7 Key Strengths & Warning Signs: LiteFinance (LiteFinance.org) Deep-Dive

7 Key Strengths & Warning Signs: LiteFinance (LiteFinance.org) Deep-Dive

LiteFinance (formerly known as LiteForex) is a long-standing FX/CFD broker brand that promotes multi-asset trading, MetaTrader platforms, copy trading, frequent promos, and wide funding options. On its site and in much of the public chatter, you’ll see claims of strong history, multiple entities, and growing user numbers. As with any broker that operates via several legal entities across regions, you’ll find both solid positives and important caveats. Below are seven strengths and warning signs to weigh before you commit capital.

1) Multi-entity structure with a mix of stronger and mid-tier regulation (Strength + Caveat)

LiteFinance operates through different corporate entities. The European arm, Liteforex (Europe) Ltd, is a Cyprus Investment Firm regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08. That places EU clients under MiFID II rules, with recognizable protections and disclosures. Outside the EU, LiteFinance Investment Limited in Mauritius holds an Investment Dealer license from the Financial Services Commission (FSC). The brand also communicates other corporate registrations to cover international operations.

Why this matters: CySEC oversight is materially stronger than offshore or mid-tier regimes in terms of investor protection. Mauritius FSC is regulation, but it is not top-tier like the UK or Australia; protections and enforcement can be more limited. Before opening an account, check which entity will hold your account, because protections vary by entity and region. (Sources: LiteFinance legal pages; operator/brand pages.)

2) A real operating history and brand continuity (Strength)

LiteFinance markets a heritage dating back to the mid-2000s and documents a domain move to the current official site. A longer operating history isn’t a guarantee, but it does provide more observable behavior over time: platform uptime, how the broker handles market stress, how it communicates policy changes, and how it treats client complaints. The public brand communications also include periodic updates to client and affiliate agreements—another sign of a running compliance cadence.

What to do with this: Treat history as a positive if it’s coupled with current-day proof of regulation, current client protection arrangements, and up-to-date documentation. (Sources: LiteFinance news/announcements; regulatory docs updates.)

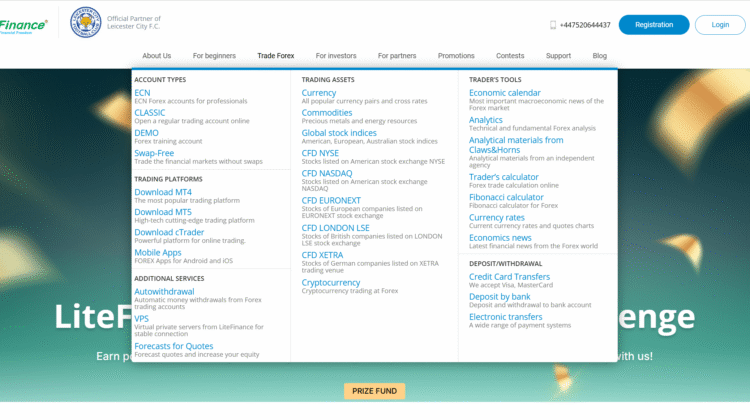

3) Platform breadth, copy trading, and many funding routes (Strength)

LiteFinance supports MetaTrader 4 and MetaTrader 5, plus its copy-trading infrastructure that lets clients follow strategy providers. On funding, it advertises a wide slate: cards, bank wires, various e-wallets, and cryptocurrencies. For many new or intermediate traders, this mix of platforms and payment rails is convenient and lowers the friction of getting started.

The flip side: convenience doesn’t equal safety. Always prefer funding paths that give you chargeback or dispute rights (where available), and test withdrawals early—don’t wait until after a run of profitable trades to discover obstacles. (Sources: product/funding pages.)

4) Public reviews are mixed: lots of praise but also pointed criticism (Mixed)

Trustpilot and regional review portals show a wide range of experiences. There are plenty of positive reviews praising platform usability, responsive support, and “fast” transfers. There are also critical posts—some recent—alleging slippage beyond expectations, order handling disputes, or withdrawal delays/non-responses.

How to read this: a big brand with global reach will accumulate both praise and complaints. What matters is the pattern and recency: if negatives cluster around withdrawals or order integrity and appear in the most recent months, treat that as a practical risk signal and demand your own proof (test a small withdrawal). (Sources: recent public review pages.)

