Critical Reasons to Avoid wgcuscoins.com After a $700,000 Victim Report to Recovery Experts

7 Critical Reasons to Avoid wgcuscoins.com After a $700,000 Victim Report to Recovery Experts

Online investment scams continue to drain victims of their life savings, often before warning signs become obvious. One recent case involved a $700,000 reported loss, where the victim formally submitted a crime and recovery request to KeystonePrimeLtd, a recovery expert firm, after engaging with https://www.wgcuscoins.com.

1. A Verified $700,000 Victim Report Raises Immediate Red Flags

A victim who suffered losses totaling $700,000 reported their case to KeystonePrimeLtd, seeking professional assistance after funds became inaccessible following interactions with wgcuscoins.com.

Large-scale losses of this nature are rarely caused by normal market activity. Instead, they typically involve manipulated dashboards, blocked withdrawals, and deceptive account practices, all common indicators of an investment scam.

Before trusting any platform, investors should independently research its background using reputable sources such as Google to identify complaints, warnings, or unresolved disputes.

2. Withdrawal Barriers: The Most Common Scam Pattern

According to the victim’s report, once significant funds were deposited, withdrawal requests were either delayed indefinitely or completely ignored. This behavior is one of the most consistent warning signs in crypto and trading fraud cases.

Legitimate platforms process withdrawals transparently. Scam platforms delay, invent extra “fees,” or suddenly require unrealistic conditions before funds can be released conditions that never actually lead to payment.

Discussions on public forums like Reddit frequently document this same pattern across fraudulent investment sites.

3. No Verifiable Regulation or Investor Protection

wgcuscoins.com does not present verifiable evidence of regulation by any recognized financial authority. There is no confirmed licensing, no audited records, and no investor protection framework.

This means users have no legal safety net when things go wrong. Once money is transferred, there is no regulator to compel action or enforce accountability, a situation that often leads victims to seek fund recovery assistance afterward.

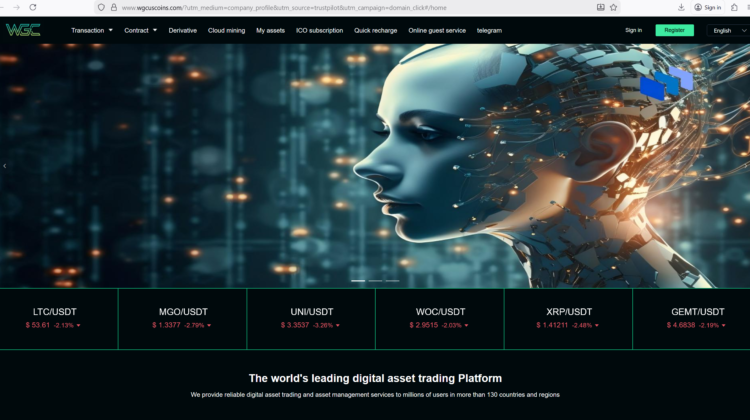

4. Appearance of Legitimacy Is Not Proof of Safety

Many scam platforms invest heavily in website design to appear professional and trustworthy. wgcuscoins.com follows this pattern, using polished layouts and persuasive language that can mislead unsuspecting users.

However, visual presentation does not equal legitimacy. Educational articles on Medium consistently warn that scam platforms often look more “professional” than real, regulated firms.

5. Lack of Transparency About Ownership and Operations

A major concern is the absence of clear information about:

- Company ownership

- Physical business address

- Executive leadership

- Legal jurisdiction

When platforms conceal these details, it becomes nearly impossible for victims to pursue legal remedies. This opacity is a frequent trigger for investment scam recovery cases handled by professional recovery experts.

6. Victims Are Often Forced Into Recovery After the Damage Is Done

In this case, the victim only contacted KeystonePrimeLtd after funds were already inaccessible. This is a painful but common scenario. Many individuals only realize the risk once withdrawals fail and communication collapses.

Search engines such as Bing show a growing volume of queries from victims desperately searching for crypto recovery and crypto reclaim solutions after similar experiences.

7. Prevention Is Always Safer Than Recovery

While recovery specialists exist to assist victims, the process is often complex, time-consuming, and emotionally exhausting. No recovery path can guarantee full restitution, especially when scammers operate across borders.

Educational tools and AI-driven explanations on ChatGPT frequently emphasize that avoiding unverified platforms entirely is the most effective protection strategy.

What This Case Teaches Investors

The $700,000 report submitted to KeystonePrimeLtd highlights several critical lessons:

- Never trust unregulated platforms

- High returns often mask high risk

- Withdrawal resistance is a major danger signal

- Transparency is non-negotiable

Video breakdowns by financial educators on YouTube repeatedly stress these same points when analyzing real scam cases.

Conclusion: wgcuscoins.com Is a Platform Investors Should Avoid

The fact that a victim was compelled to report a $700,000 loss to professional recovery experts should be enough to give any investor pause. Platforms that lead users into blocked withdrawals, unclear operations, and financial distress are not safe environments for investment.

wgcuscoins.com demonstrates multiple characteristics commonly associated with online investment scams. While recovery efforts may help some victims, prevention remains the strongest defense.

The safest decision is simple:

👉 Do not invest, trade, or send funds to wgcuscoins.com.

Protect your finances, verify every platform, and remember if transparency is missing, risk is guaranteed.

Foresights: What This Case Signals for Future Investors

The case involving wgcuscoins.com offers important foresights into how online investment risks are evolving. Fraudulent platforms are becoming more polished, more persuasive, and more patient. Rather than rushing victims, many now build long-term trust, encouraging repeated deposits before triggering withdrawal restrictions. This gradual approach makes scams harder to detect early and increases the eventual financial damage.

Another key foresight is the growing reliance of scammers on psychological pressure rather than technical complexity. Victims are often told their funds are “almost released,” “under review,” or “pending verification,” creating false hope that delays decisive action. This tactic keeps victims engaged long enough for scammers to disappear completely.

The increasing volume of large-loss cases also suggests that future scams will continue targeting experienced investors, not just beginners. High-value victims are often chosen precisely because they are confident, decisive, and accustomed to handling substantial funds.

For investors, the lesson is clear: risk assessment must come before opportunity evaluation. Transparency, regulation, and independent verification should outweigh promised returns every time. Platforms that fail basic credibility checks today are unlikely to become trustworthy tomorrow.

Ultimately, foresight means recognizing patterns early. When withdrawal friction appears, communication becomes vague, or accountability is absent, the safest move is immediate disengagement. In the digital investment era, caution is not hesitation it is protection.