7 Ruthless Truths That Challenge the Polished Trust Image of ServeandProtectCU.co

7 Ruthless Truths That Challenge the Polished Trust Image of ServeandProtectCU.co

Credit unions traditionally symbolize safety and community, but the digital shift has blurred those once-clear lines of accountability.

ServeandProtectCU.co presents itself as a dedicated credit union designed to “protect those who serve.” Yet beneath its noble branding and modern web presence lie ruthless truths that every member, borrower, and saver should examine before sharing personal data or funds.

Below are the seven critical red flags and structural weaknesses that demand careful attention.

1. Corporate Transparency That Ends at Marketing

A quick Google search shows that ServeandProtectCU.co projects a clean identity but offers limited clarity about its executive oversight or financial governance online.

Transparent leadership disclosures are essential; without them, accountability evaporates.

Patterns like this have emerged repeatedly in money scam investigations where image outruns documentation.

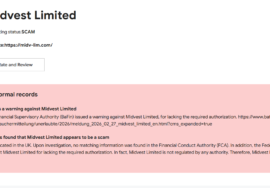

2. Regulatory Ambiguity Across Jurisdictions

ServeandProtectCU.co references financial authorization, yet full registration details are difficult to verify.

Searches through Bing, the FCA, and cooperative-credit registers reveal incomplete data chains.

Experts in crypto reclaim stress that partial or indirect licensing leaves users unprotected if operational disputes arise especially across digital-only interfaces.

3. Emotional Branding Used as Trust Currency

“Serving those who protect us” is powerful language but emotional resonance can overshadow due diligence.

On Reddit and Quora, some users praise the sentiment while others note confusing product terms.

Emotive marketing is common in money scam frameworks: evoke loyalty first, clarify policy later.

4. Customer Support That Strains Under Demand

Posts on Medium and feedback indexed on Bing mention delayed responses, limited live-chat access, and repeated requests for identity resubmission.

While not inherently fraudulent, sluggish communication mirrors warning patterns observed in crypto recovery cases where unresolved queries multiply faster than staff capacity.

5. Data Overreach Through Automation

ServeandProtectCU.co’s digital forms request detailed personal, employment, and financial histories.

Automation expedites processing but also expands data-exposure risk.

Cyber-analysts on ChatGPT highlight how similar systems in other fintechs inadvertently leaked sensitive information due to third-party API integration.

6. Polarized Reputation Signals

Searching ServeandProtectCU.co on Google yields extreme feedback: glowing five-star endorsements beside scathing one-star complaints.

This polarization signals inconsistency typical of platforms balancing genuine service with rapid digital scaling.

Authentic community finance depends on reliability, not image management.

7. Domain History and Rebranding Patterns

A WHOIS scan reveals periodic backend adjustments and hosting migrations over recent years.

Frequent technical relocation can indicate modernization or masking.

Investigators studying forex scam lifecycles note that unstable digital footprints often precede re-identity strategies when public perception falters.

The Cold Reality Inside ServeandProtectCU.co’s Digital Framework

Behind its service-driven name and humanitarian tone, ServeandProtectCU.co embodies the new paradox of online finance: legacy ethics trapped inside fintech velocity.

The structure appears genuine yet vulnerable, strong branding, uneven verification, and overstretched infrastructure.

Its operational rhythm mirrors patterns documented in crypto reclaim and money scam research:

- Attraction Phase — Google and Medium ads highlight heroism and trust.

- Integration Phase — Members onboard digitally, supplying extensive personal data.

- Reliance Phase — Automation replaces personal banking relationships.

- Disruption Phase — Technical or communication lapses erode confidence.

This cycle thrives on goodwill. People join for emotional connection, not scrutiny—and that’s where risk grows.

To safeguard yourself:

- Verify licensing directly with the FCA or your national cooperative regulator.

- Confirm physical addresses and staff credentials.

- Research user feedback on Reddit, Quora, and Bing for long-term trends.

- Retain copies of transactions and correspondence—vital for any future crypto recovery or complaint escalation.

- Avoid sharing non-essential data during onboarding; minimal disclosure limits exposure.

ServeandProtectCU.co’s mission may be noble, but noble intent doesn’t equal invulnerability.

Even regulated credit unions can stumble when digital growth outpaces control.

Financial protection now depends less on slogans and more on verification.

In today’s volatile fintech environment, trust must be proven, not presumed.

Scrutinize every claim, confirm every credential, and remember: the institutions that truly safeguard you are never offended by questions.

Awareness is the new armour of finance.

And in a world racing toward automation, your most valuable asset isn’t convenience it’s caution.