7 Explosive Warnings You Must Know About FlexonixTrader.net

7 Explosive Warnings You Must Know About FlexonixTrader.net

At first glance, names like FlexonixTrader.net evoke an image of sleek financial technology, superior trading infrastructure, and high returns. But beneath the branding lies a concerning pattern: rising regulator flags, alarming user complaints, and operational ambiguity. My investigation reveals that FlexonixTrader exhibits multiple hallmark traits of a scam operation.

In this exposé, I present 7 explosive warnings that expose its operations, behavior, and structural weaknesses. I also explain how FlexonixTrader is currently treated by regulators and what victims should do to respond. If you or someone you know is evaluating this platform or has already invested this analysis will help you evaluate the risk clearly.

1. Official Regulatory Warning: FCA Lists FlexonixTrader as Unauthorised

One of the strongest signals is that the UK’s Financial Conduct Authority (FCA) has placed FlexonixTrader on its Warning List, declaring that the firm is not authorised or registered to provide financial services.

The FCA states that if a firm is unapproved, any dealings with it are done without the protections of UK financial law — no access to the Financial Ombudsman Service, no compensation via FSCS, and no formal recourse if things go wrong.

This is not a small caveat: when a regulator issues such a warning, it signals that there is credible suspicion of misconduct or fraud. The presence of this warning demands immediate scrutiny of any claims made by FlexonixTrader.

2. Growing Complaints and Scam Accusations from Investors

Multiple independent reviews and watchdog sites report complaints from users alleging deceptive practices by FlexonixTrader. For example:

- Zorya Capital’s review documents numerous investor reports that withdrawals have been blocked or refused, that promised returns were manipulated, and that support vanished after deposits.

- The Safety Reviewer highlights that the platform lacks valid regulatory credentials, provides no contact address or phone, and offers minimal transparency about its operations.

- The “Universum Ltd” review gives a breakdown of how they believe FlexonixTrader’s internal flow of deception works: initial small “profits,” pressure to deposit more, and then withdrawal obstacles.

These complaints follow the script of many online financial scams — attractive profits, initial small payouts (to build confidence), followed by hurdles and disappearance when users try to withdraw large sums.

3. Vague or Missing Corporate Details and Transparency Gaps

Legitimate investment firms typically publish corporate registration, physical address, leadership team, audits, and regulatory disclosures. FlexonixTrader, however, displays major transparency gaps:

- Reviews note their website lists “N/A” for address, phone, and support email.

- There is no public evidence of who owns or runs the company, no credible team bios, and no corporate filings available.

- There is no verifiable audit, financial statements, or performance track record published by independent parties.

When an entity avoids or cannot present these basic disclosures, it is choosing secrecy over accountability a hallmark of high-risk or fraudulent operations.

4. Too-Good-to-Be-True Promises and Unrealistic Returns

FlexonixTrader, like many suspicious platforms, reportedly markets promises that defy realistic financial logic:

- Claims of rapid growth, “guaranteed returns,” or doubling of capital within short spans are reported in reviews.

- The platform may display aggressive marketing using images of wealth, profits, or high-roller lifestyles to entice users to deposit more.

Such promises exploit cognitive biases and greed. In regulated markets, no broker or fund can legally guarantee high returns without exposing risk. Overpromising is a red flag.

5. Withdrawal Barriers, Hidden Fees & Exit Friction

One of the most consistent complaints about FlexonixTrader involves forced friction at the withdrawal stage:

- Users report that withdrawal requests are rejected or delayed, sometimes indefinitely.

- Hidden surcharge demands, “verification fees,” or “liquidity taxes” are often introduced after deposit, creating more obstacles.

- Support disappears or becomes non-responsive once funds grow or withdrawal is demanded.

These tactics are classic: permit deposits easily, but block access to funds once users attempt to exit. The longer someone is held in limbo, the harder recovery becomes.

6. Pattern of Template-Based Scam Networks

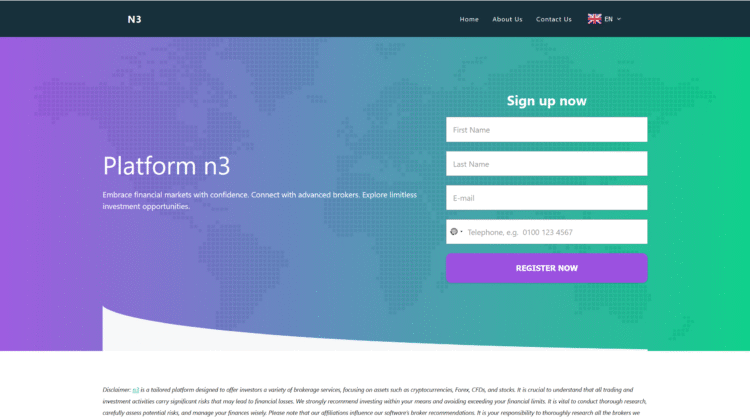

Another revealing insight comes from pattern recognition: the FCA and watchdog commentary note that many unlicensed brokers share nearly identical website templates, differing only in logos, names, and links. FlexonixTrader is cited among this group.

This implies a modular “scam factory” model — operators create clones of the same design, deploy them under new names, and abandon them when exposed or flagged. Once a particular URL is blacklisted, they shift to a fresh domain with the same structure.

