7 Brutal Issues You Must Know About BinaryTrading.com

7 Brutal Issues You Must Know About BinaryTrading.com

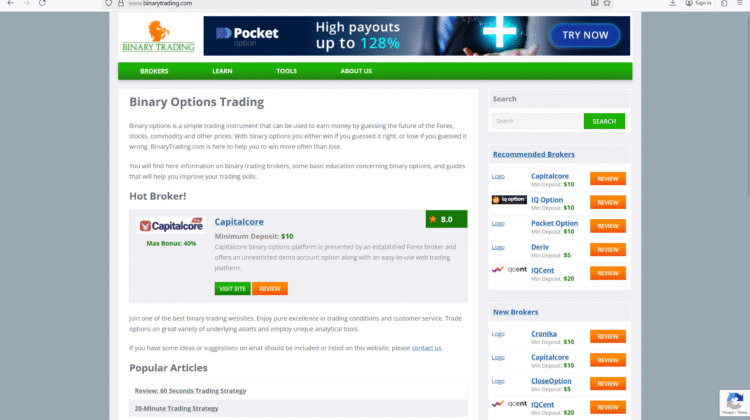

1. It’s Not Actually a Broker

The very foundation of “BinaryTrading.com” collapses under scrutiny: the site itself admits it is not a broker, nor a fund manager, nor a financial advisor. Its content is presented for educational or entertainment purposes only. This means when you visit the site expecting trading access or a regulated brokerage, you find only reviews, opinion pieces, and affiliate links. The site’s own disclaimer warns that the information should not be taken as financial advice. That difference matters enormously: you are not entering into a relationship with a broker — you’re navigating a content and affiliate site.

2. Heavy Reliance on Affiliate Commissions

BinaryTrading.com openly states it is partially compensated via affiliate commissions from brokers it lists. That creates a built-in bias: the more clients a listed broker attracts through its site, the more revenue it generates — regardless of the broker’s legitimacy or performance. When incentive leans toward driving traffic and conversions, rather than vetting or protecting readers, your interests come second.

3. Educational Label Masks Risk

Many visitors assume a site like this is a safe gateway into binary trading. But labeling content “educational” doesn’t negate the fact that much of what you read can serve as marketing for risky or unverified platforms. The site carries a general risk warning about binary options trading being highly risky and notes that losses may exceed initial capital. But that caution is diluted amid recommendations and broker listings. Because the site does not hold regulatory responsibility, its risk disclosures carry little enforceable weight.

4. No Guarantees, No Accountability

Because BinaryTrading.com is not a broker or licensed financial institution, it offers zero guarantees. If you follow a broker link from the site, deposit funds, and then lose money or cannot withdraw them, there is no legal recourse through BinaryTrading.com itself. They are outside the chain of accountability. The site’s structure makes it difficult to trace direct liability — a built-in protective wall for the publisher.

5. Mixed Quality and Transparency in Reviews

The site features reviews of broker platforms ranging from “recommended” to “scam brokers.” But many reviews lack deep validation: they often do not provide screenshots of user-submitted complaints, regulatory license checks, or comparative execution tests. Instead, they rely on basic descriptions, promotional brochures, and affiliate impressions. This kind of superficial review can mislead less experienced traders into trusting brokers whose problems lie hidden beneath the surface.

6. Market Risks of Binary Options Amplified by Content Platforms

Binary options themselves are a high-risk form of trading. By definition, they pay either a fixed return or nothing at all, with very little workspace for partial wins or nuanced exit. Many financial regulators globally have banned or heavily restricted retail offering of binary options because they are viewed by many as closer to gambling than investing. When a site like BinaryTrading.com promotes binary options through broker listings and tutorials, it is effectively pushing an instrument already considered dangerous by many authorities.

7. The Illusion of Legitimacy Through Volume

A high volume of content, dozens of broker listings, and “trusted broker” badges can give the impression of legitimacy — but volume is not proof. Many scam operations use similar content strategies: flood the web with articles, listings, and SEO visibility, hoping that sheer presence drowns out caution. Just because a broker shows up in many listings doesn’t mean it is regulated, trustworthy, or safe. Always verify independently.

Conclusion — Why You Should Treat BinaryTrading.com with Extreme Caution

BinaryTrading.com positions itself as a comparison, review, and educational platform, not as a brokerage. That distinction, however, does very little to protect users who follow its links and deposit money with brokers it promotes. By relying on affiliate commissions, the site has built a business model that rewards attracting clients — not safeguarding them. That flies in the opposite direction of fiduciary ethics.

When you follow a broker listing or a review from such a platform, you’re stepping into a darker ecosystem. The platform offers you names, promises, and persuasive language, but not the assurance of regulation, proof of execution fairness, or protection from fraud. If one of its listed brokers collapses, or if your funds are refused, BinaryTrading.com is not liable. That’s the cost of dealing through content-first platforms.

Binary options as a financial instrument already carry high risk and attract regulatory scrutiny. Many jurisdictions have banned or heavily restricted them precisely because they provoke speculative, high-stakes behavior. For a website to amplify that risk by recommending broker links, glossing over regulation checks, and hosting superficial reviews means ordinary users carry all the danger.

If you must use BinaryTrading.com, treat it as a directory and nothing more. Before committing any funds: dig independently into the broker’s license in regulation databases, look for verified audits, test small deposits and withdrawals, and demand transparency. Do not take anything on the site at face value.

Your capital deserves platforms that accept accountability, not platforms that profit when you stay in the shadows. BinaryTrading.com may teach you what brokers exist, but it does nothing to guarantee they are clean. Always trade armed with independent verification, not affiliate-driven recommendations.