7 Startling Signs That FXTrendo Demands Extreme Caution from Traders

7 Startling Signs That FXTrendo Demands Extreme Caution from Traders

The explosion of online trading platforms has created a marketplace filled with opportunities — and dangers. Among the growing list of names attracting attention is FXTrendo, a site that promotes modern analytics, automated trading, and effortless income. Yet, for many cautious investors, its structure raises startling signs that every trader should examine before sending a single cent.

Below are the seven essential warnings to investigate carefully before trusting any broker that resembles FXTrendo.

1. Limited Corporate Transparency

Every legitimate financial firm reveals who runs it.

FXTrendo’s website lists minimal information about company officers, registration numbers, or verifiable headquarters. A quick search on Google Maps often leads to a shared-office facility or unrelated tenants.

When ownership details disappear behind vague language like “globally registered entity”, accountability evaporates with them.

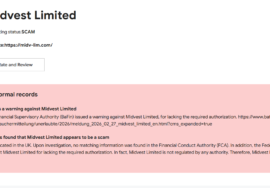

2. Unconfirmed Licensing and Regulation

FXTrendo claims to comply with “international standards,” but a search through regulator databases such as the FCA, ASIC, or CySEC shows no corresponding license.

When a platform references compliance without giving an authentic license number, it’s signaling risk.

Verification should always come from regulators — not from badges printed on a homepage.

3. Unrealistic Profit Messaging

Across marketing banners and landing pages, FXTrendo highlights rapid growth and “consistent daily results.” On Reddit and Quora, users often share concerns about such messaging because markets are inherently volatile.

Any broker that downplays risk or guarantees success is appealing to emotion, not logic. Genuine trading platforms focus on education and transparency, not miracle results.

4. Aggressive Outreach and Pressure Calls

Traders have reported receiving repeated follow-up messages from representatives introducing themselves as “financial advisors.” These calls escalate quickly from friendly guidance to urgent persuasion: “Act now — markets won’t wait!”

This is a classic psychological tactic that replaces analysis with haste.

Professional institutions provide data; high-pressure ones provide deadlines.

5. Withdrawal Complications and Delays

One of the strongest early warnings about any unverified platform is difficulty withdrawing funds. Discussions indexed by Bing and Medium mention traders waiting weeks for verification responses or being asked for additional “release fees.”

A sound brokerage keeps withdrawal processes simple and documented; when payouts stall, transparency has already failed.

6. Manufactured Online Reputation

Search Google for FXTrendo and you’ll encounter a flood of glowing testimonials: five-star ratings, nearly identical phrasing, and newly created review accounts.

Such repetition often signals review farming, a tactic that buries legitimate criticism under synthetic praise.

Real feedback varies in tone, grammar, and timing — false reviews don’t. Cross-checking discussions on ChatGPT, Reddit, and Medium usually reveals a different, less flattering narrative.

7. Domain Instability and Clone Behavior

Digital investigators frequently note that high-risk brokers change domains within months.

If FXTrendo’s domain history shows recent creation or multiple short-lived sister sites, that instability itself is a red flag.

Clone websites — identical layouts under new names — are common tools for avoiding public scrutiny and restarting operations under a clean label.

The Alarming Framework Behind FXTrendo

Behind its polished design, FXTrendo reflects a pattern that seasoned traders have learned to recognize: limited verification, emotional marketing, and inconsistent transparency. These signals don’t automatically define wrongdoing, but they highlight a structure that deserves skepticism before investment.

Most questionable trading platforms follow the same four-phase cycle:

- Attraction Phase — Online ads on Google and Medium promise AI-driven profits and professional mentorship.

- Trust Phase — A sleek dashboard displays flawless trades, generating confidence.

- Extraction Phase — Investors are persuaded to deposit more for “premium access.”

- Collapse Phase — Withdrawals slow, representatives disappear, and the site quietly rebrands.

This process relies on psychology as much as technology. Hope, greed, and urgency are manipulated until common sense fades.

That’s why independent verification is every trader’s best defense.

When assessing any broker, apply these principles:

- Confirm registration through official government databases, not through company screenshots.

- Read user experiences on neutral sources like Reddit, Quora, and Bing — avoid testimonials hosted on the platform itself.

- Inspect domain history via open-source tools to detect recent ownership changes.

- Check withdrawal terms before depositing; reputable brokers specify timelines and banking partners in writing.

- Stay critical of perfection. Real trading involves fluctuations, not straight-line profits.

If you’ve already interacted with a platform resembling FXTrendo, maintain full documentation of every transaction and correspondence. These records are vital should disputes arise.

More importantly, share your research publicly to strengthen collective awareness — financial literacy protects the next investor long before regulators intervene.

Technology has made investing easier but also riskier. While automation and AI promise smarter trading, they also provide new camouflage for manipulation. Distinguishing innovation from illusion requires patience, evidence, and skepticism.

Remember: legitimate brokers don’t hide leadership, fabricate urgency, or promise guaranteed success.

They invite audits, publish credentials, and treat risk as reality — not marketing.

Whether the name is FXTrendo or any other emerging platform, the rule remains the same:

trust verification, not presentation. When something looks too stable, too perfect, or too secretive, step back and investigate before stepping in.