11 Relentless Warnings to Expose Tritondex.com Scam Before You Lose Your Funds

11 Relentless Warnings to Expose Tritondex.com Scam Before You Lose Your Funds

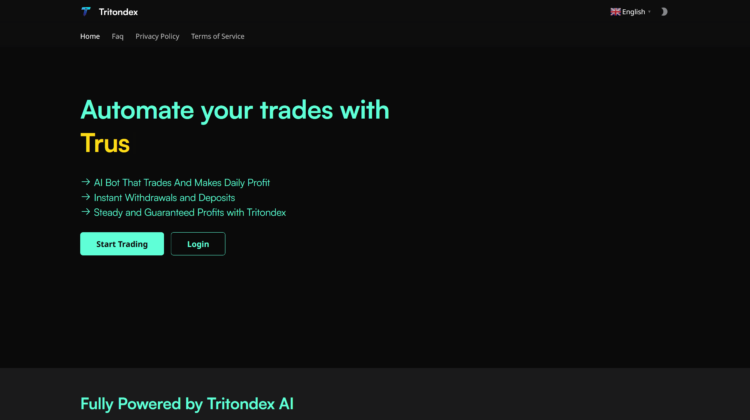

Cryptocurrency trading and DeFi platforms promise financial growth, but when a platform lacks transparency, regulatory backing, and operational legitimacy, those promises become danger signs. Tritondex.com has started circulating among online investors with bold profit claims, slick interfaces, and aggressive marketing yet the emerging patterns around this platform strongly resemble known scam operations rather than legitimate services. Before you consider depositing money or connecting wallets, it’s critical to understand the risks. Read every warning below, because acting early including taking steps to RECLAIM NOW if you are already affected is the smartest way to protect your assets.

This comprehensive investigation exposes the most significant red flags associated with TritonDex.com. These are patterns observed across numerous fraudulent platforms in crypto history, not vague speculation. Your awareness of these truths could save you from financial harm.

1. No Verifiable Regulatory or Legal Standing

Reputable trading platforms clearly display their corporate registration, regulatory oversight, and compliance certifications. TritonDex.com, however, does not provide verifiable documentation proving it is regulated by any recognized financial authority. Without this transparency, your funds have no legal protection and no third-party entity can enforce accountability.

Operating outside regulatory frameworks doesn’t just reduce investor protections, it eliminates them. When a platform lacks verifiable legal standing, you are effectively trading at your own risk with no safety net.

2. Unrealistic Profit Claims Target Emotions, Not Logic

TritonDex.com markets exceptionally high return figures in short periods of numbers designed to trigger emotional decisions rather than logical analysis. In real financial markets, returns vary with market conditions and risk exposure; legitimate platforms do not guarantee or promise outsized gains without risks.

Inflated profit displays are psychological bait. They make investors believe massive returns are guaranteed, but these figures often have no basis in real trading outcomes. When profits sound too good to be true, they almost always are.

3. Withdrawal Barriers Appear After Deposits

A defining scam pattern is the ability to deposit funds easily followed by significant resistance when attempting to withdraw them. Reports associated with platforms exhibiting similar behavior often describe:

- “Account reviews” that never complete

- Unexplained withdrawal delays with no timeline

- New verification requests only after withdrawal attempts

Legitimate trading platforms handle compliance and identity verification before deposits, not after profits are shown. When withdrawal becomes difficult or dragged out indefinitely, you are no longer trading; you are being trapped.

4. Surprise Fee Demands After Profits Appear Are Suspicious

Fees are a standard part of financial transactions, but when they are introduced only after you attempt to withdraw, that is a common scam tactic. Users linked with TritonDex.com describe unexpected fee requirements labeled as processing fees, compliance charges, or unlocking fees.

Ethical platforms disclose all fees upfront before you deposit. When new costs materialize only after funds appear to grow, the goal is to extract more money from you under false pretenses and often, once you pay, you are asked for more.

5. Customer Support Vanishes Once Problems Arise

Before you deposit, support representatives may be quick to respond, reassuring, and ready with answers. After deposits especially when withdrawal issues arise the communication changes:

- Responses slow down dramatically

- Answers become generic or evasive

- Support disappears

This pattern responsive before money, evasive after issues is a psychological tactic used by fraudulent platforms to manage complaints without resolution. Legitimate services maintain consistent communication regardless of the situation.

