8 Aggressive Warnings to Avoid the Choiceassetscfds Scam Platform Immediately

8 Aggressive Warnings to Avoid the Choiceassetscfds Scam Platform Immediately

The Trap of the Choiceassetscfds Scam Platform

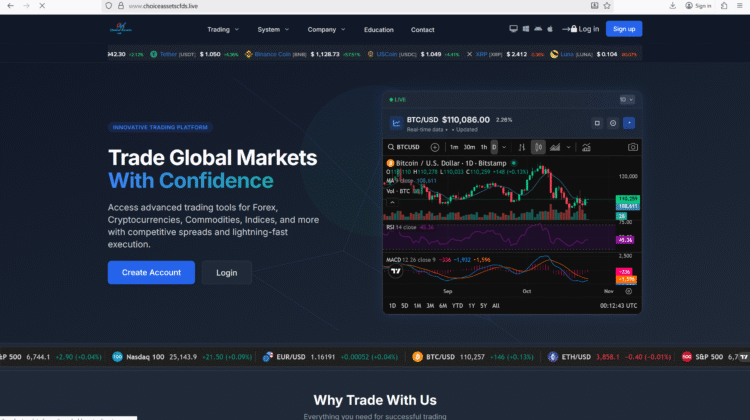

The website at https://www.choiceassetscfds.live presents itself as a professional investment and trading portal promising high-returns via CFDs, forex and cryptocurrency. Yet beneath the slick surface lies a pattern of alarming red flags indicating it is built for fund extraction, not legitimate trading. If you value your capital and refuse to become an entry in the painful arena of crypto scam recovery process, recover funds from crypto fraud, blockchain investment scam recovery, crypto scam fund retrieval services, or being forced to defeat crypto fraud schemes, then you must stay far away from this platform now.

- Regulatory Claims That Collapse Under Scrutiny

One of the clearest warnings: Independent data show that Choice Assets CFDs is not regulated by any recognised financial regulator. For example, according to BrokersView:

“Operating status: SCAM … no licence found with CySEC or Seychelles FSA despite website claims.” (BrokersView)

Additionally, the UK regulator Financial Conduct Authority (FCA) has issued a formal warning that the firm may be offering financial services without authorisation. (BrokersView)

Without verifiable regulatory oversight, you have virtually no protection if things go wrong.

- Domain Age, Transparency Gaps & Ownership Obscurity

Reports highlight that the domain is very new and the company behind the site offers minimal disclosure of corporate structure, audited accounts or client fund safeguards. One victim’s account stated:

“The site looked legit… then I tried to withdraw and the button disappeared.” (Medium)

When a platform hides its ownership, uses masked registrants and fails to provide verifiable credentials, that strongly suggests a high-risk, short-term extraction scheme rather than a long-term trading business.

- Withdrawal Nightmare – Easy In, Hard or Impossible Out

The typical victim pattern: initial small deposit, successful minimal withdrawal to build trust, then larger deposits, then withdrawal requests blocked or delayed indefinitely. For example:

“I invested $600,000 and now the button is gone, support silent.” (Medium)

Such sequences mark entrance into a scenario where you are not just losing money to markets, you are locked into a scheme where your funds cannot be retrieved without external recovery efforts.

- Marketing Hype and Unrealistic Promises Mask Risk

Choice Assets CFDs markets itself with claims like “guaranteed returns”, “global trading power”, “professional account managers”, and “minimum deposit” requirements. These slogans often assist in luring unsuspecting investors. Independent analysis calls it “a textbook extraction-first platform” designed to trap funds. (Fund Recovery Agency)

When such marketing is combined with weak regulation, the risk of loss jumps from high to extreme. - Cloned Site Templates & Network-Style Operation

Investigations show that Choice Assets CFDs shares website frameworks, contact numbers and imagery with multiple known unregulated brokers. BrokersView notes this platform’s design mirrors other flagged operators. (BrokersView)

When multiple suspect brands share infrastructure, it points to network operations built for rapid deployment and extraction—not service or longevity. - Minimal Positive User Feedback, Heavy Complaint Weight

User review aggregation shows scant positive testimonials and multiple severe complaints of missing funds, blocked withdrawals and unresponsive support. For instance, Scams2Avoid lists only two reviews—with one 1-star rating and no credible redeeming testimonials. (scams2avoid.com)

A genuine broker will have dozens or hundreds of reviews across platforms, including verifiable statement of successful client withdrawals—Choice Assets CFDs does not.

