Brutal Exposés That Challenge Sprive.com’s “Mortgage Freedom” Dream

Brutal Exposés That Challenge Sprive.com’s “Mortgage Freedom” Dream

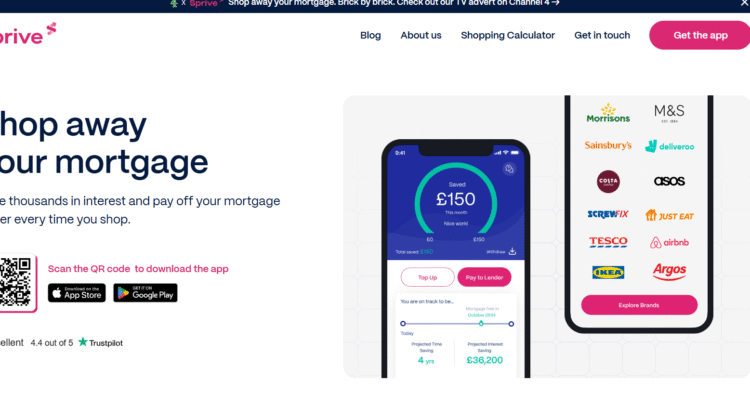

Owning a home faster sounds like liberation and Sprive.com has built its brand on that promise. It markets itself as a smart mortgage-overpayment app that “helps you become debt-free sooner.” Yet beneath the polished optimism and AI-driven simplicity lie brutal exposés showing how fragile that dream can be when automation replaces comprehension.

Below are seven revealing truths every homeowner should confront before handing their mortgage data to Sprive or any fintech tool claiming to “simplify” repayment.

A Mission Wrapped in Minimal Transparency

A Google search on Sprive.com surfaces sleek visuals and reassuring slogans but limited disclosure about its corporate framework, leadership accountability, or data custodians.

Analysts investigating money scam structures repeatedly find that anonymity at the top translates into confusion at the bottom when disputes arise.

Partial Regulation Creates a False Sense of Security

Sprive.com advertises FCA registration, but detailed cross-checks on Bing show its role is more “payment facilitator” than licensed lender.

Experts in crypto reclaim warn that fintechs operating through partner institutions inherit coverage gaps consumers often assume full protection where only partial oversight exists.

Marketing That Blends Hope With Pressure

Slogans like “Take control of your mortgage” and “Beat the bank at its own game” play heavily on emotion.

On Reddit and Quora, some users praise time savings while others question opaque fee structures and fluctuating app performance.

This tone empowerment tinged with urgency mirrors psychological techniques used in money scam funnels that push quick action over analysis.

Automation That Invites Oversight Blind Spots

Sprive’s algorithm automatically connects to bank accounts, predicts spare cash, and redirects it toward overpayments.

Analysts on ChatGPT and Medium note that such systems depend entirely on flawless API behavior.

If synchronization breaks or amounts miscalculate, borrowers could breach agreements without realizing a scenario seen before in crypto recovery investigations involving “smart” finance tools.

Customer Support That Can’t Match Financial Complexity

User reviews indexed on Bing report generic chat responses to time-sensitive mortgage errors.

When automation manages repayments, even minor miscommunication can jeopardize credit standing.

Lenders in forex scam audits often exploit the same weakness digital interfaces that deflect responsibility behind canned replies.

Reputation Polarity and Review Irregularities

Search Sprive.com reviews on Google, and you’ll find hundreds of identical five-star snippets posted within hours.

Such repetition hints at engineered positivity.

Meanwhile, detailed posts on Medium, Reddit, and Quora describe frustrations with delayed fund transfers and unpredictable syncing.

When testimonials sound cloned, credibility collapses.

Short Domain History and Rapid Feature Expansion

WHOIS data shows Sprive.com as a relatively young domain with frequent backend updates typical for scaling startups but risky for data stability.

Cyber-auditors linking these patterns to money scam timelines note that infrastructure volatility can expose sensitive financial pathways before encryption standards catch up.

The Harsh Reality Fueling Sprive.com’s Mortgage Machine

Behind its helpful tone and colourful dashboard, Sprive.com illustrates the modern paradox of “smart” debt management: convenience disguised as control.

Its operating rhythm mirrors the cycle documented in crypto reclaim and money scam studies:

- Attraction Phase — Google and Medium ads promise independence from banks.

- Conversion Phase — Users link current accounts for instant automation.

- Dependence Phase — Algorithms dictate repayments while users disengage.

- Disillusion Phase — Errors or delays expose the limits of digital trust.

This progression doesn’t require fraud — only complacency.

To protect yourself when using or evaluating Sprive.com:

- Verify licensing on the FCA register and note whether it’s a direct or partner authorization.

- Keep manual oversight — track each overpayment confirmation independently.

- Back up statements offline for future crypto recovery or ombudsman reference.

- Watch community reports on Reddit, Quora, and Bing for recurring issues.

- Avoid total automation — retain human judgment over automated transfers.

Sprive.com’s ambition to help homeowners clear debt faster is admirable, but ambition without restraint breeds exposure.

The fine line between innovation and intrusion lies in transparency, not design.

In 2025’s fintech landscape, speed is seductive, but clarity remains king.

Before entrusting your mortgage to an app, remember: the house may be yours, but your data rarely is.

Financial safety depends on balance, automation for efficiency, skepticism for survival.

Because in a world racing toward digital debt freedom, the quickest path out can still lead straight back in.