7 Ruthless Exposures About “ForexCopy.com” That Every Trader Must Weigh

7 Ruthless Exposures About “ForexCopy.com” That Every Trader Must Weigh

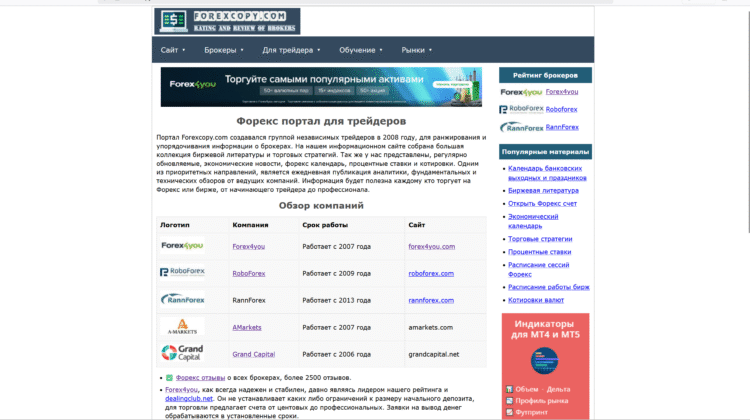

1. Ambiguous Identity & Regulatory Doubt

When you visit forexcopy.com, there is little to no verifiable information about who owns it, where it is regulated, or how it operates under legal jurisdiction. A domain that offers to replicate trades without revealing its entity or oversight is a warning sign. Legit brokers usually display registration details, license numbers, oversight bodies, and physical address—all missing or opaque here. Without real regulation, there is no real recourse if something goes wrong. You are trading at the mercy of an anonymous operator.

2. “Copying Trades” Sounds Attractive, But Is It Transparent?

The core promise of ForexCopy is simple: you let the system replicate trades of selected traders into your account. That’s not inherently bad — it’s similar to many copy-trading or mirror services. But the devil lies in the details: how trade copying is executed, how lag or slippage is handled, where fees and commissions hide, and whether the copied trader can manipulate signals. Many “copy” offerings operate as internal match systems, not real market execution. Unless ForexCopy publishes exactly how orders are mirrored, what latency exists, and how conflict of interest is avoided, you cannot trust that results reflect real external markets.

3. Commission & Fee Structure Hidden Behind Layers

Services promising “copy for free” often embed costs in other ways. ForexCopy may require you to accept that only profitable copied trades incur commission, or that you pay per subscription day, or per lot traded by the signal provider—without making all that transparent ahead of subscription. Traders often discover these costs only when profits are calculated or when they try to withdraw. Lack of clear, unchanging fee policy is a classic way to trap participants into paying more than they anticipated.

4. Execution Risk, Latency & Copy Errors

Even if a trader you follow makes profit in their own account, your copy may lag, suffer slippage, or miss trades due to connectivity or server speed. That is a normal risk. But worse is when the platform artificially limits or alters copying behavior to the disadvantage of followers. Several copy-trading services do this: allow signal providers ideal execution, but followers experience delays or worse fills. If ForexCopy does not provide independent verification or audits comparing original and follower trades, you have no way to check whether you’re being treated fairly.

5. Deposit & Withdrawal Asymmetry

In many copy-trading or signal-provider platforms, depositing funds is easy—encouraged. Withdrawal becomes a bottleneck. Clients may face unexpected delays, identity checks, bonuses that disappear on withdrawal, or other hidden rules. If ForexCopy hides or shifts withdrawal policies under different terms after deposits, it becomes a mechanism to keep capital tied to the system. Without clear, locked withdrawal rules that remain the same before and after deposit, the service may be designed to trap funds.

6. Testimonials & Profiles: Real or Fabricated?

Platforms like ForexCopy often display “top traders,” glowing results, or success stories to attract copy followers. But in many known scams, these profiles are fabricated, results manipulated, or returns presented without full context. Fake signal accounts, cherry-picked past performance, or hidden risk adjustments are common in copy-scam models. Unless ForexCopy allows third-party verification of trader histories (for example via an independent audit or public trade tracking), these displayed metrics may be illusions meant to lure capital.

7. Review Pattern & External Warnings

When you dig for information about forexcopy.com, you find minimal credible auditing or independent reviews. That’s common for many new copy services. Meanwhile, the concept of “copy-service scams” is well known: trading communities warn about fake traders, manipulated signals, hidden costs, and withdrawal traps. Reviews of similar “copy” services often expose the same patterns: users deposit, see unreal profit badges, then hit withdrawal walls or realize signal traders disappeared. Without strong external trust signals, forums, or regulation, forexcopy.com sits in a high-risk category by default.

Conclusion — The Hard Verdict on ForexCopy.com

ForexCopy.com is built on a seductive idea: replicate someone else’s success without years of learning. In theory, that is tempting. In practice, without clear regulation, full transparency, and independent verification, it becomes dangerous. The lack of any credible ownership disclosure, licensing information, or published operational backstops means users become guinea pigs.

True copy-trading models should be audited, transparent, and fair. They should clearly publish how latency is handled, how fees are applied, what happens during slippage, and how followers’ trades compare to signal providers’ original trades. ForexCopy.com offers none of that up front. Instead, you see the promise of replication and growth—but you cannot confirm that what you see is real or preserved.

Traders who use copy services must always assume risk. But they can mitigate by demanding transparency, small test deposits, early withdrawals, and continuous comparison between signal strategy publications and execution in their own account. If ForexCopy resists those basic checks, it resists accountability.

In the world of copy trading, your capital is even more vulnerable than when trading your own strategy. You’re ceding control over execution, trusting both signal provider and platform. Without the protections of regulation, arbitration, or legal recourse, a failed copy system can drain both public trust and client funds. ForexCopy picks a dangerous place to operate—promising duplication while hiding all the levers.

My verdict: treat ForexCopy.com as experimental at best, not reliable. Avoid committing meaningful capital until you see full transparency: audited track records, constant public replication logs, locked withdrawal policies, and proof that follower trades match original trades across time. Until you have all that, treat it with suspicion and caution.