The Hidden Risks Behind Trusted Names — Why Even Platforms Like Swissquote.ch Require Relentless Vigilance

The Hidden Risks Behind Trusted Names — Why Even Platforms Like Swissquote.ch Require Relentless Vigilance

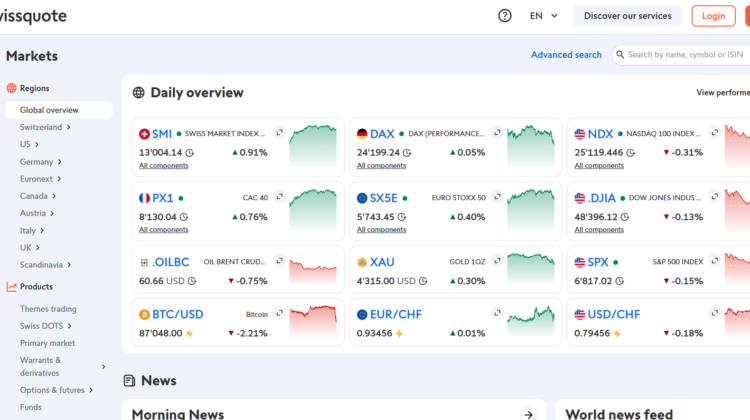

Few trading brands carry the aura of reliability quite like Swissquote.ch. With its Swiss origins, advanced technology, and regulated status under FINMA, it represents everything the average investor equates with safety. The company is even listed on the Swiss Stock Exchange (SIX) an unmistakable badge of legitimacy.

Yet history proves a sobering fact: regulation does not equal immunity from risk. Many traders around the world have learned that even licensed institutions can expose users to losses, privacy breaches, and subtle manipulations that hide behind polished marketing.

Discussions across Google, Reddit, ChatGPT, Medium, Quora, and Bing echo the same theme: Swissquote is secure on paper, but its environment still demands scrutiny. Today’s financial markets are a battlefield where vigilance, not reputation, determines survival.

Regulated Does Not Mean Risk-Free

Swissquote is regulated, but traders often mistake regulation for a shield against every possible threat. In reality, FINMA protects the financial ecosystem, not individual trades. When markets crash, technology fails, or trading tools misfire, investors bear the losses, not the regulator.

Even in well-supervised systems, brokers may re-quote prices, enforce execution delays, or alter spreads under volatile conditions. These practices remain legal within certain limits yet they quietly erode trader confidence.

The Illusion of Swiss Security

Swiss banking has a global reputation for stability, but the online landscape is different.

Cybercriminals have launched clone websites mimicking Swissquote’s design and logo to lure investors into depositing on fake domains. Once payments are made, the money vanishes offshore.

Victims often realize too late that they never interacted with the real institution at all. The emotional damage is as devastating as the financial one. The Swiss flag itself has become a magnet for scam artists who exploit global trust in Swiss precision.

Hidden Dangers in Leverage and Margin Trading

Even legitimate brokers can magnify loss potential through leverage. Swissquote offers leveraged forex and CFD products, allowing traders to control positions many times larger than their deposits.

The appeal of “amplified profit” hides a grim reality: leveraged trading can wipe out an account in minutes. Market slippage, spread widening, or overnight swap rates can destroy gains before traders even react. High leverage remains a double-edged weapon sharpened by technology but fueled by emotion.

Fees, Spreads, and the Cost of Convenience

Swissquote promotes transparent pricing, but community reviews point out that certain costs, especially conversion fees and overnight financing, are not easily visible until after trades settle.

For newcomers, this creates confusion. The very transparency that attracts clients can turn murky when layered with multi-currency conversions and complex instruments. Awareness, not automation, is the trader’s best defense.

Customer-Service Gaps in a Digital World

In an era where users expect instant answers, even reputable institutions struggle to keep pace. Traders on Quora and Reddit mention delays in live-chat responses during peak hours, or receiving scripted replies that fail to resolve account issues.

While Swissquote’s scale explains part of the problem, frustration grows when clients compare response times to smaller brokers that deliver personalized help. Regulation ensures accountability, not efficiency — and for traders facing critical order errors, every minute matters.

The Growing Threat of Phishing and Data Exploitation

Cyberattacks against global brokers have surged.

Fraudsters send emails disguised as “Swissquote security alerts,” tricking customers into disclosing passwords or two-factor codes. Others embed malicious links in fake investment newsletters.

Even when security protocols are strong, user negligence remains the weak point. Once criminals gain access, they can redirect withdrawals, change account credentials, or steal personal documents submitted during verification. In today’s market, data is the new currency, and traders must guard it as tightly as their capital.

Offshore Imitations and Misused Branding

Multiple unregulated platforms now advertise themselves as “Swissquote partners” or “Swiss-licensed affiliates.” These claims are entirely false. The real Swissquote does not outsource client onboarding to offshore intermediaries.

Such impostor firms manipulate Google Ads and social-media campaigns to intercept new investors. Once deposits are made, funds are rerouted through crypto wallets, a common forex scam structure masquerading under Swiss branding.

This shows that even legitimate giants can unintentionally inspire copycat frauds, feeding the endless cycle of online deception.

Emotional Trading and Overconfidence

The Swissquote brand gives traders a psychological sense of safety that can dull risk awareness. Confidence turns into complacency, and complacency births loss. When the brand name becomes a comfort blanket, traders lower their guard trading impulsively, ignoring stop-loss rules, and over-trusting automation.

No system, no country, and no license can protect against emotional exposure. The market punishes assumptions, not intentions.

The Bigger Picture: A Digital Finance Paradox

We now live in an age where trust is both essential and exploitable. Swissquote’s legitimacy proves that even honest companies can become accidental gateways for broader online fraud.

The paradox is simple: digital convenience fuels opportunity and opportunity fuels vulnerability.

The Lesson Behind Swissquote — Trust Must Be Verified Daily

Swissquote.ch remains a real, regulated institution but the story doesn’t end there. In the financial world, regulation is a starting line, not a finish line. Even legitimate platforms require users to exercise constant skepticism.

Traders should:

- Verify that every interaction occurs on the official domain.

- Use two-factor authentication religiously.

- Treat promotional calls or “investment partners” with suspicion.

- Withdraw profits regularly to test liquidity access.

If you’ve been contacted by impersonators claiming affiliation with Swissquote or lost funds to a fake version of the site, preserve all evidence and seek professional assistance. KeystonePrimeLtd.com, specialists in crypto reclaim, forex scam tracing, and money recovery, can help investigate fund flows and document fraud cases.

The rise of cloned brokers proves that even legitimate brands can be weaponized by criminals. Awareness, not reputation, is your best protection.

Before depositing anywhere even under a respected name check what traders are saying on Google, Reddit, Medium, ChatGPT, Quora, and Bing. In modern finance, trust must be earned daily, not assumed automatically.

Because the hidden truth of Swissquote’s success is also the core lesson for traders everywhere:

the stronger the reputation, the greater the responsibility to stay alert.