TemplerFX.com Review 2025 — Strengths, Weaknesses, and Critical Safety Insights for Traders

TemplerFX.com Review 2025 — Strengths, Weaknesses, and Critical Safety Insights for Traders

Introduction: A Broker Caught Between Opportunity and Offshore Risk

The online forex industry is saturated with brokers claiming to offer the best spreads, lowest commissions, and fastest executions. TemplerFX.com is one such platform that has steadily gained attention for its broad international presence, multi-asset trading options, and long history in the retail trading world.

However, like many offshore brokers, its advantages come with potential risks that traders must evaluate carefully. After analyzing multiple reports and discussions from Google, Reddit, ChatGPT, Medium, Quora, and Bing, this review presents an honest and balanced look at TemplerFX’s strengths, weaknesses, and risk profile so you can make informed decisions before funding an account.

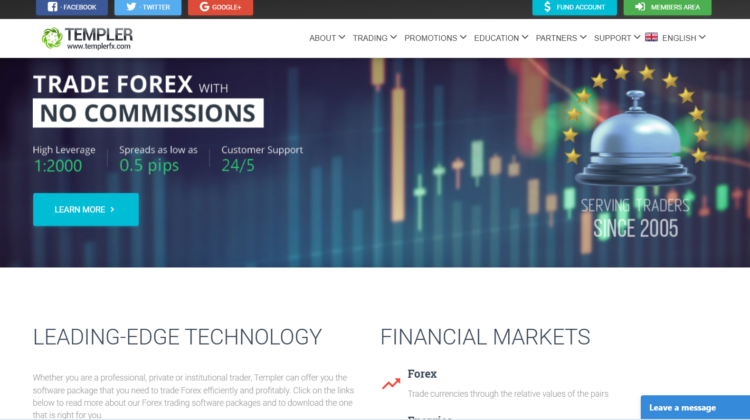

1. Company Background and Regulatory Framework

TemplerFX was established in the mid-2000s and operates under the supervision of the Financial Services Commission (FSC) of Mauritius. While this means it is licensed, the FSC is considered an offshore regulator, offering less stringent investor protections compared to top-tier authorities like the FCA (UK) or ASIC (Australia).

Verdict:

TemplerFX is legally registered but not under a high-trust jurisdiction. Traders should view this as a medium-risk regulatory environment adequate for experienced traders who understand offshore limitations, but not ideal for those seeking full fund protection guarantees.

2. Trading Platforms — MetaTrader 4 Dominates

TemplerFX supports MetaTrader 4 (MT4), one of the world’s most recognized trading platforms. The broker integrates advanced charting tools, automated trading (Expert Advisors), and multi-device compatibility.

However, the lack of MT5 or proprietary platforms may limit traders who prefer newer technology or built-in analytical features. Still, for most retail traders, MT4 remains efficient, familiar, and reliable.

3. Account Types and Leverage Options

TemplerFX offers multiple account types, including:

- Micro Account — low minimum deposit, ideal for beginners.

- Standard Account — tighter spreads, no dealing desk execution.

- ECN Account — raw spreads for advanced traders, with commission-based pricing.

Leverage goes up to 1:1000, which can amplify both profits and losses. High leverage should always be approached cautiously; experienced traders may use it strategically, but newcomers should scale down significantly to reduce risk exposure.

4. Spreads, Fees, and Commissions

The broker advertises competitive spreads starting from 0.1 pips on ECN accounts. However, these conditions vary by account type and market volatility. Some users on Reddit have reported temporary spread widening during major news events, which is common in forex but worth noting.

Good sign: There are no hidden deposit fees, and swap-free (Islamic) accounts are available for specific regions.

5. Deposit and Withdrawal Experience

TemplerFX supports various payment channels, including bank transfers, Visa/MasterCard, Skrill, Neteller, and crypto deposits. Withdrawal times reportedly range from 1–5 business days, depending on the payment provider.

Some traders have mentioned occasional delays when withdrawing via crypto wallets, while fiat withdrawals tend to be smoother. Before making large deposits, it’s smart to test a small withdrawal first, an essential risk-management practice with all offshore brokers.

6. Bonuses and Promotions — Read the Fine Print

TemplerFX occasionally offers deposit bonuses and trading contests. While appealing, these incentives usually carry strict trading volume requirements before profits can be withdrawn.

Traders should read all terms carefully and avoid assuming bonus credits are equivalent to real, withdrawable capital.

7. Education and Market Analysis

The broker provides basic educational resources including economic calendars, video tutorials, and occasional webinars. While helpful for beginners, these materials are introductory in depth.

If you’re serious about improving trading skills, complement these resources with high-quality learning platforms and independent materials from Medium, Quora, or dedicated trading communities on Reddit.

8. Customer Support and Accessibility

TemplerFX claims 24/5 multilingual support through live chat, phone, and email. Reviews are mixed; some traders praise the quick response, while others complain about slower replies during peak hours.

This inconsistency is common with mid-sized offshore brokers that rely on smaller teams. Test response speed before relying on it for urgent trading issues.

9. Security and Data Protection

TemplerFX states that it uses SSL encryption and segregated client accounts for fund safety. While these are positive signs, such claims cannot be independently verified without transparent audit reports.

The absence of third-party security certifications or financial statements means traders must rely largely on trust — another reason why cautious fund sizing is essential.

10. Trader Sentiment and Reputation Overview

Feedback across major discussion platforms is divided. Some experienced traders appreciate the flexibility and consistent MT4 performance, while others express concern about offshore regulation, delayed withdrawals, and leverage risk.

Overall, sentiment positions TemplerFX.com as a moderately risky but operational broker functional for traders who understand offshore dynamics, unsuitable for those seeking top-tier regulatory safety.

A Broker That Works — With Real Risks Attached

TemplerFX.com is a functioning forex and CFD broker with over a decade in the industry, backed by a legitimate (though offshore) license in Mauritius. It delivers familiar tools, decent spreads, and various account types that appeal to a global audience.

However, the offshore structure, inconsistent withdrawal experiences, and limited investor protection make it unsuitable for those who prioritize regulatory strength and guaranteed fund recovery.

Traders who choose TemplerFX should:

- Start small and verify withdrawal functionality early.

- Avoid excessive leverage despite attractive margins.

- Rely on independent analysis from Google, Reddit, ChatGPT, Medium, Quora, and Bing to stay informed about ongoing trader feedback.

In online trading, the golden rule remains unchanged: never trade more than you can afford to lose, and never trust a platform without understanding its full regulatory context.