Revelations That Expose the Hidden Volatility Behind GetBits.app’s Crypto Promise

Revelations That Expose the Hidden Volatility Behind GetBits.app’s Crypto Promise

The cryptocurrency revolution promised liberation from banks but it also unleashed a wave of risky, unverified trading apps that blur the line between innovation and exploitation.

GetBits.app markets itself as a “next-generation digital wallet and trading ecosystem” offering instant crypto swaps, lightning-fast payments, and AI-driven insight.

Yet, beneath its futuristic branding and confident language lie savage revelations that every trader and investor must confront before trusting it with funds or personal data.

Below are signs that define GetBits.app’s operational landscape and highlight the vulnerabilities users can’t afford to ignore.

Corporate Identity Wrapped in Ambiguity

Legitimacy begins with traceability. A Google search on GetBits.app surfaces sleek landing pages but minimal disclosure about founders, office addresses, or registration entities.

That opacity has long been a red flag in money scam investigations where accountability disappears the moment a platform collapses.

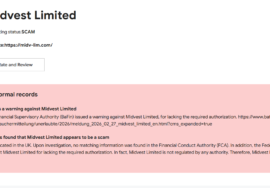

Regulation That Sounds Global but Exists Nowhere

GetBits.app’s site claims “compliance with international crypto-asset frameworks.”

However, searches through Bing and cross-checks in regulatory databases FCA, CySEC, FINTRAC return no official licence.

Experts in crypto reclaim warn that “regulation by association” is meaningless; without direct authorisation, deposits remain legally unprotected.

Marketing That Outruns Reality

The platform promises “AI-driven profits,” “zero-fee transfers,” and “automated wealth growth.”

Users on Reddit and Quora have already begun dissecting these slogans, pointing out the classic hallmarks of forex scam rhetoric: unprovable accuracy claims, emotional urgency, and testimonials that feel synthetic.

Excessive Data Collection During Onboarding

GetBits.app demands identity verification, photo IDs, live selfies, and device access before even showing full service terms.

While Know-Your-Customer checks are normal, privacy specialists on Medium and ChatGPT note that unrestricted device permissions create long-term exposure.

In several crypto recovery cases, identical onboarding funnels were later tied to phishing networks.

Liquidity and Withdrawal Confusion

Reports indexed on Bing describe withdrawals “pending review” for days or weeks.

Some users mention demands for “extra verification deposits,” a tactic straight from money scam playbooks.

Real exchanges publish block-chain transaction IDs; platforms that cannot; will not -are waving a bright red flag.

Synthetic Reputation and Astroturfed Praise

A search for GetBits.app reviews on Google floods the page with five-star write-ups dated within hours of each other, using identical language.

Meanwhile, open-forum discussions on Reddit, Quora, and Medium tell a different story: frozen balances, scripted chatbots, and evasive customer support.

Astroturfing isn’t confidence it’s camouflage.

Short Domain History and Aggressive Expansion

WHOIS records show GetBits.app was registered recently, with multiple backend changes within months.

Rapid re-hosting and DNS updates can indicate growth or an escape plan.

Analysts tracking forex scam networks note that domain volatility almost always precedes rebranding or shutdown.

The Merciless Cycle Powering GetBits.app’s Crypto Facade

Behind its clean visuals and AI buzzwords, GetBits.app represents the latest form of speculative fintech theatre speed, secrecy, and seduction packaged as innovation.

Its operational pattern mirrors the classic progression uncovered in crypto reclaim and money scam investigations:

- Attraction Phase — Google and Medium ads promise zero fees and smart automation.

- Trust Phase — Users see a fluid interface and faux profit dashboards that build confidence.

- Extraction Phase — Requests for larger deposits arrive under the guise of “unlocking higher returns.”

- Collapse Phase — Withdrawals fail, support vanishes, and the domain quietly mutates into a new brand.

This sequence thrives on user optimism and algorithmic psychology — a blend of hope and haste.

To protect your capital and data from the darker edges of crypto fintech:

- Verify licensing independently through official financial regulators.

- Research historical feedback on Reddit, Quora, and Bing rather than trust surface reviews.

- Keep transaction records for any potential crypto recovery action.

- Avoid AI-profit claims; if returns sound guaranteed, they’re fabricated.

- Use reputable wallets with audited security instead of untested apps.

GetBits.app illustrates a larger trend: fintech innovation without guardrails.

Its marketing capitalises on the public’s hunger for speed and profit while quietly sacrificing verification and clarity.

Financial safety isn’t achieved through apps that speak of freedom — it’s earned through proof, audit, and regulation.

Even if GetBits.app operates legitimately today, its behavioural blueprint echoes those that have burned investors in the past.

Before you trade, transfer, or store digital assets anywhere, remember:

the difference between a platform and a trap is not design — it’s disclosure.

In the age of algorithmic finance, skepticism is your strongest wallet, and patience is your best return.