7 Brutal Truths That Expose the Underlying Risks Behind Countingup.com’s “Smart Banking” Image

7 Brutal Truths That Expose the Underlying Risks Behind Countingup.com’s “Smart Banking” Image

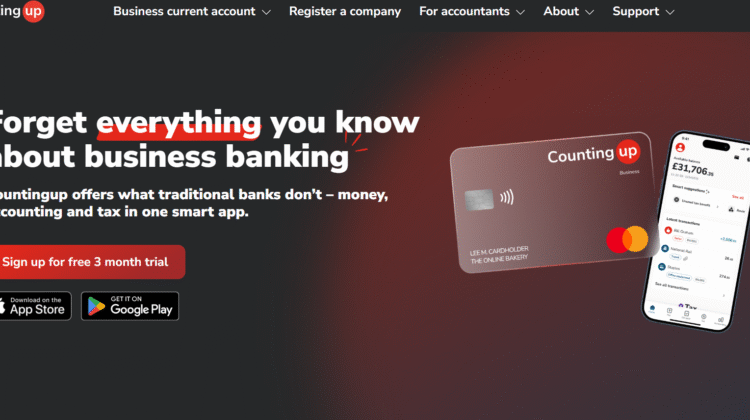

In an era where small businesses are turning to digital-first financial platforms, Countingup.com stands out as an app promising seamless banking, automatic accounting, and effortless financial management. It markets itself as the solution that merges convenience with control. But beneath the professional veneer lies a set of brutal truths that highlight the hidden risks of trusting an app more than an institution.

Below are the seven critical signals that every freelancer, entrepreneur, or small-business owner should review before depending entirely on Countingup.com or similar digital-finance solutions.

1. Limited Corporate Transparency

When researching any financial platform, visibility of leadership and registration is essential.

A Google search for Countingup.com reveals surface-level company details but minimal public disclosure about its internal governance or data management practices.

Transparency is the backbone of financial security and where it’s thin, oversight becomes questionable.

Patterns like this often surface in money scam and digital compliance audits, where lack of visible accountability leads to consumer vulnerability.

2. Unclear Regulatory Oversight

Countingup.com mentions operating under financial regulations through partner institutions, but direct licensing verification under its domain is challenging.

Searches on Bing and regulatory databases like the FCA show overlapping entries with multiple entities.

This structure complicates who actually safeguards customer funds.

Experts in crypto reclaim and forex scam prevention warn that indirect licensing — when a platform relies on a partner’s authorization instead of its own, leaves consumers exposed if the relationship dissolves.

3. Marketing That Outpaces Reality

Slogans like “Run your business from your phone” and “Instant insight into profits” make Countingup.com sound foolproof.

But users on reddit.com and Quora report limitations in customer service responsiveness, transaction delays, and inconsistent data syncing.

As many Medium analysts note, when convenience becomes the entire sales pitch, clarity about limitations often fades, a dynamic mirrored in money scam patterns built around overconfidence.

4. Customer Support Gaps

Small-business owners expect reliability, but reports from Bing and review sites indicate gaps in customer support during system outages or verification disputes.

Automated replies and slow responses create anxiety for users managing real-time financial operations.

Automation saves cost but sacrifices reassurance, a warning crypto recovery professionals have seen across emerging fintech brands that grow faster than their service infrastructure.

5. Dependence on Automation and Data Integration

Countingup.com’s app automatically categorizes spending, generates invoices, and manages accounting entries.

While that sounds innovative, it raises the same question that defines most digital financial systems: who controls the data?

Experts writing on ChatGPT and Medium emphasize that automation without manual override or clarity about data storage introduces serious privacy and accuracy risks, particularly if algorithms mislabel or expose sensitive information.

6. Reputation Gaps and Review Irregularities

Searching Countingup.com on Google shows predominantly positive results.

But a deeper read reveals clusters of reviews that echo the same phrasing, a possible sign of reputation engineering.

Balanced user accounts across Reddit, Quora, and Bing paint a more mixed picture: customers satisfied with convenience but frustrated with limited flexibility, unclear error responses, and slow identity checks.

7. Domain and Brand Longevity Questions

A WHOIS inspection shows Countingup.com has experienced domain updates and backend adjustments since launch.

While common for tech startups, constant changes in backend infrastructure, branding, or ownership links can complicate long-term trust.

Experts studying forex scam patterns note that even legitimate companies can inadvertently mirror the same volatility as short-lived, high-risk ventures if they pivot too rapidly.

The Harsh Reality of Countingup.com’s Digital Ecosystem

Behind its clean interface and reassuring messaging, Countingup.com represents the paradox of the modern fintech era: maximum automation, minimum human connection.

The company’s goal of merging banking and bookkeeping is commendable. Yet the execution exposes structural risks common across emerging financial technologies.

The same pattern has appeared repeatedly in crypto reclaim and money scam reports worldwide:

- Attraction Phase — Users are drawn to simplicity and efficiency.

- Trust Phase — Automation creates the illusion of total control.

- Dependence Phase — Users centralize data and transactions within one app.

- Disruption Phase — Technical issues, slow responses, or unclear governance expose users to unexpected losses or operational paralysis.

This cycle doesn’t require malicious intent — only overconfidence.

When companies promise perfection, they invite unrealistic expectations.

To protect yourself when working with Countingup.com or similar digital-banking platforms:

- Verify licensing directly through official regulators, not marketing claims.

- Diversify financial tools — never rely on a single platform for business liquidity.

- Back up your transaction records outside the app regularly.

- Cross-check user feedback on Reddit, Quora, and Bing to uncover genuine patterns.

- Watch for policy changes regarding data use or account closures.

Crypto recovery specialists continually warn that most victims of financial loss didn’t fail to act — they failed to verify.

Innovation without oversight is the modern frontier of financial risk.

Countingup.com may not resemble a classic scam, but its structure embodies the fragility of automation-driven banking: efficient when stable, disruptive when tested.

In today’s era of instant finance, the burden of verification now belongs to the user.

Don’t confuse convenience with credibility.

Technology may simplify money, but it doesn’t simplify accountability.

The truth remains relentless:

your awareness is your insurance, your skepticism is your profit, and your research is your only protection.

After I initially commented I appear to have clicked

on the -Notify me when new comments are added- checkbox and now

whenever a comment is added I receive 4 emails

with the same comment. Perhaps there is an easy method you can remove

me from that service? Thanks a lot!