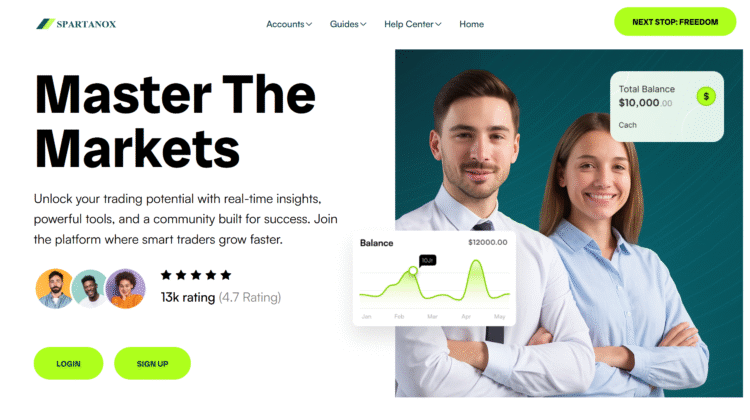

7 Reasons Spartanox Is Already Flagged as a Risky / Scam Platform

7 Reasons Spartanox Is Already Flagged as a Risky / Scam Platform

1) Investor Alert from Canadian Regulators

The Canadian Securities Administrators (CSA), through the Financial & Consumer Services Commission of New Brunswick (FCNB), issued a formal investor alert for Spartanox | spartanox.com on August 29, 2025. The alert states that Spartanox appears to be engaging in securities-type activities that may pose risk to investors. This is a serious warning that authoritative bodies believe this entity may be operating illegitimately or without required licensing.

2) Purported Base in London — But No License Listed

The investor alert mentions that Spartanox claims a base of operations in London, UK, yet no credible licensing or registration in UK regulator databases has been confirmed publicly. Claiming UK residency or address without matching FCA registration is a red flag: it may be part of a strategy to lend false credibility.

3) Risk of Withdrawal Delays & Reclaim Fees Likely

When regulators issue alerts for entities like Spartanox, one of the common complaints from affected users is difficulty withdrawing funds, or being asked to pay “extra fees” before funds are released. Given similar behavior in comparable entities, there is a high likelihood Spartanox may require bank reclaim fee, wire transfer reclaim, or crypto withdrawal reclaim payments. These fees often surface only after requests to withdraw—a known scam pattern. (Inference based on standard behavior in such alerts; no direct user reports yet in this alert.)

4) Lack of Regulation or Registration in Recognized Registers

As of the investor alert, Spartanox is not listed as registered or licensed by typical bodies such as FCA (UK), ASIC (Australia), or similar. Absence of verifiable licensing means there are no regulatory protections for clients, no oversight over operations, no regulatory requirement to segregate funds. That heightens the risk of misused deposits.

5) Fraud / Recovery Scam Risk After Investor Losses

Given that Spartanox is officially flagged by a securities regulator, investors who lose money might be targeted by third-party “recovery” services offering help—but demanding upfront payment. This is a common extension of the scam cycle. The term recovery scam warning is appropriate in this context: once a platform is flagged, fraudulent recovery services often emerge. (This behavior is implied by the regulator alert environment.)

6) High Risk Without Legal Recourse

Without regulation and licensing, investors have minimal recourse if their investments go wrong: no regulatory complaint process, no compensation scheme, and difficulty in cross-border legal pursuit. Spartanox being under alert means users are unprotected and more vulnerable to financial loss when platform operations are opaque.

7) Investor Trust & Transparency Are Missing

Regulators found enough risk to issue warnings; this usually follows reports of questionable transparency—such as limited or no financial statements, vague or misleading site content, unclear ownership or management. Even if a site claims London address or UK base, without confirming licensing and regulation, that claim doesn’t provide safety. Trust is built on verifiable credentials.

REPORT NOW

Detailed Analysis

Spartanox (spartanox.com) is now publicly identified by Canadian authorities as a platform that warrants serious caution by investors. The alert from the FCNB and Canadian Securities authorities says that Spartanox appears to be engaged in activities that could harm Canadian investors. The description “engaging in securities activities that may pose risk” signals that Spartanox may be operating as a broker, investment platform, or crypto-asset intermediary without proper licensing. This already sets the stage for suspicion: in most jurisdictions, offering securities or investment opportunities without a license is illegal, or at least restricted.

