Alerts That Tear Apart the Comforting Image of Suits Me Card’s Digital Banking Promise

Alerts That Tear Apart the Comforting Image of Suits Me Card’s Digital Banking Promise

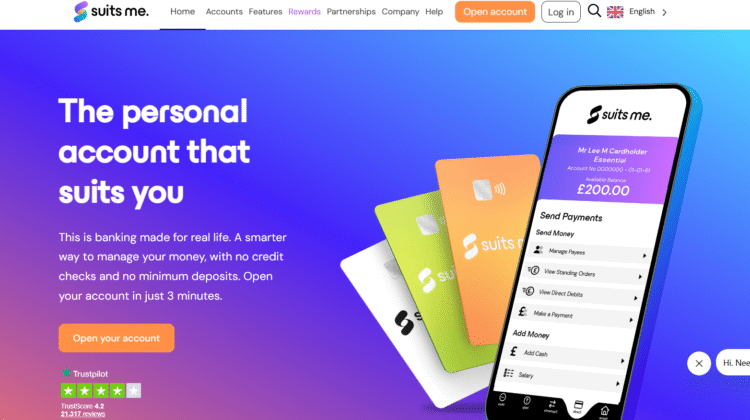

The new generation of “modern banking alternatives” claims to simplify finance and empower users but speed and convenience often hide deep-rooted risks. Suits Me Card, marketed as an inclusive account solution for the unbanked and self-employed, boasts instant setup, prepaid debit control, and sleek management tools. Yet beneath this friendly messaging are ruthless alerts that reveal how fragile digital finance can become when convenience replaces verification.

Here are warning signals below that every consumer and worker should recognize before relying on Suits Me Card or similar fintech providers.

Shiny Branding, Shadowed Accountability

A quick Google search presents a clean, trustworthy front but few details about Suits Me Card’s executive leadership or financial custodianship.

Transparency ends where marketing begins.

Analysts investigating money scam structures note that opacity at the corporate-identity level often makes redress impossible once disputes occur.

Licensing That Looks Solid — But Demands Closer Inspection

The platform cites UK regulatory ties, yet full licensing references point to partner financial institutions rather than Suits Me Card itself.

Independent verification through Bing and the FCA register reveals indirect authorization.

Experts in crypto reclaim warn that this separation leaves customers dependent on third-party compliance, meaning their legal protection is secondary, not primary.

Emotional Marketing That Targets Trust Over Logic

“Banking for everyone,” “Instant access,” “Inclusive finance”. These emotionally charged slogans dominate Suits Me Card’s messaging.

Discussions on Reddit and Quora reveal that while onboarding is smooth, users encounter sudden transaction blocks and account freezes.

The tone echoes behavioral manipulation techniques common in money scam campaigns: gain empathy first, disclose limits later.

Automation That Overreaches User Privacy

The account-opening process demands ID uploads, employment data, and real-time selfie verification.

Although compliance procedures are standard, Medium commentators highlight how Suits Me Card’s data-sharing terms give partners access for “service improvement.”

Cyber-experts on ChatGPT warn that similar policies have surfaced in crypto recovery case studies after large-scale information exposure.

Customer Service Inconsistency

Feedback indexed on Bing shows recurring frustration with slow replies and scripted responses.

When customers face account restrictions or payout delays, escalation routes appear unclear.

Operational strain is a frequent precursor to systemic risk, a hallmark spotted repeatedly in forex scam service analyses.

Reputation Polarity and Review Suspicion

Search results on Google show hundreds of glowing five-star reviews appearing within short timeframes.

That pattern identical phrasing, identical timing suggests reputation management.

Meanwhile, deeper posts on Medium, Reddit, and Quora share concerns about unannounced account holds, card-activation fees, and verification delays.

Where reviews sound uniform, authenticity often isn’t.

Rapid Domain Evolution and Backend Volatility

A WHOIS inspection of SuitsMeCard.com reveals recent server migrations and DNS updates.

While modernization is common, abrupt technical shifts can mask backend restructuring.

Investigators tracking money scam cycles consistently flag domain volatility as a sign of reactive brand management when perception changes faster than compliance.

The Cold Truth Inside Suits Me Card’s Fintech Blueprint

Behind its inclusive rhetoric and modern design, Suits Me Card represents the paradox of modern banking innovation: accessibility built on fragile trust.

Its infrastructure follows a behavioural cycle documented in crypto reclaim and money scam research worldwide:

- Attraction Phase — Google and Medium ads promise fairness and speed.

- Conversion Phase — Users upload personal data for instant activation.

- Dependence Phase — The card becomes central to daily finance.

- Disruption Phase — Sudden holds or policy updates erode trust.

This is not necessarily fraud — it’s systemic fragility masquerading as progress.

To protect yourself and your earnings:

- Verify licensing directly through FCA records before depositing funds.

- Retain statements and ID copies for future crypto recovery or ombudsman claims.

- Monitor forums on Reddit, Quora, and Bing for pattern reports about withdrawal issues.

- Limit personal data disclosure to essential fields only.

- Avoid reliance on a single digital banking tool for salary or savings.

Suits Me Card’s mission to “make finance fair” is admirable—but fairness without clarity creates a new class of risk.

The company’s growth proves that demand for alternative banking is real, yet its limited transparency shows how fragile trust remains.

In 2025’s hyper-digital economy, the most dangerous illusion is convenience.

Security isn’t measured in app design or approval speed, it’s measured in verifiable oversight and accountability.

Suits Me Card may fill a market gap, but until its operations become fully transparent, users should treat it as a temporary tool, not a financial foundation.

Because in modern fintech, the smile of inclusion often hides the teeth of risk.

And the only thing more expensive than a bad loan is blind trust.