7 Relentless Truths About TitanFX That Traders Must Know

7 Relentless Truths About TitanFX That Traders Must Know

1. Regulation That Walks the Line

TitanFX touts multiple licenses across Vanuatu, Seychelles, Mauritius, and the British Virgin Islands. While on the surface this appears like a fortress of regulatory protection, it’s more castle of sand than stone. All these are offshore regulators known for relatively loose oversight. The Vanuatu Financial Services Commission, for example, is criticized for minimal capital requirements and weak enforcement. Because TitanFX lacks any license from top-tier regulators like the FCA, ASIC, or CySEC, clients do not benefit from strong consumer compensation schemes, nor from the kind of legal teeth those regulators wield. This regulatory web gives an appearance of legitimacy while leaving many gaps in protection.

2. Account Types That Promise Much, Deliver Less

TitanFX offers a choice between a Standard account (where spreads include the broker’s margin) and a Blade (raw spread + commission) style account. The Blade account advertises spreads from as low as 0 pips, but it charges commission (often around $3.50 per standard lot, per side). In practice, this means your “ultra-tight” spread advantage can evaporate under commission, slippage, or during volatile conditions. Even the Standard account, with no commission, carries wider spreads, especially during news events or low liquidity hours. What looks like flexibility is often a balancing act that shifts risk back to the trader.

3. Execution Claims vs. Realities

TitanFX markets itself on fast execution and a high-performance infrastructure (their “Zero Point” technology). They say they route prices from 50+ banks and dark pool liquidity, aiming for minimal latency. Yet user accounts and independent reviews report slippage, delayed order fills, requotes, and occasional execution freezes during high volatility. Some traders state that during major market moves, charts diverge, stop losses trigger slightly off target, or orders are rejected. When the broker sits between you and liquidity, the integrity of execution becomes suspect—and in several cases, the broker’s interests align with execution irregularities.

4. Withdrawal & Deposit Contrast

One of the recurring patterns across broker complaints is easy deposits, hard withdrawals—and TitanFX is no exception. Many users praise TitanFX for fast deposits and reportedly “instant” withdrawals (even in a minute) in Trustpilot reviews. But others claim significant delays, additional identity verification demands, or partial rejections, especially when withdrawing profits. Some state requests are flagged for “compliance review” without clear explanations. When money flows in freely but struggles to flow out consistently, one must question whose control and incentives are at play.

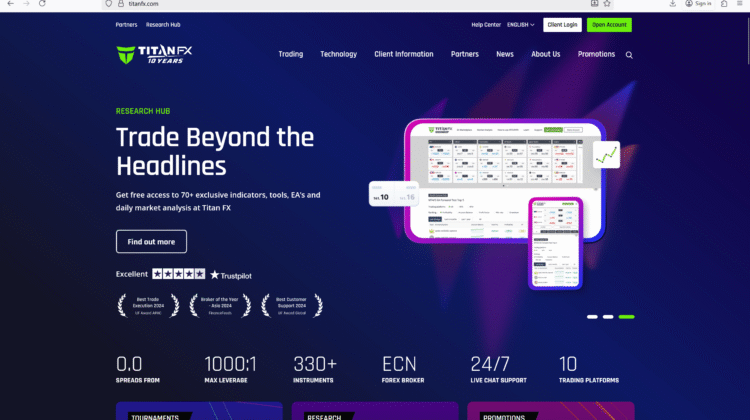

5. Marketing Glamor, Mixed Realities

The TitanFX brand is polished. The website highlights sleek tech, institutional liquidity, zero fees, and global reach. Trustpilot reviews boast glowing praise about “zero pip spreads” and “instant cashouts.” Yet browsing deeper, you’ll find critical reviews claiming poor customer support, frozen funds, or shifting rules. This contrast suggests selective showcase of positive feedback while downplaying legitimate user grievances. A broker with nothing to hide would allow the full feedback spectrum to stand without careful curation.

6. Instrument Range & Hidden Costs

TitanFX offers forex, indices, commodities, stocks, energies, and crypto instruments via CFDs. That range is attractive, but comes with caveats. Swap or overnight costs are appended when positions are held past daily cut-offs; triple swaps midweek sneak in extra costs. The broker publishes “zero fees on deposits/withdrawals,” but ignores possible intermediary bank or network charges. Also, while spreads are tight on major pairs, exotic or low-volume instruments often face wide spreads and liquidity gaps. Hidden costing often hits smaller or less liquid markets hardest.

7. User Feedback Patterns Reflect Risk

Forums, broker review sites, and FX communities show a recurring narrative: traders report successful deposits, real gains, then trouble withdrawing. Complaints about slow responses from support, unhelpful dispute handling, or accounts locked under vague “verification” rules appear often. Positive reviews exist, but the volume of negative stories is consistent and repeating across jurisdictions and time. When multiple independent voices point to the same core issues, it is more than coincidence—it’s evidence of structural risk.

Conclusion — Brutal Verdict on TitanFX

TitanFX may shine by name and presentation, but its foundation is riddled with structural cracks built into its regulatory makeup, execution practice, and client relationship model. While the broker offers desirable features—multiple asset classes, competitive pricing, two types of account structure, and advanced technology—the trade-offs lie in control, protection, and consistency.

First, regulation is the bedrock of trust in trading. TitanFX carries a multi-jurisdiction flag, but all are offshore and lower tier. Without strong oversight, clients have limited recourse when disputes arise. No consumer compensation funds, no regulatory insurance, minimal enforcement—all typical hazards of offshore brokers.

Second, pricing illusions bend reality. Low spreads on the Blade account vanish once commissions, slippage, and spread widenings arrive. The Standard account hides costs inside broader spreads. Either way, the trader bears hidden burdens. Low headline numbers can mask real cost traps.

Third, execution integrity matters, and in TitanFX’s case, reported slippages and irregular order fills push the risk back to the user. A broker that controls routing has power to tilt outcomes subtly—especially in volatile periods. When execution starts working against traders, the advantage disappears.

Fourth, the deposit/withdrawal asymmetry is a telltale signal. Easy money in, friction getting money out—that’s a pattern consistent with many brokers that prioritize capital intake. If withdrawals depend on layered compliance checks or shifts in policy, your access to your own funds becomes vulnerable.

Fifth, marketing gloss must be judged against consistent feedback. Polished websites, “zero fee” banners, and selective reviews won’t override hundreds of consistent user grievances. Transparency does not fear criticism; it integrates it into improvement.

Sixth, instrument range is generous, but hidden costs and liquidity gaps punish smaller or exotic exposures. Overnight charges, spread widenings, illiquid trade execution—these are the silent drains few traders see until it’s too late.

Seventh, patterns in user feedback provide alarm. When many voices repeat the same pain points—withdrawal struggles, support silence, account restrictions—it’s not random; it’s systemic.

If you consider trading with TitanFX, treat your first capital as an experiment. Start with minimal funds, test small withdrawals, document every step. Insist on proof of segregated accounts, full audit reports, transparent fee disclosures, and clear support channels. If any of those appear dodged, walk away.

Your broker should be a partner, not a hurdle. TitanFX may offer impressive features, but until it bridges its regulatory trust gap, proves consistency in withdrawals, and abolishes execution ambiguity, it remains risky terrain. In trading, the worst losses aren’t from the market—they’re from the broker you trusted.