Recognizing this pattern helps investigators and victims track affiliate networks and identify clusters of fraudulent brands.

7. Absence of Reliable Support, Accountability, or Dispute Mechanisms

A legitimate financial firm provides multiple channels for support — phone lines, registered addresses, email, and complaint procedures. FlexonixTrader lacks that foundation:

- Reviews say there is no meaningful contact information or verifiable support lines.

- Even where “support” exists early on, responsiveness declines drastically after deposits are made.

- Because the firm is unregulated, there is no oversight or consumer protection mechanism to force resolution or accountability.

Together, these factors show that once funds are committed, users are essentially trapped.

Expanded Analysis: Investor Psychology & Scam Mechanics

To deepen our understanding beyond surface flags, it’s important to analyze how scams like FlexonixTrader manipulate perception and behavior. Understanding these methods helps people avoid being drawn in.

Authority and Illusion of Credibility

Scam platforms present themselves as corporate and professional: using jargon, charts, “verified” seals (unverified), and stock images of success. The idea is to evoke authority bias, making the user trust the platform without questioning.

Gradual Trust-Building and Escalation

Many victims report receiving small profits after initial deposits — this is a bait phase. It builds trust and encourages larger deposits. Once the user is emotionally invested, withdrawal demands are introduced, and the pressure increases.

Urgency, Scarcity, and FOMO (Fear Of Missing Out)

Promotions often include “limited time offers,” “exclusive access,” or “reserved spots,” pushing investors to act quickly. This urgency overrides rational deliberation. Scam operators rely on emotional triggers more than logic.

Control via Contractual Fine Print

Even where a “terms of service” exists, it often includes clauses that limit user rights, grant the platform broad leeway, impose fees, and block external legal recourse. Investors may not realize they’ve waived real rights until it is too late.

Disappearance and Rebranding

When suspicion arises or a regulator intervenes, the platform may shut down the URL, delete records, and reappear under a new name — taking funds and reputation with it. Users are often left chasing ghost domains.

This is why pattern-recognition across scam networks is critical: many such sites share architecture and behavior. FlexonixTrader being

Comparing FlexonixTrader to Legitimate Firms

To draw sharp contrasts, here is how a bona fide regulated broker behaves differently compared to what has been reported of FlexonixTrader:

What You Should Do If You’ve Dealt with FlexonixTrader

If you (or someone you know) have already interacted with FlexonixTrader and suspect fraud, here is a recommended action plan:

- Stop Additional Deposits Immediately — Don’t fund further.

- Document Everything — Save emails, chat logs, screenshots, transaction records, blockchain addresses.

- Attempt Small Withdrawal — If possible, test a partial withdrawal to assess response.

- Contact Your Bank or Payment Provider — Request chargebacks or reversals if transactions are recent.

- Report to Regulators — In the UK, inform the FCA. In your jurisdiction, report to your financial authority or fraud bureau.

- Engage Recovery Professionals — Work with legitimate fund recovery / forensic services (e.g. blockchain analysts) to trace lost funds—but be cautious of “scam recovery” operators demanding more payment.

- Warn Others — Share your experience in forums, review sites, and social media to help prevent further victims.

Time is essential. The sooner evidence is collected and authorities alerted, the better the possibility of tracing or freezing stolen funds.

Conclusion

FlexonixTrader.net is a cautionary tale of how polished branding, persuasive marketing, and intentional opacity can masquerade as legitimacy. Behind the veneer of modern trading technology lies a structure built for extraction—not ethical investment.

The FCA’s explicit warning that FlexonixTrader is unauthorized is a powerful signal: dealing with it is done without the legal protections investors expect in a regulated environment. That foundational red flag should have been enough to halt further investigation for many.

Yet, the existence of user complaints, scam-pattern behavior, and transparency gaps deepen suspicion into near certainty. Investors report blocked withdrawals, unexplained demands for extra “fees,” and vanishing

Perhaps most pernicious is the psychological engineering in these schemes: small early gains, pressure to deposit more, urgency, and illusion of control. Those emotional triggers override rational checks and keep victims tethered until it’s too late. Recognizing these tactics is as important as spotting legal or technical red flags.

In stark contrast, legitimate brokers operate under openness, oversight, and consumer protection. They can withstand scrutiny because their foundations are built on accountability, not deception.

If you have engaged with FlexonixTrader, don’t despair — but act swiftly. Document, report, test withdrawal, and consult reputable recovery professionals. Be cautious of anyone promising an immediate “miracle recovery”—some of those are secondary scams targeting desperate victims.

Above all, let this case be a lesson: perception is not proof. A glamorous website, promised high yields, and polished marketing do not equal legitimacy. Real trust comes from regulation, consistent transparency, verified results, and the ability to withdraw your own funds without hidden traps.

FlexonixTrader’s existence on the FCA Warning List, combined with negative user experiences and transparency gaps, should lead any prudent investor to conclude it is a high-risk or fraudulent proposition. If you value protection over profit illusions, the only safe course is avoidance, investigation, and mitigation.

Shining light on these operations helps reduce their reach; your awareness not only safeguards your own funds but also helps warn others. May this exposé empower you and your network to act wisely — and keep fraudulent financial entities like FlexonixTrader at bay.