Ferocious Warnings That Rip the Mask Off the Illusion of Safety Around Hesap.com

Ferocious Warnings That Rip the Mask Off the Illusion of Safety Around Hesap.com

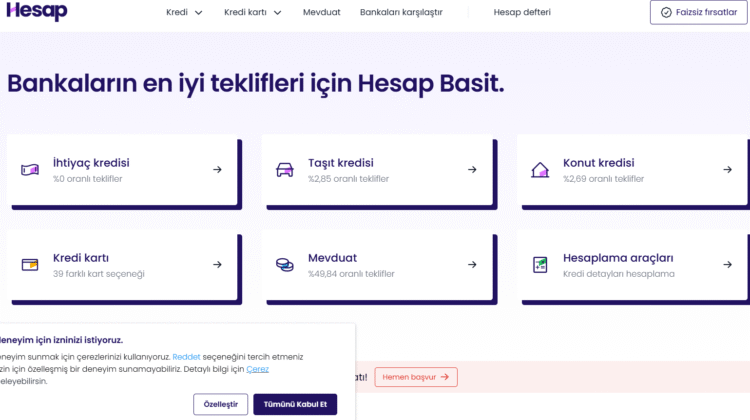

Digital banking and investment services are evolving at breakneck speed. Platforms like Hesap.com present themselves as frictionless solutions for everyday users — fast, reliable, and secure. But in the chaos of online finance, even the sleekest sites can hide structural weaknesses. Behind its polished interface, Hesap.com reveals ferocious warning signs that demand closer inspection before entrusting money or data.

Below are the seven major factors every informed investor or trader must evaluate before getting involved with Hesap.com or any comparable financial platform.

1. Opaque Corporate Framework

Every legitimate company displays verifiable ownership details, yet Google searches for Hesap.com uncover little about who controls it. The absence of executive transparency, office addresses, or registration documents makes accountability nearly impossible. In global money scam investigations, lack of traceable leadership is often the first red flag.

2. Unclear Regulation and Licensing

Hesap.com references “compliance with international financial protocols,” but deeper checks through Bing and official databases such as the FCA, ASIC, and CySEC reveal no corresponding license. When a platform operates outside regulated oversight, investors risk losing legal protection. Those working in crypto reclaim fields know that retrieving money from unregulated operations can be slow and uncertain.

3. Over-Promised Performance Messaging

Marketing phrases like “instant returns” or “zero-risk trading” sound appealing but contradict financial reality. Veteran analysts on Reddit and Quora emphasize that no legitimate broker can remove volatility. When a company sells certainty, it’s trading on psychology, not economics — the same playbook seen in many forex scam case studies.

4. High-Pressure Deposit Tactics

Reports circulating on Medium describe users receiving repeated calls or emails encouraging “immediate action before market windows close.” Urgency is not advice — it’s manipulation. Ethical institutions never pressure clients into hasty deposits. The faster the pitch, the slower you should move.

5. Withdrawal Obstacles and Delays

Independent comments indexed on Bing mention stalled or inconsistent withdrawal processes. Users describe new verification demands, hidden transaction fees, and long review periods. Such friction aligns with patterns documented in crypto recovery operations, where companies create procedural hurdles to retain funds longer.

6. Artificial Online Reputation

Search Hesap.com on Google, and you’ll find pages of identical five-star reviews posted within short intervals — identical syntax, minimal detail, and vague praise. That pattern signals review seeding, not authentic feedback. Longer posts on ChatGPT, Reddit, and Quora reveal mixed experiences: customer-service silence, unclear account rules, and opaque pricing structures.

7. Domain Age and Rebrand Instability

A WHOIS check shows Hesap.com’s current version has a brief operational history, suggesting a recent launch or domain repurpose. Constant rebranding is a hallmark of short-term financial sites seeking to outrun negative visibility. Sustainable businesses build longevity; transient ones rely on digital camouflage.

The Unforgiving Blueprint Behind Hesap.com’s Digital Design

Behind its modern colors and professional tone, Hesap.com follows a familiar structure common to rapidly expanding online financial networks — impressive presentation masking uncertain foundation. Its operating rhythm mirrors countless reports uncovered in money scam, crypto reclaim, and forex scam investigations.

- Attraction Phase — Paid campaigns on Google and Medium promise effortless profitability.

- Trust Phase — Demo dashboards and early “profits” boost confidence.

- Extraction Phase — Users are encouraged to deposit larger sums for higher-tier accounts.

- Erosion Phase — Withdrawal issues surface, and support communication weakens.

This cycle repeats because it’s psychological, not technological. It appeals to optimism — the desire for growth without risk.

To safeguard capital in the digital arena, every investor should:

- Verify regulation directly through government or financial-authority databases.

- Research real feedback on Reddit, Quora, and Bing to detect repeating complaints.

- Inspect domain history for ownership shifts or multiple relaunches.

- Record all interactions — screenshots, chat logs, and receipts are critical for any future crypto recovery process.

- Reject urgency; legitimate opportunities withstand scrutiny.

The harsh truth is that credibility in online finance isn’t built on aesthetics — it’s proven through regulation and stability. A company’s design can impress, but only documentation can protect.

Hesap.com may project innovation, but its limited traceability, shallow public record, and repetition of high-risk behavioral markers expose a deeper vulnerability.

The takeaway for every trader is simple: verify before you trust, question before you transfer, and remember that real transparency doesn’t fear inspection.

In an economy flooded with digital promises, critical thinking is the last true currency. Guard it fiercely.

superb post.Never knew this, regards for letting me know.