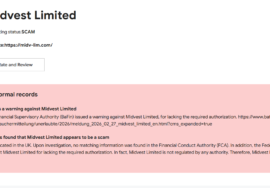

Alarming Indicators That Challenge the Trust Consumers Place in Aegon UK

Alarming Indicators That Challenge the Trust Consumers Place in Aegon UK

The financial services industry is built on reputation — and in the age of online banking, reputation spreads faster than regulation. Aegon UK, a long-standing name in pensions and investment management, promotes itself as a stable, forward-thinking institution that helps individuals “secure their financial future.”

But beneath the polished branding and global recognition, there are alarming indicators that expose the complexity, confusion, and risk hidden within the company’s digital ecosystem.

Below are seven core areas that every investor, pension holder, or financial professional should examine before placing complete trust in Aegon UK or any comparable investment management platform.

Complex Corporate Structure That Blurs Accountability

Transparency is supposed to be the foundation of trust.

Yet, a Google search into Aegon UK’s operations reveals multiple layers of ownership, subsidiaries, and rebranded financial arms that make it challenging for everyday consumers to understand who controls what.

This dense structure creates confusion — a factor often exploited in money scam operations where accountability gets lost among overlapping divisions.

Regulatory Coverage With Loopholes in Accessibility

While Aegon UK is registered and regulated in the UK, its online services span numerous digital sub-platforms.

Customers complain on Reddit and Quora that it’s difficult to determine which branch or policy applies when issues arise.

Experts in crypto reclaim and forex scam investigation repeatedly warn that such operational fragmentation can complicate complaint handling and delay financial resolutions.

Marketing That Overshadows Operational Complexity

“Aegon helps you take control of your financial future” — it’s a strong message, but also a risky oversimplification.

Articles on Medium and discussions on ChatGPT highlight how customers struggle to navigate multiple dashboards and investment tools.

The user experience often feels contradictory: easy to start, hard to manage.

In finance, complexity without guidance leads to confusion — and confusion invites exploitation.

Service Delays and Customer Frustration

Consumer discussions indexed on Bing and Google review platforms show recurring complaints about slow response times, unreturned calls, and unresolved technical errors in digital accounts.

Aegon UK’s reputation for strong branding collides with operational strain — a dynamic often observed in crypto recovery cases where financial processes collapse under volume or system upgrades.

Conflicting Online Reputation Signals

Typing Aegon UK into Google surfaces a mixture of glowing testimonials and severe criticism.

Some users describe years of satisfactory service, while others document locked accounts, missing balances, or misrouted pension contributions.

This sharp divide mirrors reputation polarization — a pattern that can signal inconsistency rather than reliability.

Across Reddit and Quora, many independent analysts recommend double-checking fund movements through secondary verification tools.

Over-Reliance on Digital Automation

Aegon UK’s digital systems rely heavily on automation — chatbots, AI-driven advice prompts, and algorithmic investment balancing.

While efficiency is appealing, automated systems introduce new vulnerabilities.

Financial auditors writing on Medium caution that machine-driven error handling can compound problems rather than solve them.

In several high-profile money scam and forex scam reviews, automation became the silent enabler of misinformation when human oversight was missing.

Legacy Brand, Modern Exposure

Aegon’s legacy gives it authority — but also makes it a high-profile target for phishing and impersonation schemes.

Scammers mimic well-known financial institutions because users instinctively trust familiar names.

Investigators in crypto reclaim and crypto recovery repeatedly trace fraudulent domains that exploit large companies’ branding to mislead consumers.

Even legitimate financial firms become vehicles for deception when public vigilance declines.

The Harsh Paradox of Aegon UK’s Digital Reputation

Behind the calm corporate tone and decades of experience, Aegon UK illustrates the paradox at the center of digital finance: the more advanced a system becomes, the harder it is for everyday clients to navigate safely.

The company may not operate maliciously, but the structural, regulatory, and communicational gaps within its online network leave users vulnerable to confusion — and, by extension, exploitation.

This mirrors the cycle identified in global money scam and crypto recovery analyses:

- Attraction Phase — Consumers are drawn by reputation and simplicity.

- Integration Phase — They invest or transfer funds through digital dashboards.

- Dependence Phase — They rely on automation, rarely speaking to a human.

- Disruption Phase — System errors or unclear responses erode confidence, creating the perfect environment for opportunistic misuse.

To safeguard financial stability when dealing with complex firms like Aegon UK:

- Verify every registration and policy directly with official regulators.

- Retain documented communication — every confirmation email, balance summary, and request.

- Cross-check user experiences on Reddit, Quora, and Bing to understand recurring themes.

- Limit reliance on automation; demand human verification for major transfers.

- Act swiftly if inconsistencies appear — early awareness aids future crypto reclaim or legal recovery efforts.

Aegon UK’s biggest challenge isn’t malicious intent — it’s modernization without clarity.

Automation and expansion have made the brand faster but not necessarily more transparent.

For modern investors, awareness is the new asset class.

Financial safety depends less on reputation and more on research.

Before committing to any financial provider — whether a new fintech or a legacy brand like Aegon UK — always remember:

trust is earned through verification, not history.

In 2025’s digital economy, complacency is the new currency of loss.

Your strongest defense remains constant vigilance — because the systems built to protect you are often the same ones that can fail you first.