- Escalation into Recovery Mode, Not Profit Mode

If you engage with this platform, the realistic journey is not profit—it is recover funds from crypto fraud. The moment you spot withdrawal refusal, account freeze, or bonus-upgrade demands is the moment you must assume you are trapped and shift into recovery strategy. Legacy recovery firms already list this platform for reclamation services. (Fund Recovery Agency)

Your goal must pivot swiftly from “let’s profit” to “let’s extract what I can and exit”. - Final Verdict: Avoid Without Exception

When you combine lack of regulatory oversight, hidden ownership and domain structure, withdrawal nightmares, aggressive marketing, multiple complaints and vector cloning of scam sites—the only rational conclusion is: Choice Assets CFDs is not safe. If you value your capital, your time, mental well-being and legal rights—you should walk away now. Do not deposit. Because once you do, you enter a zone where every dollar increases your exposure to loss, and your best hope is recovery—not trading success.

CONCLUSION

Uncompromising Final Warning: Stay Far From This Platform

Let there be no misunderstanding: the Choice Assets CFDs scam platform is not a broker worth cautious engagement—it’s one you must actively avoid. The high-risk combination of unverified regulation, obfuscated ownership, withdrawal issues and severe negative feedback means the potential for loss is near-certain. Every moment you spend with the platform exposes more of your capital to extraction rather than gain.

If You Are Already Engaged: Act Immediately

If you have already deposited funds with Choice Assets CFDs, do not assume you will rectify the situation later through normal trading. Document everything now: deposit receipts, screenshots of trading dashboard, chat records with support/account manager, withdrawal request history. Stop depositing any further. Begin exploring charge-back or payment reversal options with your bank. Consider contacting reputable recovery specialists who handle crypto scam fund retrieval services. Time is critical: the earlier you act, the higher your chance of recovering something—though no guarantee exists.

Know What You Should Expect—but Are Not Getting Here

A legitimate broker offers: a verifiable licence from a well-known regulator (e.g., FCA, ASIC, CySEC), transparent corporate entity disclosure, segregated client funds, realistic leverage and friendly but professional marketing, consistent successful withdrawal records and robust user testimonials. Choice Assets CFDs offers none of those or very few with insufficient evidence. You are not just facing market risk—you are facing broker risk where your capital can vanish not because of market moves, but because of structural extraction.

Prevention Beats Recovery

Your strongest defence is simple: don’t engage. Before depositing any significant sum: verify the broker’s licence via official regulator register, test a withdrawal with a small amount, confirm the legal entity you truly contract with, review independent and current user feedback, ask about segregation of funds and audited accounts. If at any step you find vagueness, pressure to deposit more, impossibility of withdrawal clarity, or unverifiable claims—walk away. Avoid the entire possibility of being forced into the blockchain investment scam recovery track by choosing a credible, transparent, fully regulated broker instead.

Final Thought: Your Capital Is Precious—Protect It Relentlessly

Your funds are not for experimental platforms promising high returns with minimal credentials. When a website like Choice Assets CFDs presents a flashy front but lacks foundational protections, you’re not trading—you’re risking your money in a trap. If your aim is real investing with oversight, integrity and withdrawal assurance—then your first act must be to walk away from Choice Assets CFDs. Preserve your funds, protect your trust, and refuse to become another case in the world of defeat crypto fraud schemes. Let this statement serve as your resolute warning: do not deposit.