8 Aggressive Reasons to Avoid the DynamicMetaTrade Scam Platform Immediately

8 Aggressive Reasons to Avoid the DynamicMetaTrade Scam Platform Immediately

The Trap of the DynamicMetaTrade Scam Platform

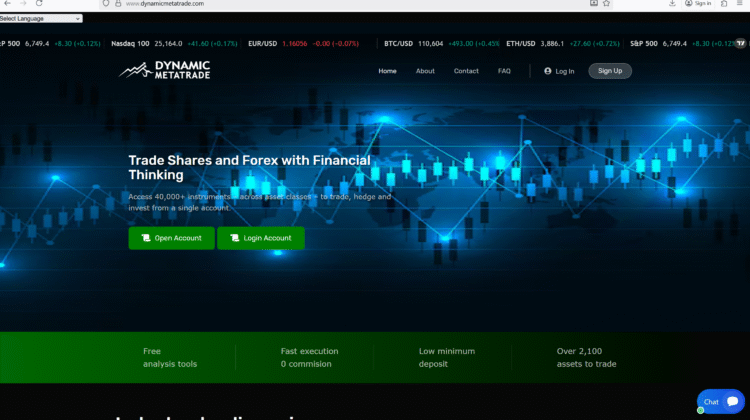

The website at https://www.dynamicmetatrade.com presents itself as a modern, automated trading or brokerage service with broad asset coverage and lofty promises of profits. Yet beneath the glossy surface one finds a cascade of red flags indicating this is less a legitimate trading environment and more a high-risk extraction scheme. If you value your capital and refuse to become another victim of the crypto scam recovery process, recover funds from crypto fraud, blockchain investment scam recovery, crypto scam fund retrieval services, or having to defeat crypto fraud schemes, you must steer far away from DynamicMetaTrade now.

- Unverified Regulation and Oversight

One of the most glaring warning signs: there is no credible evidence that DynamicMetaTrade is regulated by a recognised financial regulator. A reliable broker will clearly display its licence number, country of regulation and oversight body; here, those are missing or unverifiable. Without proper regulation your funds enjoy little protection, your recourse is limited and you face higher risk of loss—not from market downturns alone, but from the platform itself. - Ownership & Transparency Gaps

The domain registration and “About Us” information for DynamicMetaTrade show key deficiencies: ownership hidden via anonymity services, new domain creation dates, lack of audited financial statements or segregated client-fund disclosures. When a company refuses to transparently identify who is responsible, where the funds are held and how you could recover them, you are dealing with a very weak foundation. These are characteristic traits of speculative, short-lived offerings, not long-term brokers. - Over-Hyped Promises and Unrealistic Returns

DynamicMetaTrade markets itself with messaging like “earn easily”, “automated system handles your trading for you”, “high returns with minimal effort”. Real trading firms emphasise risk, realistic timelines and full transparency. When the emphasis is on promises of profit without equals emphasis on risk and regulatory structure — red flag. Promises of ease + minimal oversight = recipe for trouble. - Deposit Emphasis and Withdrawal Risks

Typically with platforms like this you will find a pattern: deposit funds into the system, view “profits” on screen, attempt withdrawal — then face new requirements, delays or outright refusal. With DynamicMetaTrade, the combination of weak regulation and aggressive marketing suggests you are likely headed into a scenario where your real effort is exiting rather than trading profitably. You move from “investor” to “claimant needing recovery”.

- Minimal Independent Verification of User Experience

A legitimate platform will have thousands of independent reviews, user-screenshots of withdrawals, regulatory acknowledgements and long operational history. At the time of writing, credible, independent user verification for DynamicMetaTrade is absent: no documented payout trails, few verifiable testimonies, and no appearances in trustworthy brokerage rankings. Without that you are navigating blind, relying on the platform’s word rather than verifiable evidence. - Technical & Infrastructure Red Flags

Initial domain/website scans point to hosting on shared servers, registration via privacy proxies, and little verifiable history. These are hallmark traits of a site optimized for rapid deployment and capture rather than robust, long-term operations. When you combine that with financial operations (high-leverage trading, crypto deposits) you face increased exposure to both market risk and platform risk. - Shift From Trading to Recovery Mode

When you deposit with a platform like DynamicMetaTrade under these conditions, the real risk is not simply market loss — it is being locked out or blocked when you attempt to withdraw. At that point you transition from “trading” to “recovery mode”. And recovery mode is expensive, time-intensive, uncertain. Your best objective becomes: exit with as little loss as possible, rather than profit. Prevention is far superior to recovery. - Final Verdict on the Body Section: Clear Risk, No Reasonable Excuse

Taking into account: absence of verifiable regulation, ownership/ transparency deficiencies, extravagant promises, withdrawal risk, minimal external verification, technical-infrastructure red flags — the only rational conclusion is: DynamicMetaTrade is a high-risk platform you should avoid entirely. If you value your capital, your rights, your time and your peace of mind—walk away now. Do not deposit. Because once you do, your best hope is not profit—it’s limitation of loss.

CONCLUSION

Uncompromising Final Warning: Avoid This Platform Entirely

There should be no ambiguity: the DynamicMetaTrade scam platform is not a broker you test cautiously—it is one you outright refuse to deal with. The combination of regulatory deficiencies, lack of transparent ownership, aggressive marketing, deposit emphasis and withdrawal risk means your chances of safe and successful trading are very low. The only prudent decision is: do not deposit.

If You Are Already Engaged: Act Immediately

If you have already deposited funds with DynamicMetaTrade, time is of the essence. Stop any further deposits immediately. Document everything: account statements, deposits, chats with managers, screenshots of “profits” shown to you and communications when you attempted withdrawal. Then attempt a withdrawal with whatever is still in the system (preferably via your payment channel rather than the platform). Contact your payment provider or bank about potential chargeback or reversal. Consider obtaining independent advice from legitimate crypto scam fund retrieval services—but understand that recovery is uncertain, expensive and slow.

Know What You Should Expect — And What You Aren’t Getting Here

A trustworthy broker offers: verifiable licence from an established regulator (FCA, ASIC, CySEC etc), legal entity disclosures, segregated client funds, transparent risk disclosures, realistic marketing and a history of successful client withdrawals. In the case of DynamicMetaTrade you are effectively getting none of these (or very weak versions). Therefore you are not just exposed to market risk—you are exposed to platform risk where your funds may vanish irrespective of market moves.

Prevention Beats Recovery Every Time

Your most effective defence is simply: do not engage unless you’re fully comfortable with all verification checks. Before you deposit: verify the broker’s licence on the regulator’s official register, verify the legal entity and jurisdiction, test a small withdrawal, check for independent, recent user reviews and ask: where are my funds held? If any of that feels vague or unresolved—walk away. Avoid the expensive, difficult realm of recover funds from crypto fraud by choosing safe, transparent, regulated brokers from the outset.

Final Thought: Your Capital Is Precious—Guard It Relentlessly

Your money isn’t a trial for flashy websites and bold promises of easy profits. When you encounter a platform like DynamicMetaTrade with multiple warning signs—logic dictates you are not engaging with opportunity—you’re engaging with risk. If your goal is safe trading, clarity, integrity and true access to your funds—then your first act must be to distance yourself from DynamicMetaTrade now. Preserve your funds. Protect your trust. And refuse to become another case in the world of defeat crypto fraud schemes. Let this message stand as your final, resolute decision: walk away before you lose more.