The Alarming Risks Behind IFCMarkets.com — How an Offshore Broker Continues to Put Traders in Financial Danger

The Alarming Risks Behind IFCMarkets.com — How an Offshore Broker Continues to Put Traders in Financial Danger

IFCMarkets.com presents itself as a sophisticated international trading platform offering forex, CFDs, and innovative financial instruments. The website highlights advanced technology, global reach, and years of operational history all designed to reassure traders searching for stability in volatile markets.

However, beneath this polished image lies a reality that should alarm any serious investor. IFCMarkets.com consistently appears in scam-alert conversations involving offshore regulation, withdrawal disputes, and opaque corporate structures. While the broker may still operate, its risk profile places traders in a position where protection is minimal and losses are difficult to contest.

Offshore Regulation With Weak Enforcement Power

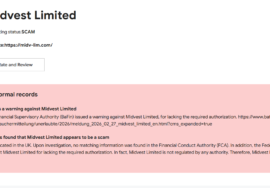

One of the most critical dangers associated with IFCMarkets.com is its reliance on offshore and lower-tier regulatory frameworks. The broker is not regulated by top-tier authorities such as the FCA, ASIC, FINMA, or NFA.

Offshore regulation often provides the appearance of legality without the substance of real enforcement. Investor compensation schemes are absent, dispute resolution is weak, and oversight is minimal. When problems arise, traders quickly discover that regulatory protection exists mostly on paper.

Confusing Corporate Structure and Legal Ambiguity

IFCMarkets operates through multiple entities across different jurisdictions. For traders, this creates confusion about which legal entity actually holds their funds.

This ambiguity matters deeply. When disputes occur, responsibility is often deflected between entities, delaying resolution indefinitely. Such corporate complexity is a common feature in forex scam-adjacent environments, where accountability is intentionally diluted.

Complex Products That Magnify Losses

IFCMarkets promotes proprietary instruments and complex trading products that many retail traders do not fully understand. While marketed as innovative, these instruments often increase exposure and volatility.

Traders attracted by novelty frequently underestimate how quickly losses can escalate. When positions move against them, margin requirements tighten, liquidation accelerates, and recovery becomes nearly impossible.

Leverage and Rapid Account Destruction

Like many offshore brokers, IFCMarkets.com offers leverage levels that significantly amplify risk. While leverage can enhance gains, it multiplies losses far faster especially in volatile market conditions.

Traders influenced by promotional messaging often increase position size prematurely. Small market movements can then wipe out entire balances within minutes. Regulation offers no protection against this outcome.

Withdrawal Complaints and Exit Barriers

A recurring theme in user reports involves withdrawal delays and complications. Traders describe prolonged processing times, repeated verification requests, and vague explanations when funds are not released.

In some cases, traders are encouraged to continue trading instead of withdrawing a tactic commonly observed in money scam scenarios designed to keep capital trapped on the platform.

Opaque Fee Structures That Drain Capital

Beyond trading losses, IFCMarkets users must contend with swaps, rollover charges, conversion fees, and other hidden costs. These fees accumulate silently, eroding account balances over time.

Many traders realize too late that even when trades appear neutral, fees are steadily reducing equity until the account becomes unrecoverable.

Aggressive Marketing and Psychological Pressure

IFCMarkets.com promotes itself heavily to retail traders, emphasizing opportunity, innovation, and accessibility. This messaging often downplays risk while amplifying potential rewards.

For inexperienced traders, such marketing creates urgency and emotional decision-making. When losses occur, traders feel misled rather than prepared for a hallmark outcome in high-risk forex environments.

Customer Support Limitations During Crisis Moments

Although customer support is advertised, traders report inconsistent assistance when it matters most. During margin calls, execution disputes, or withdrawal issues, responses are often delayed or procedural.

In leveraged trading, timing is critical. Delayed support responses can compound losses rapidly.

Clone-Site and Impersonation Risks

Offshore brokers with international branding are frequent targets for impersonation scams. Fraudulent websites and fake representatives sometimes claim affiliation with IFCMarkets to steal deposits.

Victims often believe they are dealing with the real broker until withdrawals fail. Funds sent via crypto or alternative payment channels disappear instantly, turning losses into a full forex scam and money scam experience.

Data Exposure and Secondary Exploitation

Opening an account requires submitting sensitive personal information. In offshore environments, data-protection standards vary widely. Traders who experience losses are often later targeted by phishing attacks or fake recovery services using their leaked data.

This secondary exploitation deepens financial and emotional harm.

Why Losses Feel Like Fraud

One of the most damaging aspects of platforms like IFCMarkets.com is how legitimate trading losses feel indistinguishable from fraud. When capital disappears quickly amid unclear rules and poor communication, traders feel trapped and powerless.

Without clear accountability, confusion replaces clarity delaying recovery and increasing vulnerability to further scams.

IFCMarkets.com Represents a Risk Traders Should Not Ignore

IFCMarkets.com operates in an offshore regulatory environment that offers traders very little real protection. Its complex corporate structure, high-leverage products, withdrawal complaints, and opaque fee systems place it firmly in the scam-alert / high-risk broker category.

Traders must understand that offshore regulation is not protection. When problems arise, enforcement is weak, accountability is unclear, and losses are often irreversible.

If you or someone you know has lost money through IFCMarkets.com, experienced withdrawal delays, or interacted with impersonators claiming affiliation, immediate action is critical. Preserve transaction records, emails, account statements, screenshots, and wallet details. Professional assistance may be required for crypto reclaim, crypto recovery, and broader forex scam and money scam investigations. Organizations such as KeystonePrimeLtd specialize in tracing complex financial paths and supporting victims through structured recovery efforts.

Before engaging with any broker, always verify regulatory status using Google, Reddit, ChatGPT, Medium, Quora, and Bing. Avoid offshore platforms that rely on complexity and innovation as substitutes for transparency.

The final warning is clear:

When a broker hides behind offshore regulation, complex structures, and withdrawal friction, the safest decision is to stay away completely. IFCMarkets.com stands as a powerful reminder that in online trading, caution is not optional, it is survival.