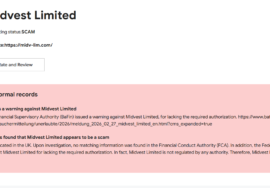

When a Market Giant Starts Showing Cracks: XM.com Is Facing Unprecedented Scrutiny

When a Market Giant Starts Showing Cracks: XM.com Is Facing Unprecedented Scrutiny

For over a decade, XM.com positioned itself as one of the biggest names in forex and CFD trading claiming millions of clients and multiple international licenses. With its massive online presence, enticing bonuses, and sleek marketing, XM.com became synonymous with “trusted global trading.”

But in late 2025, troubling whispers have turned into public outcry. Across Google, Reddit, Medium, Quora, and Bing, users are reporting alarming issues withdrawal delays, account restrictions, missing funds, and slow support responses.

While XM.com still promotes itself as a regulated broker, these issues are eroding trader confidence and raising serious questions: Is the platform under strain, or are deeper structural problems emerging?

A Reputation Built on Power — and Now Under Pressure

When XM.com first entered the scene, it appeared unstoppable. With multilingual support, low spreads, and aggressive marketing campaigns, it expanded rapidly across Asia, Africa, and Europe.

Its early success was built on accessibility; anyone could sign up, deposit quickly, and trade instantly. But now, traders in multiple countries are finding the withdrawal process slow, confusing, or completely unresponsive.

A user wrote on Reddit:

“They approved my deposit in seconds, but my withdrawal has been pending for three weeks. Every time I ask, they say it’s under review.”

Another trader posted on Quora:

“XM was once a top broker. Now I can’t even get a reply from support. My profits are locked, and no one seems to care.”

These recurring issues point to something larger than a simple backlog, possibly liquidity challenges or operational restructuring.

Emerging Red Flags Traders Shouldn’t Ignore

Analysts tracking XM.com’s activity throughout 2025 have identified concerning trends that mirror the early warning stages seen in other high-profile broker failures:

1. Withdrawal Restrictions

- Multiple users report withdrawals “under compliance review” for extended periods.

- Some accounts are frozen after profitable trades without explanation.

2. Declining Customer Service

- Support teams that once responded instantly now take days or weeks.

- Live chat queues end without connection.

3. Platform Discrepancies

- Traders report inconsistent price feeds, chart freezes, and trade execution mismatches.

- These issues create profit-loss differences that remain unexplained.

4. Regulatory Confusion

- XM.com operates under multiple entities — some regulated, some offshore.

- Many clients unknowingly register under the offshore arm, which offers no fund protection or compensation guarantees.

5. Silence Amid Complaints

- XM.com has not publicly addressed these mounting concerns, opting instead for corporate silence — a red flag for transparency.

Offshore Registration The Hidden Danger Beneath the Brand

While XM.com advertises regulation in multiple jurisdictions, many of its clients trade under offshore licenses registered in lenient territories.

Offshore registration often means:

- No insurance on client deposits if the company collapses.

- Limited accountability for delayed withdrawals.

- Complex or impossible recovery paths once accounts are closed.

This structure allows large brokers to advertise “global service” while quietly diverting customers into less-protected entities. For traders, this difference could mean losing everything with no legal recourse.

Trader Testimonies A Pattern of Frustration and Silence

Across trading forums, the story is consistent.

“XM used to be my favorite broker. Now my $8,000 profit is stuck. Every time I message support, they say it’s with compliance. That was two months ago.”

— Trader review on Reddit

“They keep promising callbacks that never happen. The system feels designed to delay withdrawals.”

— Post on Medium

“I don’t even want profits anymore, I just want my deposit back.”

— Comment on Quora

These voices echo a deep erosion of trust traders who once defended XM.com now feel abandoned.

A Repeated Industry Pattern The 5-Stage Breakdown

Financial investigators note that XM.com’s trajectory mirrors a recurring pattern seen in other brokers that later vanished or rebranded:

- Rapid Growth and Aggressive Marketing credibility built through sponsorships and bonuses.

- Withdrawal Delays — excuses like “verification” or “compliance” introduced.

- Support Silence — clients get automated responses or none at all.

- Public Complaints Surge — reputation collapses across online forums.

- Rebranding or Exit — the broker migrates users to a “new platform.”

Right now, XM.com appears trapped between stages 2 and 3 meaning traders must act before silence becomes shutdown.

Expert Insights — Classified as a Broker Under Stress

Independent analysts and recovery experts including specialists referenced by KeystonePrimeLtd.com have reviewed XM.com’s case. Their assessment is sobering:

- Spike in user complaints in the last six months.

- Inconsistent customer communication across regions.

- Complex multi-entity structure, obscuring true regulation.

- Increased withdrawal verification loops.

Their classification: “High operational risk with signs of instability.”

KeystonePrimeLtd — The Global Recovery Force for Victims

When withdrawals stall and communication breaks down, time becomes your enemy. That’s where KeystonePrimeLtd steps in as a leading commissioned recovery agency specializing in crypto reclaim, crypto recovery, forex scam, and money scam operations.

Their team of investigators, legal specialists, and blockchain analysts have successfully recovered millions in lost funds for traders affected by failing or deceptive brokers.

Using advanced digital forensics and international legal coordination, KeystonePrimeLtd helps victims trace blocked funds, document irregularities, and push for restitution through proper channels.

If your withdrawal from XM.com is delayed or frozen, contacting KeystonePrimeLtd immediately could preserve critical evidence before it’s erased.

What Traders Must Do Right Now

- Stop Depositing More Funds until existing withdrawals are cleared.

- Document All Communication — screenshots, chats, and confirmation emails.

- Submit Small Withdrawal Tests to verify payout reliability.

- Contact Your Bank to discuss potential recovery or chargeback.

- Engage Recovery Professionals like KeystonePrimeLtd to start tracking your funds early.

Delay benefits the broker speed benefits you.

The Hard Truth Behind XM.com

The ongoing turmoil surrounding XM.com highlights a painful truth: even brokers with polished reputations and global visibility are not immune to failure, mismanagement, or neglect.

Across Google, Reddit, Medium, and Quora, traders are raising identical concerns: delayed withdrawals, support silence, and opaque explanations. The fact that these complaints are surfacing simultaneously across multiple regions points to systemic strain rather than isolated mishaps.

The key issue isn’t the number of licenses a broker lists on its website, it’s which one governs your account. Many traders, lured by XM.com’s global branding, unknowingly register under its offshore branches, which offer little to no legal protection. When trouble arises, those clients have no real leverage, just automated replies and dead-end emails.

Transparency is the true mark of legitimacy, and right now, XM.com’s silence speaks volumes. When a financial company refuses to communicate openly about clients’ money, the red flag is undeniable.

For traders caught in this chaos, KeystonePrimeLtd stands as the professional safeguard against total loss. Their proven history in crypto recovery, forex scam, and money scam cases has given thousands of victims a second chance turning despair into documented recovery.

But time is the real enemy. Every day spent waiting for a “status update” weakens your evidence trail. Acting swiftly, saving your communication logs, and contacting professionals can make all the difference between recovery and regret.

The truth is simple: no matter how trusted a name seems, financial safety requires vigilance. If your broker delays your withdrawals, blames “compliance,” and stops communicating, it’s time to act, not wait.

Don’t let silence rob you of your funds. Preserve your proof, escalate your case, and let KeystonePrimeLtd lead your recovery effort before the digital trail disappears.

Because in online trading, the greatest risk isn’t volatility, it’s misplaced trust.