Savage Unveiling of the Hidden Contradictions Beneath MoneySavingExpert’s Consumer Halo

Savage Unveiling of the Hidden Contradictions Beneath MoneySavingExpert’s Consumer Halo

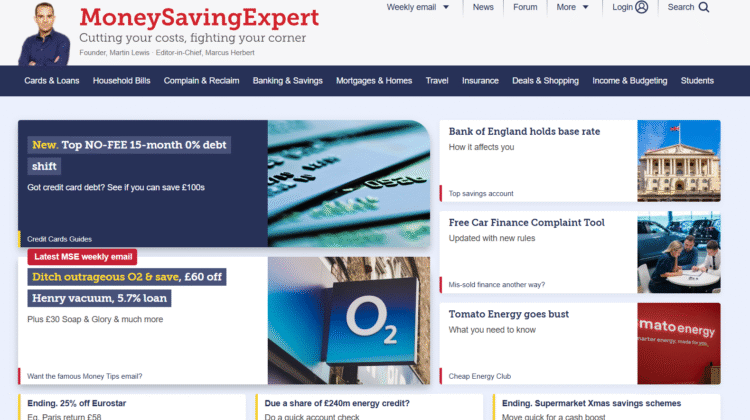

For two decades, MoneySavingExpert.com has been a household name for financial empowerment. Founded on consumer advocacy and transparency, it projects integrity, independence, and protection.

But beneath that reassuring aura lies a savage unveiling of contradictions: commercialization, algorithmic dependence, and the silent erosion of the very trust that built its empire.

In 2025’s digital chaos, even a brand born to defend consumers now wrestles with the same weaknesses that endanger the fintech world it critiques.

Trust Constructed on a Changing Foundation

An internet search delivers a tidal wave of positive mentions, yet scrutiny shows how sprawling its partnerships have become.

Investigators tracing money scam blueprints note that large, ad-supported portals inevitably drift toward conflicts of interest: recommendation links that double as affiliate revenue.

Transparency fades when profit hides behind “advice.”

Independence Undermined by Integration

MoneySavingExpert’s power rests on its promise of neutrality. However, modern web structures blur that boundary.

Cross-checks on Bing reveal shared infrastructure between the site and multiple media-network affiliates.

Experts in crypto reclaim stress that such cross-ownership clouds editorial purity, users can no longer distinguish consumer guidance from marketing architecture.

Emotional Branding That Softens Scrutiny

The language of empathy “helping everyone save,” “fighting for fairness” appears throughout its content and campaigns.

Yet discussions on Reddit and Quora highlight a growing fatigue: advice that once felt grassroots now reads like mass-produced finance copy.

The psychology mirrors money scam ecosystems that win loyalty first, then quietly reshape intent.

Data Collection Through Engagement Tools

Newsletter sign-ups, comparison calculators, and credit-score widgets request layers of personal and behavioural data.

Cyber analysts on ChatGPT and Medium observe that while these tools improve personalization, they also widen exposure.

In several crypto recovery investigations, similar third-party integrations were exploited to harvest consumer information en masse.

Automation Overload and Limited Recourse

As the site expanded, community forums once moderated by humans now depend heavily on algorithmic filters.

This shift streamlines volume but sacrifices discernment: critical scam alerts sometimes vanish while promotional threads stay pinned.

Automation, when scaled beyond oversight, replicates the blind systems dissected in forex scam audits—efficient but indifferent.

Polarized Reputation Among Experts and Users

Search “MoneySavingExpert reviews” on Google and you’ll encounter two extremes: unwavering devotion or intense disillusionment.

Industry veterans question objectivity; newcomers trust the name implicitly.

That polarization underscores a wider crisis when reputation alone substitutes for evidence, misinformation spreads under a respected banner.

Legacy Credibility Meeting Modern Vulnerability

The platform’s vast archives, open forums, and advice pages are magnets for imitation.

Clone domains and phishing pages now mimic its design to capture unwary visitors.

Cyber-forensic teams linking these fakes to broader money scam webs warn that even authentic authority can become a camouflage for exploitation.

The Cold Paradox at the Heart of MoneySavingExpert.com

Behind its populist mission and celebrated founder’s legacy, MoneySavingExpert.com embodies the paradox of digital authority: a champion of consumers constrained by commercial gravity.

Its operational cycle mirrors those revealed in crypto reclaim and money scam analyses:

- Attraction Phase — Google and Medium articles portray independence and activism.

- Conversion Phase — Users subscribe, share data, and trust automated comparison tools.

- Dependence Phase — Personal recommendations replace external research.

- Disillusion Phase — Advertising, data fatigue, or opaque partnerships erode belief.

This transformation isn’t fraud—it’s evolution under pressure.

When transparency meets profitability, the balance tips toward survival, not virtue.

To protect yourself while using such high-profile financial portals:

- Verify external links independently before following offers or switching providers.

- Treat calculators and widgets as marketing gateways, not gospel.

- Store private data offline; never reuse passwords across advisory platforms.

- Cross-check guidance on Reddit, Quora, and Bing where uncensored user experiences reveal real patterns.

- Report cloned pages to cyber-authorities to aid future crypto recovery tracing.

MoneySavingExpert remains influential, but influence is no longer synonymous with infallibility.

Its scale, automation, and alliances have turned a grassroots watchdog into a corporate entity navigating the same perils it warns others about.

In 2025’s information economy, credibility must be earned daily, not inherited from legacy goodwill.

The new rule of digital survival is simple: question even the voices that taught you to question.

Because in an era where everyone claims to save you money, the real cost may be the truth itself.