7 Distressing Facts That Prove PaceCapitalFX Is a Ruthless Investment Scam

7 Distressing Facts That Prove PaceCapitalFX Is a Ruthless Investment Scam

Online trading has become a global obsession — and with it, the perfect hunting ground for sophisticated scammers. One of the most distressing names emerging in complaint forums is PaceCapitalFX, a website that promises secure, automated profits but delivers only frustration, manipulation, and financial ruin.

Below are the seven distressing facts that reveal how PaceCapitalFX operates as a calculated con designed to drain investors’ wallets.

1. Phantom Company and Fabricated Address

PaceCapitalFX claims to be headquartered in London’s financial district. A quick Google Maps search shows nothing more than a rented virtual-office suite shared by dozens of dissolved shell firms.

No corporate filings. No public directors. No regulatory footprint.

This deliberate anonymity exposes the company for what it is — a ghost structure built for rapid disappearance.

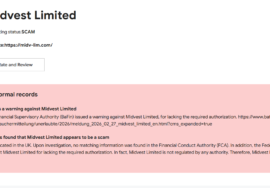

2. Counterfeit Licensing and False Oversight

The homepage proudly flaunts badges from CySEC and the FCA, but when cross-checked through Google.com and official databases, no such license exists.

The license ID listed actually belongs to an unrelated brokerage.

Operating without regulation gives PaceCapitalFX unlimited freedom to alter trades, block withdrawals, and erase accounts without consequence.

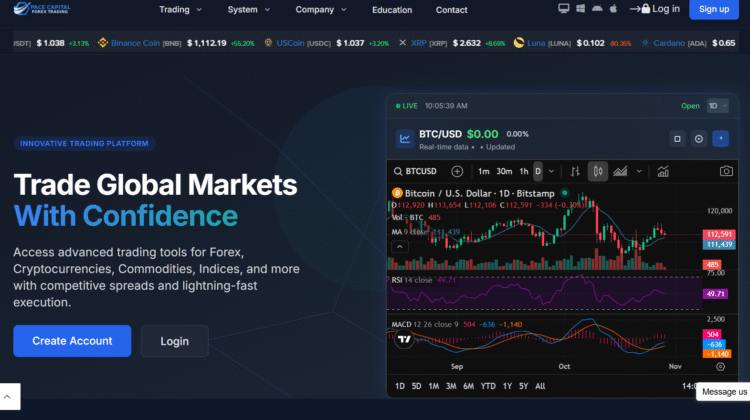

3. Artificial Trading Interface

Numerous victims report that the PaceCapitalFX trading panel is completely simulated.

The balance numbers move upward to show “profit,” but behind the scenes, no live trades reach the market.

When users try to withdraw, the interface freezes or the dashboard suddenly shows “system maintenance.”

A legitimate broker connects to exchanges — PaceCapitalFX connects to nothing but deception.

4. Psychological Manipulation and Persistent Calls

Once registered, traders receive a barrage of calls from so-called “account managers.”

They speak with urgency, promising “guaranteed daily returns” and “VIP signals.”

When you hesitate, they guilt-trip you — “real investors don’t fear opportunity.”

This emotional pressure is not customer service; it’s psychological control designed to push endless deposits.

5. Withdrawal Nightmares and Fake Fees

The moment you request a withdrawal, the lies escalate.

Victims are told to pay new “tax verification fees” or “account-release charges.”

Refuse, and your account is suspended. Agree, and your money vanishes for good.

The company has no banking partners and no payout system — it survives entirely on deposits it never intends to return.

6. Fabricated Reputation and Online Noise

Search Reddit.com, Medium.com, and Quora.com, and you’ll find eerily similar five-star reviews praising PaceCapitalFX’s “fast withdrawals” and “expert mentorship.”

These are purchased posts from content farms.

Real victims on ChatGPT.com and Bing.com threads describe the opposite — blocked accounts, silent support, and irreversible losses.

This flood of fake praise hides real warnings beneath layers of algorithmic noise.

7. Rebranding and Clone Fraud

Once a wave of exposure hits, PaceCapitalFX vanishes — only to reappear weeks later under a slightly altered name and domain.

Every clone uses the same templates, same scripts, and the same stolen “license numbers.”

This cyclical deception lets scammers stay one step ahead of regulators while continuing to prey on new investors

The Ruthless Mechanics of PaceCapitalFX

Behind the corporate jargon and digital polish, PaceCapitalFX is an engineered theft operation.

It doesn’t trade currencies; it trades trust for cash.

Its operation follows a chillingly consistent four-stage model:

- Lure Phase — Paid ads on Google and Medium promise AI-driven trading success.

- Trust Phase — Fake profits appear in dashboards to encourage larger deposits.

- Extraction Phase — Emotional manipulation and fabricated upgrades drain accounts.

- Collapse Phase — Withdrawals freeze, agents vanish, and the website disappears.

The scheme thrives on psychological precision. It targets ambition, fear, and optimism simultaneously.

Reports on Reddit, Quora, and Bing describe the same nightmare — identical scripts, identical losses, identical silence afterward.

This is not poor management; it’s premeditated exploitation.

Scammers behind PaceCapitalFX use technology, social media, and even AI-generated ads to mimic legitimacy and evade detection.

Their success depends on speed — every week a new domain appears, and a new wave of victims begins.

If you’ve interacted with this platform, take action immediately:

- Contact your bank or card provider and initiate a fraud investigation.

- File a complaint with your national financial regulator.

- Warn others through public forums to disrupt their recruitment cycle.

Legitimate brokers operate transparently, under verified oversight.

PaceCapitalFX is the opposite — a manufactured illusion built to steal confidence, savings, and dignity.

When a company guarantees success, it isn’t offering opportunity — it’s baiting desperation.

Protect your finances, question every promise, and never trust unverified brokers.