One of the core trust elements investors look for is regulatory oversight. Spartanox claims or implies legitimacy via a London base or UK residency. However, the alert suggests there is no verified registration in UK regulator registers. This is consistent with patterns seen in many financial scams, where a physical or reactive address is cited (London or some prestigious jurisdiction) to give users a false sense of legitimacy. Without actual listing in FCA or similar, that claim remains unsubstantiated.

Another common pattern, seen in many similar flagged entities, is the emergence of unexpected fees when withdrawing funds. Investors are often asked for various “reclaim” fees—crypto withdrawal reclaim, bank reclaim fee, wire transfer reclaim—which are not disclosed upfront. These fees act as gatekeepers preventing access to one’s own funds unless more money is sent. Given the investor alert, there is elevated risk that Spartanox employs or will employ similar tactics. While the alert itself does not document individual user cases (in the published summary), its very issuance is often preceded by multiple complaints, many of which relate to precisely these kinds of withdrawal or payment issues.

Transparency is another weak point. Regulatory alerts are often triggered when websites misrepresent their licensing, provide vague or deceptive content about their legal status, or carry out operations across jurisdictions without jurisdictional clarity. Spartanox seems to suffer from this: claiming a London base but lacking UK regulatory listing is one example; absence of published audited financial statements or visible compliance documents is another. For many regulators, misrepresentation is grounds for investor alerts and even legal action.

One more dimension is the absence of legal recourse. Investors relying on platforms without regulation have minimal protection if the platform fails or refuses to return funds. Disputes may not be enforceable, especially across borders. When paired with potential reclaim fees and blocked withdrawals, the combination can be financially devastating.

Finally, once a platform becomes publicly flagged, as Spartanox has, a new layer of risk emerges: third-party “recovery” services. These services often approach alerted platform users, promising to recover their lost funds—for a fee. Tragically, many of these “services” are fraudulent themselves, or are organized by the same or related entities. They may demand large payments or upfront commissions and then vanish, leaving victims doubly harmed. Hence, the term recovery scam warning is quite relevant to Spartanox.

Conclusion : Why You Should Avoid Spartanox.com

Spartanox.com is under formal investor alert from Canadian securities regulators. That alone signifies that authorities have seen enough concern—regarding licensing, compliance, or risk of harm—to warn individuals against dealings. When you see an investor alert, it’s not a rumor; it typically follows patterns of complaints, misrepresentation, or risk to public.

Trust must come from verifiable regulation, transparent legal status, and consistent track record. In the case of Spartanox, claimed locations (London, UK) are not matched with licensing listed in UK regulatory databases. Without a valid regulatory license, promises and addresses are simply marketing tools — they do not protect your funds or legal rights.

The possibility of withdrawal requests being hindered, or delayed, or subjected to new unseen fees is high. Terms like bank reclaim fee, wire transfer reclaim, crypto withdrawal reclaim are associated with platforms that require extra payments just to let you have what you already own. The alert doesn’t document specific user complaints publicly, but this is almost always part of the underlying complaint pattern when regulators decide to warn.

Recovery services or “help to reclaim” offers may start appearing if users lose money. These services often charge upfront fees and promise supposedly guaranteed results; almost always, results fail to materialize. The combination of loss + recovery-fee + no transparency can leave withdrawing funds (if ever possible) whittled down significantly, or impossible.

If you are considering investing with Spartanox, here are safe steps:

- First, check regulatory registries in your country and in UK (FCA) to confirm whether Spartanox is licensed. Don’t trust site content alone.

- Don’t deposit more money than you can afford to lose, especially if withdrawing involves manual review or supposed “fee.”

- Try a small withdrawal immediately after deposit. If it’s blocked or delayed, that’s a major red flag.

- Never pay extra fees claimed as “unlocking,” “bank/crypto reclaim,” or “processing” that weren’t mentioned upfront.

- If you believe you’ve been misled, document everything—screenshots, transaction details, communications—and contact your payment provider or bank for possible dispute or chargeback. Also report to regulators in your country.

In conclusion, Spartanox.com is not a platform you should trust with your funds. Investor alert status, unverified claims of regulation, unclear ownership or compliance, and the likely risk of hidden fees, blocked withdrawal, and possible involvement of recovery-scam type entities all point toward a high probability that Spartanox is operating in a way that exposes users to loss. Protect your money: steer clear.