6. No Verifiable Proof of Real Trading Activity

A real trading platform connects to recognized exchanges or decentralized liquidity pools and can demonstrate where and how trades are executed. TritonDex.com does not provide independent proof tied to known exchanges or verifiable liquidity sources.

Without transparency into real trade execution and liquidity, the “profits” shown on dashboards are just numbers not evidence of genuine market participation. If there’s no proof your funds are being actively and independently traded, then nothing real is happening behind the scenes.

7. Sleek Interface Does Not Substitute For Legitimacy

TritonDex.com may look modern and professional, but good design does not equate to good practices. Many fraudulent platforms use slick visuals to mask their lack of transparency and accountability.

A polished interface can lull investors into a false sense of confidence, making them overlook the lack of verifiable substance behind the visuals. Design alone never proves legitimacy proof of real operations.

8. Testimonials and Reviews Are Unverified and Potentially Fabricated

Platforms often showcase testimonials to build trust. However, in high-risk platforms, these testimonials are frequently unverified, exaggerated, or even fabricated. At this time, there is no credible, independent audit confirming the authenticity of user reviews associated with TritonDex.com.

Without third-party verified testimonials vetted by trusted sources, these success stories should be viewed with skepticism. Fake testimonials are a common tactic used to lure new investors into the same trap earlier victims fell into.

9. No Recognized Third-Party Endorsements or Independent Audits

Legitimate platforms usually have footprints in reputable crypto communities, independent audit reports, or endorsements from known industry professionals. TritonDex.com lacks verifiable third-party validation. There are no recognized audits confirming its operations or endorsements that support its claims.

When a platform’s credibility depends solely on its internal narrative with no external verification, that narrative must be treated with extreme caution. Legitimate operations welcome independent audits and scams avoid them.

10. Excessive Personal Data Requests Increase Your Exposure

Know Your Customer (KYC) procedures require some personal information for regulatory compliance, but fraudulent platforms often request more data than necessary without clear justification. These excessive requests may occur after a deposit is made, increasing your risk exposure without providing any verifiable benefit.

Excessive personal data collection put you at risk of identity misuse, privacy violations, or even further financial exploitation. A platform that demands more data than necessary without transparent purpose is not prioritizing your security.

11. Ignoring Warning Signs Makes Recovery Harder

Every warning sign you ignore makes your position weaker. Blocked withdrawals, surprise fees, vanishing support, and unverifiable trading are not random issues; they are patterns of entrapment that escalate over time.

If you are already experiencing these signals with TritonDex.com, stop all additional deposits immediately and RECLAIM NOW through proper documentation and evidence-based steps. Acting early protects your remaining funds and increases the likelihood of recovery.

Waiting or hoping problems resolve themselves only deepens the risk. In many cases, active steps taken early are the difference between partial recovery and total loss.

Exclusive Conclusion: Protect Your Future, Not Illusions

TritonDex.com exhibits multiple indicators consistent with known scam behavior: no verifiable regulation, inflated profit claims, withdrawal barriers, surprise fees after deposits, unresponsive support, lack of verifiable trading proof, polished design without operational depth, unverified testimonials, absence of third-party validation, and excessive personal data requests.

These patterns are not isolated; they reflect systemic risk factors that have historically resulted in financial loss for investors. Real trading platforms operate with transparency, clear regulation, upfront fee disclosure, and evidence of real market participation. When a platform fails these fundamentals, its promises become dangerously hollow.

If you have already invested and are facing resistance when withdrawing, unexpected fee demands, or stalled communication, do not compound the situation by sending more funds. Instead, document every interaction, stop further payments, and RECLAIM NOW through evidence-based recovery steps.

For those who have not yet invested: treat this as an urgent warning. The safest investment decision right now is to stay out of a platform that cannot demonstrate legitimacy through regulation, audits, and operational transparency.

Remember:

- Transparency is non-negotiable

- Regulation is protective

- Real profits require real execution

- Delays often conceal deeper issues

If TritonDex.com cannot prove these fundamentals, then protecting your financial future starts with caution not participation.