumes, misleading liquidity data, and “phantom” market cap numbers. These fake figures attract novice investors, painting illusions of stability and growth where none exist. Smaller altcoins often exploit this by paying for visibility, pumping their rankings overnight, and vanishing after orchestrated rug pulls. It’s a systematic cycle — one that the platform enables by providing the illusion of legitimacy. Behind those colorful charts and sleek graphs, the truth is often buried under layers of cleverly masked manipulation.

4. Hidden Listings and Pay-to-Play Schemes

While the platform claims to follow strict listing guidelines, multiple sources and insiders have exposed CoinMarketCap’s pay-to-list structure. Certain projects allegedly pay significant amounts for faster listing approvals or more favorable visibility. This commercial bias compromises the platform’s supposed neutrality. Instead of prioritizing user safety and authenticity, CoinMarketCap appears to prioritize profit-driven exposure, giving dangerous projects a stage to scam unsuspecting investors. This shadowy business model transforms a once-useful data site into a minefield of deceit.

5. Data Delay and Strategic Timing

Timing is everything in crypto. A few seconds can mean the difference between profit and loss. CoinMarketCap.com often shows delayed or selectively updated prices, particularly during volatile swings. While users assume these lags are technical issues, experts suspect otherwise. These calculated “glitches” could allow certain insider groups to front-run market changes, exploiting the delay to their advantage. When data delay becomes predictable, it ceases to be a technical error — it becomes a strategic manipulation mechanism.

6. Deceptive Confidence and Community Misdirection

CoinMarketCap.com leverages its massive community following to engineer confidence. Every day, millions of users check the site without question, trusting its data as gospel truth. That’s the real danger — psychological control. When people stop questioning data, they become easy to manipulate. Forums and ranking systems on CoinMarketCap foster herd mentality, pushing users toward certain tokens through social momentum rather than actual merit. The site doesn’t just list coins — it manufactures hype, creating self-fulfilling market movements that benefit insiders while trapping newcomers.

7. The Data Monopoly Problem

CoinMarketCap.com’s dominance has created a data monopoly in the crypto world. Many exchanges, apps, and media outlets rely on its data feed, amplifying its influence exponentially. When one platform controls the perception of price, rank, and legitimacy across multiple systems, it essentially controls the market narrative. This monopolistic grip makes it easier for the controlling entities to distort truth and harder for smaller, honest platforms to compete. In short, the crypto world is being fed one version of the truth, dictated by a platform with questionable motives.

8. Privacy Concerns and Tracking Footprints

Another often-overlooked danger is data harvesting. CoinMarketCap.com collects vast amounts of user behavior data — from browsing patterns to wallet connections and geolocation. That data can be monetized, analyzed, or even shared with affiliates. When combined with Binance’s ecosystem, the surveillance potential becomes staggering. Users who believe they’re merely “checking coin prices” might be unknowingly feeding one of the largest behavioral databases in the crypto world.

9. Warning for Newcomers

For newcomers stepping into the volatile crypto space, CoinMarketCap.com can look like a safe harbor — clean, simple, informative. But that’s precisely the illusion that traps beginners. They rely on its data to make critical investment decisions, unaware of its biased listings, delayed updates, and manipulated metrics. Many investors who trusted the platform have been burned by rug pulls, fake volume coins, and market traps — all because they trusted a source that didn’t deserve it.

10. The Path Forward — Awareness and Independence

It’s time for users to wake up. CoinMarketCap.com is not the ultimate crypto oracle it pretends to be. It’s a powerful, agenda-driven platform with corporate hands pulling the strings behind the curtain. The solution isn’t blind trust — it’s data diversification. Relying on multiple independent data aggregators, cross-referencing exchange APIs, and using on-chain analytics can help users regain control over their decision-making. The fight for honest crypto information starts with rejecting centralized data manipulation masquerading as neutrality.

EXCLUSIVE CONCLUSION

CoinMarketCap.com once symbolized independence and accessibility in crypto data. Today, it’s a corporate-controlled stage, projecting a polished illusion of credibility while quietly serving hidden masters. It thrives on perception, not authenticity. And that makes it one of the most dangerous entities in modern cryptocurrency — because it doesn’t have to scam you directly to destroy your wallet; it simply needs to mislead your trust.

Every user entering the digital market should understand this core truth: data is power. Whoever controls the data controls your decisions, your emotions, and your wallet. CoinMarketCap.com has become a data dictator, shaping market moods, amplifying hype coins, and muting projects that threaten its affiliates. That’s not transparency — that’s strategic manipulation disguised as information service.

If users continue feeding their attention and trust into such systems, the crypto space risks becoming another centralized ecosystem — dominated not by banks this time, but by data monopolists who dictate which coins thrive and which disappear. Binance’s acquisition of CoinMarketCap wasn’t a coincidence; it was a calculated move to seize narrative control. Every chart, every ranking, every metric displayed on that website serves a purpose — and that purpose isn’t always aligned with your best interests.

So what’s the real takeaway? Be vigilant. Don’t let a website’s clean interface or familiar logo lull you into blind obedience. Always verify from multiple sources. Compare CoinMarketCap’s data with CoinGecko, Nomics, or on-chain analytics. Watch for discrepancies. Train yourself to question what you see, because in crypto, what looks “official” can easily be a trap built on numbers and design.

CoinMarketCap.com may still hold immense influence today, but awareness is the weapon that can break its spell. The more investors understand how this machine operates, the less power it has to manipulate. Treat it not as a guide, but as a potential hazard zone. Approach it with caution, skepticism, and strategic distance.

In the end, crypto was born from rebellion — the rebellion against centralized power, deceit, and manipulation. Allowing a site like CoinMarketCap.com to monopolize information is the ultimate betrayal of that very foundation. Every trader, every investor, and every enthusiast must guard against falling into its web of data distortion.