5) Past regulator alerts around look-alike domains in the broader LiteForex/Lite- ecosystem (Warning—contextual)

Regulator warning lists sometimes include sites that imitate or “clone” brand names in order to defraud consumers. There have been warnings in the past about sites using “Lite Forex” variants. To be clear, a warning about a clone domain does not automatically indict the official brand—but it does mean the brand is attractive enough to fraudsters to warrant imitations, and it underlines why you should verify you’re on the official domain and engaging the correct legal entity for your region.

Actionable tip: bookmark and use the official client portal and confirm the licenced corporate name on your account agreement matches the regulator’s register entry. (Sources: official warning lists and coverage; brand “domain move” notices.)

6) Policy and documentation cadence is visible—but you still need to read the fine print (Strength + Caveat)

The brand publishes client agreements, affiliate terms, and regulatory-document updates. That’s good hygiene. But the practical protections you get—negative balance protection, complaint handling timelines, execution policies, bonus terms—depend on the entity and the product. Spreads and costs can vary by account type and market conditions. Promos can come with turnover or withdrawal restrictions. If you trade the news or use tight stops, your expectations for slippage and execution need to be set by the broker’s actual policies, not its marketing copy.

Bottom line: the presence of documents is a plus; your job is to confirm the substance that matters to your strategy and withdrawal expectations. (Sources: legal/advantages pages; change logs.)

7) Practical risk: entity mismatch and withdrawal friction remain the real-world tests (Warning)

For any multi-entity broker, the two biggest “lived” risks are (a) ending up under the wrong entity for your expectations, and (b) hitting withdrawal friction when it matters. Even with many positive public comments, recent individual complaints about stop management, support responsiveness, or payouts must be treated seriously until you verify your own flow with small, early tests.

Practical safeguard checklist:

- Confirm your entity before funding. EU clients should know whether the account sits under CySEC. Others should understand the protections under Mauritius FSC versus EU.

- Fund small, withdraw early. Deposit a token amount, place a couple of small trades, then withdraw to test speed and paperwork.

- Prefer reversible rails. Where possible, choose payment methods that give you dispute rights.

- Screenshot everything. Keep copies of T&Cs, spreads at trade time, ticket details, and support chats.

- Don’t ignore recency. Weight 2024–2025 user reports more heavily than older ones.

(Sources: public reviews and broker docs.)

Conclusion: Final Verdict on LiteFinance

LiteFinance is not a fly-by-night name. It’s a mature brand with a visible corporate footprint, platform breadth, and a combination of EU and international entities. For many traders, especially those who onboard via the CySEC-regulated company, the balance of convenience and oversight can be acceptable. The broker’s continued publication of documents, regular communications about policy changes, and the presence of a wide (and vocal) user base all add up to a profile that’s more established than the average offshore-only outfit.

That said, establishment is not immunity from risk. The single biggest determinant of your safety is which entity holds your account. If you land under the EU entity, you inherit EU-style guardrails. If your account is with the Mauritius Investment Dealer entity, you do have regulation—but it is not equivalent to top-tier regimes like the UK or Australia. That difference shows up when things go wrong: complaint escalation, dispute resolution, compensation schemes, and the regulator’s practical enforcement power.

User feedback is a second pillar. LiteFinance has many satisfied clients, which matters. But mixed into that are credible reports of slippage disputes, stop-distance disagreements, and withdrawal-related frustration—especially in the most recent year. You should treat those as risk signals to be tested, not ignored. A clean, small withdrawal within your first week is a far better truth test than any marketing banner or anonymous review.

On the product side, copy trading and varied funding are genuine strengths. Yet, every additional feature—bonuses, credits, exotic funding rails—adds terms. If you prefer the shortest path from trading to payout, consider declining promotions with turnover conditions and stick to straightforward account types. If you do accept a bonus or use copy trading, make sure you understand how losses, offsets, and withdrawals are treated under the letter of the agreement.

Finally, remember that brand ecosystems with long histories sometimes attract cloners and “sound-alike” sites. This puts a bit more burden on you to confirm you’re dealing with the real thing. Use the official client portal, check the exact licensed corporate name on your documents, and cross-check it on the regulator’s register.

Bottom line: LiteFinance sits in the middle ground between unregulated, high-risk outfits and the most tightly policed, top-tier brokers. It can be a workable choice if you (a) place your account under the strongest available entity for your region, (b) run quick, early withdrawal tests, and (c) keep your trading and funding as “plain vanilla” as possible. If your priority is maximum legal protection and minimal ambiguity, you may still prefer brokers regulated in top-tier jurisdictions. If you’re comfortable with the mixed-entity model and you verify your own payout flow, LiteFinance can be viable—provided you remain hands-on about your safeguards.