7 Stark Warning Signs That AmariCapital.com Is a High-Risk (Likely Scam) Broker You Should Avoid

7 Stark Warning Signs That AmariCapital.com Is a High-Risk (Likely Scam) Broker You Should Avoid

Introduction

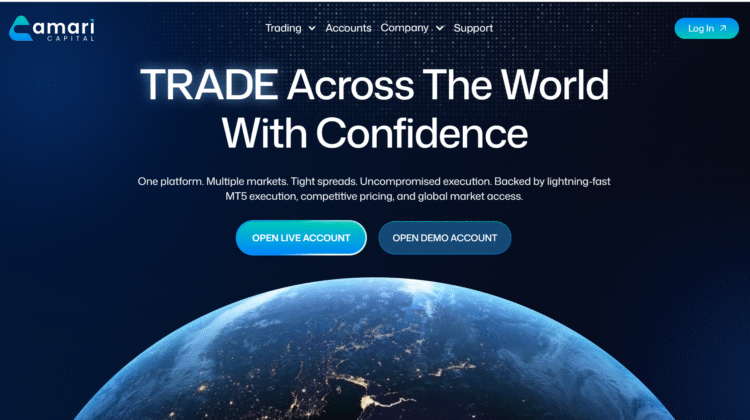

Shiny websites, bold promises, and “global” language are the paint jobs scammers love. Amari Capital (amaricapital.com) presents itself as a modern, multi-asset brokerage “built for performance,” but the public record tells a very different story: no verifiable regulation, brand-new domain, offshore-style opacity, and independent watchdogs flagging it as a likely scam. This article compiles the red flags so readers have a clear, evidence-based reason to keep their money out.

1) No recognized license anywhere it claims to operate

Legitimate brokers list regulator, license number, and legal entity you can independently verify. Amari Capital provides none that check out. Industry trackers report zero regulatory registrations tied to the brand, while broker-watch sites explicitly label it unregulated and high risk. If a platform invites deposits without supervision by a top-tier watchdog (FCA/ASIC/CySEC, etc.), your funds sit outside meaningful protections.

2) The website’s own “Legal & Compliance” page says a lot but proves nothing

Amari’s Legal & Compliance page leans on lofty claims about “transparency” and “client fund security,” but doesn’t list an actual regulator or license ID you can verify in a public register. It’s marketing-speak in place of hard facts, which is a standard tell in high-risk broker patterns.

3) Watchdogs and directories are already waving red flags

Multiple independent monitors are blunt: BrokersView writes that it “appears to be a scam,” citing no regulatory license and no DFSA/SCA authorization despite a Dubai claim. WikiFX/WikiBit show no regulation and very low scores. FXGecko posts a risk warning with “0” verified regulators. Reputational footprints like these rarely converge by accident.

4) New domain with privacy shield classic “hit-and-run” setup

WHOIS shows amaricapital.com registered June 22, 2024, masked behind privacy, with Cloudflare nameservers—exactly the kind of lightweight, portable infrastructure used by short-lived broker sites that can vanish or “rebrand” quickly. Domain freshness isn’t guilt by itself, but new + unregulated + high-risk flags is the wrong trifecta.

5) Dubai aura without Dubai authorization

Amari’s pages posture a “global” presence and imply UAE proximity/servicing, yet neither the DFSA (DIFC) nor the UAE SCA lists an authorized “Amari Capital” entity. That location glow-up—claiming prestige markets while skirting their regulators—is a pattern repeated in many scam brokers.

6) Testimonials that look generic and unverifiable

The site showcases glowing quotes and first names with stock-style portraits, but no verifiable identities, no broker-of-record checks, no withdrawal proofs. Without traceable, third-party verification, “reviews” function as sales copy, not evidence. (Serious brokers link to independent review platforms with auditable histories.)

7) Sign-up funnel before substance

You can open an account by agreeing to T&Cs and a client agreement in a slick onboarding flow—before you see a regulator-backed legal entity. That’s backwards. Robust firms start with who they are (entity, license, registry) and only then invite deposits. High-risk players do the reverse: collect funds first, answer later.

8) Independent articles outline how to check Amari still doesn’t pass

Risk-education posts (and even Amari’s critics) show you how to verify a firm in FCA/CySEC registers. Applying those steps to “Amari Capital” returns no authorization—the most important test a retail client can perform. If a broker fails the registry test, stop there.

9) Context: regulators are warning about a surge in unauthorized firms

The FCA has repeatedly warned consumers about unauthorized trading apps/firms and the spike in fake/impersonation scams in 2025. That broader environment makes extra caution vital, especially for new, unregulated sites courting deposits with marketing language.

10) Pattern match with known scam playbooks

Put it all together—no license, fresh domain, marketing over proof, Dubai name-dropping without DFSA/SCA listing, generic testimonials, watchdog warnings—and you’ve got a pattern we’ve seen across countless busted brokers. It doesn’t require a smoking gun to recognize a repeat scam contour.

✅ Conclusion : Treat AmariCapital.com as High-Risk and keep your funds out

In retail trading, your first duty is capital preservation. Amari Capital fails the baseline tests that protect it. The regulator test comes first: are they authorized by a recognized authority, with an entity name and license number you can independently confirm? Across multiple sources—BrokersView, WikiFX/WikiBit, FXGecko—the answer is no. That alone should halt any deposit. The absence of an FCA/ASIC/CySEC-style license means no supervisory guardrails, no prudential standards, and no straightforward ombudsman path if something goes wrong.

Next is the domain integrity test: age, ownership, and portability. A June 2024 registration, privacy-shielded contact, and CDN fronting can be legitimate in isolation, but when paired with unregulated status, the risk of “launch → harvest deposits → rebrand/vanish” rises. If a broker is serious, it lays down verifiable roots that outlast a marketing cycle. Amari hasn’t.

Then comes the substance test: does the site show regulator-verifiable entity details, audited disclosures, proof of reserves/segregation, or clear membership in compensation schemes? Instead, Amari’s Legal & Compliance page offers assurances without evidence; its testimonials read like ad copy; and the onboarding funnel asks for agreement and KYC before presenting any concrete regulatory standing. That’s sales before safeguards, which is exactly the wrong order for financial services.

Finally, consider the macro backdrop: in 2025, regulators warn of rising waves of unauthorized firms and impersonation scams. In that climate, the burden of proof falls even harder on a newcomer to demonstrate legitimacy. Amari has not produced the evidence—and independent monitors are already telling you so.

Practical steps for readers who’ve encountered, or worse, funded Amari:

- Do not deposit more. Attempt a small withdrawal immediately to test exit functionality.

- Collect evidence (screens, emails, dashboards, TXIDs). Maintain a timeline.

- Report to your national regulator/consumer-protection body and file with scam-watch portals.

- If approached by “recovery agents,” be skeptical—recovery scams often target recent victims.

- Going forward, verify brokers directly in regulatory registers before you ever fund.