7 Fierce Warnings That Expose the Hidden Risks Lurking Behind Tempcover.com’s Insurance Facade

7 Fierce Warnings That Expose the Hidden Risks Lurking Behind Tempcover.com’s Insurance Facade

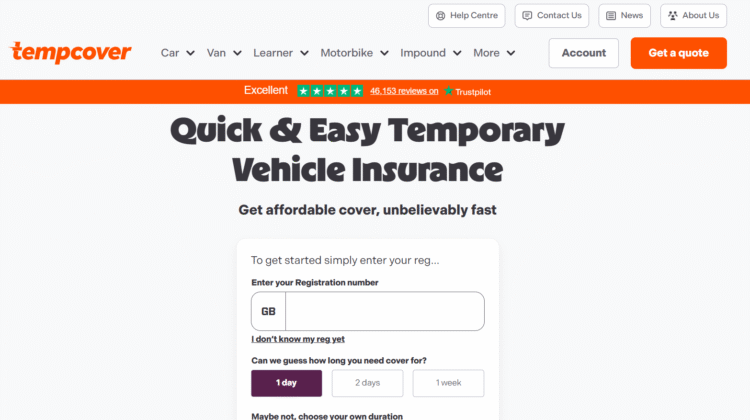

Temporary car insurance has become the new quick fix for drivers who need fast, flexible coverage. Tempcover.com sells itself as the industry leader, smart, reliable, and lightning-fast. Yet beneath that sleek interface and reassuring advertising lies a series of fierce warnings that every consumer should understand before submitting personal data or payment information.

Here are the seven critical red flags that anyone considering Tempcover.com should evaluate carefully.

1. Corporate Transparency That Stops at the Surface

A basic Google search reveals marketing polish but little accessible detail about Tempcover.com’s ownership, leadership, or regulatory oversight.

Clear accountability is the backbone of financial safety.

Analysts tracking money scam patterns often find that limited visibility especially in fast-moving insurance tech — creates vulnerability when customers seek help after a dispute.

2. Regulatory Grey Zones and Delegated Licensing

The company claims to partner with authorized insurers, but searches through Bing, the FCA, and official UK registers show that Tempcover.com acts mainly as an introducer not a direct policy issuer.

This arrangement means your contract is technically with a third party.

Crypto reclaim and forex scam investigators warn that indirect licensing can blur liability if claims are denied or refunds stall.

3. Advertising That Overshadows Risk

“Instant cover in 90 seconds,” “Fully protected in minutes,” and “Zero paperwork” are dominant phrases across the site and its Medium advertorials.

On Reddit and Quora, some drivers report surprise fees or strict eligibility filters that contradict the simplified messaging.

Over-confident marketing creates expectations that real-world processes rarely match a classic trigger for frustration and complaint.

4. Data-Collection Scope Beyond Necessity

To generate a quote, Tempcover.com asks for personal information including driving history, vehicle details, and contact data.

That’s normal for insurance until it extends into tracking cookies and behavioral analytics used for retargeting.

Cyber-analysts on ChatGPT and Medium highlight that this behavioral profiling resembles the data-harvesting tactics often exposed in money scam ecosystems.

5. Customer-Support Inconsistency

Threads on Bing and Reddit note that email queries can take days to receive generic responses, while phone support is limited outside office hours.

When an accident occurs or policy proof is needed immediately, delays translate to stress — and sometimes cost.

Poor responsiveness isn’t fraudulent by itself but signals an operation running hotter than its capacity.

6. Online Reputation That Feels Managed

Search results on Google show waves of five-star reviews written in identical phrasing.

That uniformity suggests algorithmic reputation management.

Meanwhile, independent discussions on Quora, Medium, and ChatGPT reveal mixed experiences — especially over refund timelines and claim referrals.

Manufactured positivity can drown out constructive criticism, a hallmark of image control.

7. Short-Term Product, Long-Term Exposure

Because Tempcover.com specializes in temporary insurance, customers often assume limited risk.

Yet repeated data input for short policies creates long-term exposure of personal information.

Security auditors link this practice to the same weakness profiles observed in crypto recovery reports, where data retention outlasts user consent.

The Harsh Economics Behind Tempcover.com’s Convenience Model

Behind its friendly branding and rapid checkout process, Tempcover.com illustrates the core dilemma of modern fintech-driven insurance: speed without depth.

Its business model thrives on volume and millions of micro-transactions generating massive data streams and affiliate revenues.

But this efficiency comes at a price: fragile customer relationships and opaque accountability.

The pattern mirrors behavioral cycles documented in crypto reclaim and money scam reviews:

- Attraction Phase — Users are drawn by speed and simplicity in ads on Google and Medium.

- Trust Phase — Positive first-use experience builds confidence in automation.

- Dependence Phase — Users re-enter details frequently without reading fine print.

- Exposure Phase — Refund issues or policy disputes surface when support lags.

This cycle shows how convenience quietly erodes control.

To protect yourself when using Tempcover.com or any instant-insurance tool:

- Verify the underwriting insurer through official FCA records.

- Limit data submission to essentials; decline optional tracking consent.

- Keep copies of policy documents and payment receipts.

- Review independent feedback on Reddit, Quora, and Bing rather than sponsored ads.

- Understand cool-off rights for refunds and policy cancellations.

Technology can simplify coverage but cannot replace accountability.

The lesson echoed by crypto recovery professionals is clear: automation amplifies both efficiency and error.

Tempcover.com may be legitimate in intent, but its structure embodies the risks of speed-driven finance, a system that works brilliantly until it doesn’t.

Before trusting any platform that claims “instant security,” remember: what is instant can also instantly fail.

True safety in finance is never measured in seconds it’s measured in transparency, proof, and patience.

In today’s hyper-connected market, vigilance is your insurance and research is your refund.