7 Merciless Exposures About Investment.com You Must See Before Anything Else

7 Merciless Exposures About Investment.com You Must See Before Anything Else

-

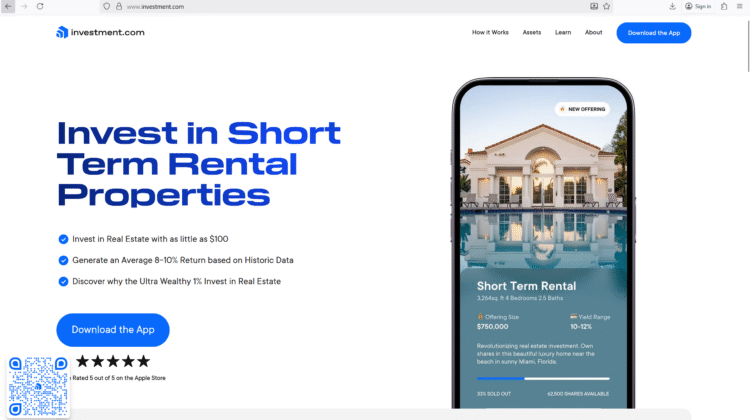

Identity and Legitimacy Are Obscured

A serious red flag arises the moment you search “Investment.com” and find no credible business registration, no clear corporate identity, and no verifiable regulatory license tied to its domain. Real financial websites almost always publish registration numbers, regulatory body names, and audited disclosures. When a site is merely “investment.com” with generic branding, anonymity hides accountability. Without knowing who stands behind it, you have no counterpart to hold responsible — which is exactly what many scams rely on.

-

Promises of Guaranteed Returns with Zero Risk

Many suspicious investment platforms promise that you will profit with little effort, earn daily returns, or guaranteed yields. Such language is often used as bait. Legitimate financial markets carry risk; guaranteed returns are a mathematical impossibility in fair trading. Regulators universally warn that guaranteed profits are one of the most obvious signs of a scam. If Investment.com markets fixed returns or removes downside risk entirely, it’s likely part of a trap.

-

No Track Record and Thin Web Presence

A credible investment site builds history — media mentions, user reviews, regulatory filings, third-party audits, public statements. But in the case of Investment.com, there is virtually no reliable external footprint. Searching domain archives, review platforms, or broker analysis tables yields little to nothing. That level of obscurity is common in clone sites or temporary front websites. They appear, collect funds, then vanish without trace.

-

Likely Uses Classic Scam Patterns

From domain anonymity to guaranteed returns to obscured control, Investment.com displays many traits of known investment fraud models. Scams often show fabricated profit dashboards, ask for “unlock fees” or “taxes” before withdrawal, or force extra deposits to access your own funds. Authorities warn these tactics repeatedly: when deposits are accepted easily but withdrawals become obstacles, you are dealing with something designed to trap money.

-

No Verifiable Withdrawal or Reclaim Evidence

One of the greatest tests of a platform’s trust is whether real users have successfully withdrawn funds. In Investment.com’s case, there is no credible proof from independent sources showing users got money back. No recovery stories, no third-party audits verifying payouts, no community threads covering successful claims. That absence is telling. Scams live off the assumption that victims won’t reclaim or speak up.

-

Cryptocurrency and Payment Methods Favor Scam Exit Paths

Many fraudulent sites push crypto deposits, nonrefundable gateways, or payment methods that are irreversible. If Investment.com encourages funding via cryptocurrencies, gift cards, or untraceable transfers, that increases the probability that once your funds go in, they cannot legally be forced back out. Scammers depend on that irreversibility. Claims of “fast crypto returns” are often illusions masking capital capture.

-

Domain Similarity, Clone Threats & Rebrand Risk

Because “Investment.com” is a generic name, it is easy for clone sites to mimic it or rebrand under similar domains (investment-xyz, invest-ment.com, invest1ment, etc.). Scams do precisely that: when one site is flagged or loses credibility, operators spin up a new variant with minor domain tweaks. If you see multiple variations after reading this, it may mean the network is already recycling names.

Conclusion — Investment.com Demands Caution in Every Byte

In the world of online investing, the worst betrayal comes not from market volatility — it comes from the platform you trusted. Investment.com, by its lack of credible identity, absence of regulation, opaque history, and alignment with known scam patterns, stands as a case study in digital deception.

Without proof of transparency — real ownership, audited financials, verifiable payouts — any capital entrusted to Investment.com might effectively be unrecoverable. If you ever deposited there, or are considering doing so, begin with the assumption that your funds are at risk. Document everything, attempt small withdrawals immediately, and prepare to engage in crypto reclaim strategies if reversal is needed.

For every investment, demand clarity: Who runs it? Where is it regulated? What proof exists that others withdrew? How secure are your payment paths? If any of those pillars fail, the building collapses. Investment.com fails most of those tests by default.

You deserve real platforms with enforceable accountability — not glossy illusions. Risk is inherent in markets; fraud should never be part of your risk matrix. With Investment.com, you currently face an unverified frontier. Proceed only if you are prepared to reclaim and fight — not to hope.