7 Frightening Warnings That Expose TradeFoxs as a Calculated Brokerage Scam

7 Frightening Warnings That Expose TradeFoxs as a Calculated Brokerage Scam

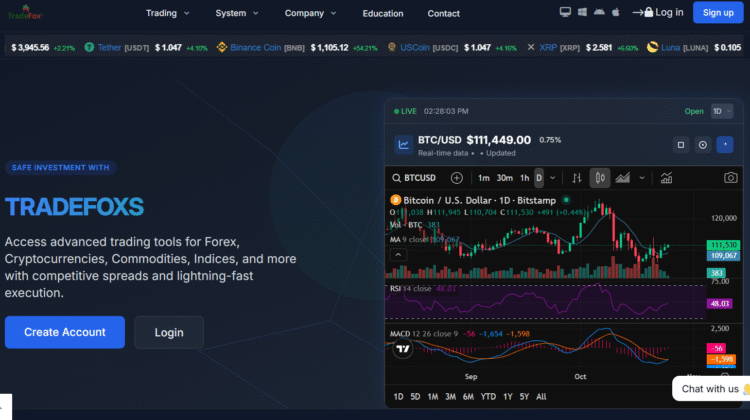

As global markets surge with digital trading, deceptive brokers multiply in their shadows. One of the most frightening and fast-spreading examples is TradeFoxs — a site that sells itself as a professional forex and crypto platform but secretly operates as a financial trap.

Here are the seven frightening warnings proving that TradeFoxs is not a broker but a digital ambush.

1. Phantom Registration and Fake Address

TradeFoxs claims to operate from a major European financial hub. But searches through Google Maps and official business registries show no corporate presence whatsoever. The “suite number” they list belongs to a virtual-office mailbox.

A genuine financial firm is traceable — TradeFoxs is a ghost built for disappearance.

2. False Licensing and Forged Regulatory Claims

On its homepage, TradeFoxs proudly displays a “global license badge.” Yet verification via Google.com and regulator databases such as the FCA and CySEC confirms no record of authorization.

The so-called certificates are counterfeit graphics — a common ploy used to build false trust and lure first-time investors.

3. Manipulated Trading Platform

Victims describe TradeFoxs’s dashboard as a slick illusion of profitability. Charts fluctuate, balances rise, and trades “execute,” but the interface is disconnected from real markets.

When users try to withdraw, the dashboard freezes or invents “pending audits.” It’s pure software theater, not trading.

- Aggressive Cold Calls and Emotional Manipulation

After signup, “account managers” attack relentlessly with calls and WhatsApp messages. They flatter, promise “exclusive signals,” then shame hesitant investors for being “afraid of success.”

This isn’t financial advice — it’s psychological warfare crafted to empty your wallet.

5. Withdrawal Nightmares and Fake Fees

Once clients request payouts, TradeFoxs demands bogus “tax payments” or “processing fees.” Those who refuse are locked out permanently. Others are told their funds are “under review by compliance.”

This scripted delay is designed to buy time while the scammers vanish with the deposits.

6. Fabricated Reviews and Digital Reputation Theft

Across Reddit.com, Medium.com, and Quora.com, identical five-star posts appear under different usernames — all praising “fast withdrawals” and “expert support.”

These are purchased testimonials created to drown out genuine warnings.

Meanwhile, honest victims surface on ChatGPT.com and Bing.com threads sharing proof of lost savings and blocked accounts.

- Rebranding and Serial Fraud

Like all professional scam networks, TradeFoxs rebrands once exposed.

New domain, same scripts, same criminals. This endless rebirth allows them to keep stealing from new victims across countries.

The Cruel Mechanics Behind TradeFoxs

Beneath its modern facade, TradeFoxs is a predatory machine, not a broker.

Every element — from fake licenses to the AI-styled trading dashboard — exists to steal with precision.

The operation follows a predictable, four-step pattern:

- Hook Phase — Ads on Google and Medium promise AI-driven wealth.

- Trust Phase — Agents display fake profits to build confidence.

- Extraction Phase — Investors are pushed to “upgrade plans” with bigger deposits.

- Collapse Phase — Withdrawals fail, support disappears, and the domain dies.

The cycle restarts under a fresh brand.

Victims on Reddit, Quora, and Bing describe identical tactics: sweet talk at first, silence after the final payment.

Fighting back requires speed and awareness:

- Alert your bank’s fraud team immediately.

- Report TradeFoxs to your financial regulator.

- Post warnings on community sites so others don’t fall for the same script.

Real brokers operate with licenses, transparency, and audits.

TradeFoxs offers none of these. It is a digital predator that feeds on trust and ignorance.

If a company guarantees profits and pressures for deposits, it’s not an investment —it’s bait.

Stay skeptical, stay vigilant, and never let greed override due diligence.