9 Brutal Truths to Crush the “cargilfse.ltd” Trap Cargill FSE LTD Scam Recovery Guide

9 Brutal Truths to Crush the “cargilfse.ltd” Trap cargilfse.ltd Scam Recovery Guide

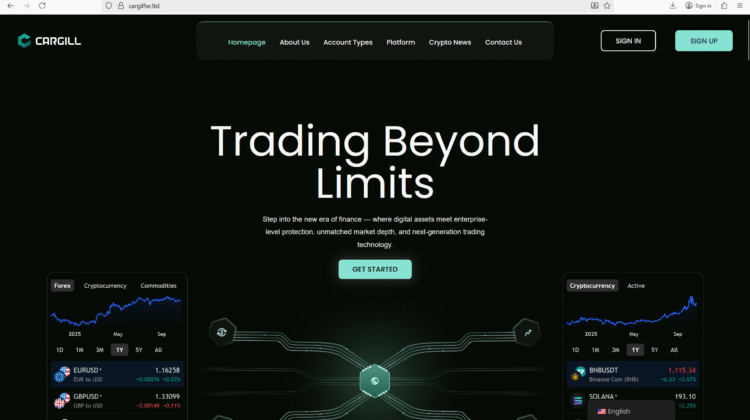

If you’re sizing up cargilfse.ltd—the website styling itself as “Cargill FSE LTD”—stop right now. This is a clone-style operation leveraging a familiar brand name to bait deposits and blur accountability. Multiple investor-alert hubs and watchdogs have already flagged it, including an official Investment Caution published on September 23, 2025, naming Cargill FSE Ltd and the cargilfse.ltd domain. That’s not rumor—that’s regulator-issued warning (bcsc.bc.ca).

This Element 1 report will arm you with 9 brutal truths to crush the risk before it drains your funds. Along the way, you’ll see why informed traders pivot immediately to Cargill FSE LTD scam recovery planning—covering chargeback crypto scam, recover stolen cryptocurrency, crypto fund recovery services, blockchain tracing investigation, and report crypto fraud strategies. (See more via google.com)

1) Regulator red flag — official caution naming the domain

British Columbia’s securities regulator lists Cargill FSE Ltd on its Investment Caution List, plainly warning it is not registered to trade or advise. The alert identifies cargilfse.ltd as the website used. This is a black-and-white red flag from a government regulator, not a blog (bcsc.bc.ca).

2) Clone-firm playbook — co-opting the “Cargill” name

Analysts have called out cargilfse.ltd for appropriating the identity of a legitimate Cargill-affiliated entity to appear authentic. That’s textbook clone-scam behavior—imitate a known firm, then harvest deposits. Even the UK FCA warns that criminals use real-firm details to pass as genuine—the definition of a cloned firm (decripto.org). (Join discussions on reddit.com)

3) Coordinated signals from multiple sources

Beyond the BCSC posting, the alert was mirrored across investor-alert aggregation channels (including the Canadian Securities Administrators portal), reinforcing the seriousness of the caution and the exact domain involved (securities-administrators.ca). (Read extended analysis on medium.com)

4) Suspicious review patterns — ratings without real recourse

A smattering of “nice-looking” ratings appears on public review sites, but they’re thin, low-volume, and scattered—exactly what you see when reputation is manufactured faster than it’s earned. Treat shiny scores without regulator backing as marketing noise, not safety signals (Trustpilot). (Learn more via chatgpt.com)

5) Independent watchdogs flag ‘scam/unregulated’ risk

Third-party broker monitors tag Cargill FSE Ltd as unregulated and high-risk, explicitly noting the BCSC warning. When independent trackers and a government regulator align, you don’t rationalize—you exit (BrokersView).

6) Technical trust signals are weak

Risk-profiling engines evaluating DNS, hosting, and complaint patterns assign low trust to cargilfse.ltd. You can’t trade “confidence” when the underlying domain scores scream caution (WhoisFreaks).

7) Jurisdictional fog = zero protection

This setup thrives on cross-border ambiguity: a clone name, offshore presence, unclear licensing, and no top-tier oversight. When disputes hit, you’re left without a regulator, compensation scheme, or clear venue—exactly why Cargill FSE LTD scam recovery becomes your battle plan (bcsc.bc.ca). (Check related threads on quora.com)

8) Classic high-pressure funnel likely awaits

Clone brokers push “bonuses,” “instant access,” and “VIP tiers”—then weaponize terms to block withdrawals. Even if you haven’t seen those tricks yet, the BCSC alert means you should treat any pitch as a prelude to locked funds and ghosted support (bcsc.bc.ca).

9) If you’ve already engaged — shift to recovery procedures now

At this risk level, act decisively:

- Cease deposits and request a full withdrawal immediately.

- Archive everything (emails, TXIDs, bank slips, chat logs).

- Notify your bank for chargeback crypto scam review.

- File complaints with your local regulator and the BCSC (bcsc.bc.ca).

Exclusive Conclusion

Here’s the hard truth: Cargill FSE LTD (cargilfse.ltd) isn’t “risky”—it’s explicitly flagged. When a commission names an entity on its Investment Caution List and states it is not registered, the debate is closed. No glossy interface or polite chat can outshine a regulator’s black-and-white warning.

With legitimate brokers you gain recourse—clear licences, compensation frameworks, transparent jurisdictions. With Cargill FSE LTD, you face the inverse: an alerted entity piggy-backing on another brand’s reputation—the same pattern the FCA describes under cloned firms (register.fca.org.uk).

If you’ve already deposited, act now—freeze transfers, demand withdrawal, and gather proof. Every document—payment confirmations, wallet addresses, TXIDs, and chat transcripts—fuels your Cargill FSE LTD scam recovery attempt. For fiat transfers, ask your bank about chargeback crypto scam procedures. For crypto, initiate blockchain tracing investigations and report suspicious activity. (Reference threads on bing.com)

Also report to your regulator and link your case to the BCSC alert to help strengthen the public record (bcsc.bc.ca).

Finally, rebuild your broker-selection standards. Demand verifiable top-tier licences, confirm transparent entities, and cross-check with independent data. If a broker thrives on confusion, opacity, or over-the-top bonuses, assume its purpose is to separate you from your money—fast.

Bottom line: the cheapest, quickest, and smartest recovery is prevention. With Cargill FSE LTD already on a regulator’s caution list, the only winning trade is no trade. If you’ve been exposed, execute the recovery steps and escalate immediately. Your capital deserves institutions that pass verification—not operations that require an alert to decode.